- Bitcoin price renews the uptrend after stepping past the 50-day SMA.

- A break above $7,200 could pave the way for the anticipated gains targeting $9,000 amid the halving in May.

Bitcoin commenced the week’s trading in the positive territory after defending support above $7,200. Last week’s surge above $7,000 was the second after Bitcoin crashed more than 50% in March amid a widespread COVID-19 triggered selloff. At the moment, Bitcoin is trading over 85% higher from the lows trade in March. The gains last week were reminiscent of the upward correction in the United States stock market. Bitcoin has lately become more and more correlated with the stock market and other traditional asset. A situation that has had people questioning Bitcoin’s safe haven status.

According to Qiao Wang from Messari, a cryptocurrency analysis firm, said that cryptocurrency markets and the traditional stock markets are in anticipation as the Federal Reserve prepares to stimulate the economy from the shocks of the Coronavirus pandemic.

Short-term, as usual, I don’t have a strong view,” wrote Mr. Wang about the cryptocurrency. “I think it could easily swing between $5,000 and $9,000 due to a variety of forces like the demand for the USD and the hype around halving.

As reported, Bitcoin’s step above the 50-day SMA has renewed the bullish interest and a lift-off towards $9,000 seems imminent. Looking at the price performance in the last 12 months, Bitcoin soared 280% after breaking above the moving average in April 2020 and 43% after a similar move in February 2020. However, a resistance at $7,200 must be overcome in order to open the way for the lift-off. This zone was a key support in May 2019 and could act the same in the current situation following a breakout.

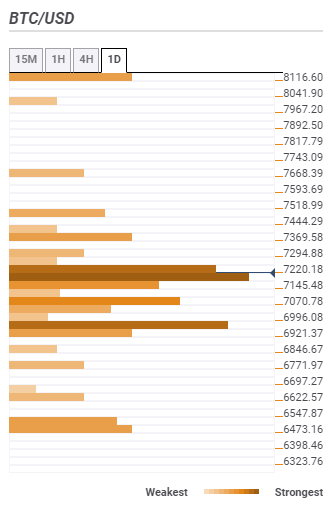

Bitcoin confluence resistance and support areas

Resistance one: $7,220 – Highlights the pivot one-day resistance one.

Resistance two: $7,369 – Highlights the pivot one-week resistance one, and the pivot point one-day resistance two.

Resistance three: 8,116 – Home to the SMA 100 one-day and the pivot point one-week resistance three.

Support one: $7,145 – Converges the Fibo 23.6% one-day, the Bollinger band 4-hour middle curve and the SMA five 4-hour.

Support two: $7,070 – Hosts the SMA 50 4-hour and the SMA 200 1-hour.

Support three: $6,996 – Highlights the Fibo 38.2% one-week, pivot point one-day support two and the BB 1-day middle curve.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.