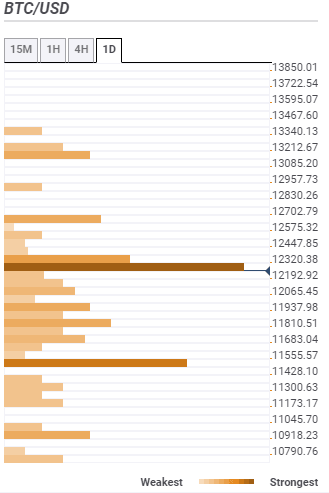

Bitcoin Price Prediction: BTC/USD mega boost to $13,000 in the offing – Confluence Detector

- Bitcoin holds above support at $12,200 to build the next phase of the journey targeting $13,000.

- BTC/USD is looking moving towards key confluence resistance at $12,320 and $12,702.

Bitcoin price is taking a breather from the formidable price action recorded since the American session on Monday. Besides stepping above $12,000 BTC/USD soared to monthly highs at $12,492. On hitting a barrier under $12,500, BTC spiraled to confirm support at $12,200. Bullish momentum appears to be gathering strength from the bullish camp for a run-up targeting $12,400 resistance.

Short term analysis shows that selling pressure has reduced especially with the RSI holding above 60. The MACD is still in the positive region even though Bitcoin retreated from the 2020 highs. There is a bearish divergence below the MACD, suggesting that selling pressure is still present, but not strong enough to cause damage to the progress made above $12,000, at least in the short term.

BTC/USD 1-hour chart

%20(27)-637333346739405328.png&w=1536&q=95)

Bitcoin confluence levels

According to the confluence tool, Bitcoin is moving towards a tough resistance at $12,320. The critical zone is home to various technical indicators including the Bollinger Band 15-minutes lower curve, the previous low 1-hour, the pivot point one-week resistance one, the Fibo 38.2% one-day, the SMA ten 15-minutes and the Bollinger Band one-day upper curve.

Glancing higher, another resistance holds the ground at $12,702. If Bitcoin rises above $12,500, the bulls must prepare for another battle in this area. It currently holds two indicators; the pivot point one-day resistance one and the pivot point one-week resistance two.

Gains above the second resistance are likely to come relatively easy, making the journey above $13,000 sustainable because only minor seller congestion is expected at $12,957. Beyond $13,000 traders must keep in mind possible hurdles at $13,212 and $13,340.

On the downside, support is expected at $12,192 as highlighted by the SMA 100 15-minutes. The range between $11,555 and $12,065 happens to be the widest support range. It is followed by the buyer congestion at $11,428 as highlighted by the previous month high, the pivot point one-day support two and the Fibo 61.8% one-week.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren