Bitcoin price prediction: BTC/USD keeps hugging the $7,500 channel may go up in price - Confluence Detector

- The daily confluence detector has three healthy resistance levels on the upside.

- Two healthy support levels at $7,435 and $7,370 are holding the price up.

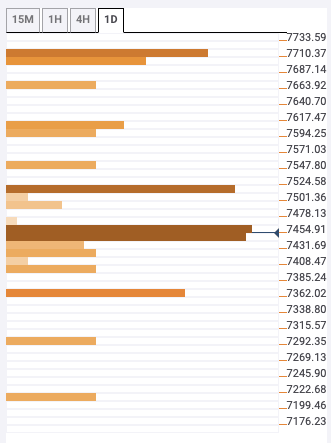

After four straight bearish days, BTC/USD has had a bullish start to Friday. So far, the price has gone up from $7,431 to $7,451.50. The hourly chart shows us that the price has been trending horizontally in a narrow $130-range. The daily confluence detector indicates that there are three healthy resistance levels on the upside at $7,455, $7,520 and $7,720, which are preventing further growth. Conversely, there are strong support levels at $7,435 and $7,370 that are holding the price up.

BTC/USD daily confluence detector

Looking at the resistance levels, $7,455 has the one-hour previous high, five-day simple moving average (SMA 5), SMA 10, 15-min previous high, SMA 100, one-hour Bollinger band middle curve and one-day Fibonacci 61.8% retracement level. $7,520 has the SMA 10, one-day Pivot POint resistance one and one-day previous high, while $7,720 has the previous month low.

When it comes to the support levels, $7,435 has the one-week Pivot Point support two, 15-min previous low and SMA 5. $7,370 has one-day Pivot Point support one and one-day previous low.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.