- Bitcoin is likely to enter into a period of consolidation above $9,800 before a breakout.

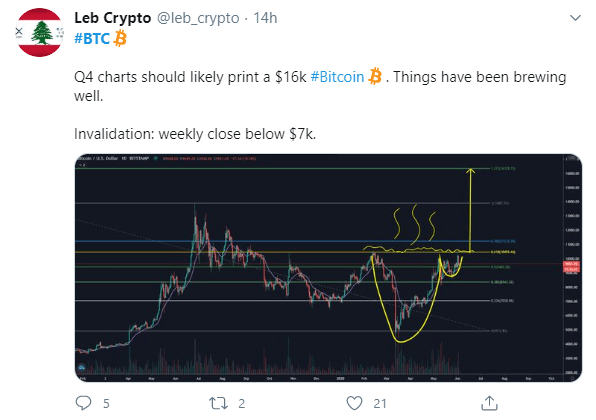

- Leb Crypto, an analyst on Twitter believes that Bitcoin’s next stop is $16,000.

Bitcoin dipped to $9,300 earlier this week following a failed attempt on sustaining recovery above $10,000. However, the dump was nothing but a volatility stint because there was no follow up. Recovery in the last 48 hours has been lethargic but steady. For Bitcoin bulls, the fight for gains above $10,000 is the only goal, at least for now.

In the meantime, BTC/USD is trading above $9,800. On the upside, Bitcoin hit a wall at $9,848 (intraday high). A minor adjustment has since forced Bitcoin to $9,830 (prevailing market value). The trend at the time of writing is bullish but due to the shrinking volatility, rapid price movements are unlikely in the Asian session.

Related content: Cryptocurrency Market Update: Bitcoin unrelenting in the fight for $10,000

Bitcoin price technical picture

BTC/USD is holding above the ascending trendline amid the bulls’ desire to pull above $10,000. The technical indicators applied hint towards consolidation taking place above $9,800. This sideways trading is key for the next run above $10,000, probably during the weekend session. RSI is leveling its motion at 60 after recovering from May lows at 44. A gradual slope upwards means that the price is inclined more to the north. The MACD puts emphasis on the consolidation as it flirts with the mean line (0.0).

BTC/USD daily chart

On the other hand, Bitcoin price is above all the moving averages; the 50-day SMA and the 200-day SMA. Therefore, it is very hard for sellers to enact an extremely bearish move. Besides, an analyst on Twitter Leb Crypto, reckons that Bitcoin is ready to “print a $16k” because “things have been brewing well.”

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Over $560 million in liquidation

Bitcoin hovers around $97,000 on Wednesday after declining more than 5% the previous day. Ethereum and Ripple follow in BTC’s footsteps and decline 8.3% and 6.15% respectively. This recent pullback has triggered a wave of liquidations, resulting in over $560 million in total liquidations in the crypto.

Crypto market surged to $3.9 trillion record market cap as Solana's revenue plunged in December: Binance

In a report on Monday, Binance Research stated that the crypto market reached a market capitalization milestone of $3.9 trillion in December. The researchers suggest anticipation surrounding Donald Trump's upcoming pro-crypto administration could stretch the bullish momentum in the coming weeks.

Aave V3 taps Aptos blockchain for first non-EVM integration

Aave Labs launched its decentralized lending protocol, Aave v3, on the Aptos testnet following an announcement on its governance platform. This marks the protocol's first non-EVM integration, leveraging Aptos's Move programming language for its v3 functionality.

XRP consolidates below $2.50 as long-term investors offload $470M

XRP price slid 8% towards $2.30 on Tuesday, as bulls failed to reclaim the $2.50 resistance level. On-chain data suggests rising selling pressure for XRP long-term investors ahead of Donald Trump’s inauguration.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-637269248795313930.png)