Bitcoin price prediction: BTC/USD is at risk to move below $9,000 — Bitcoin confluence

- BTC/USD bulls lost the control over the situation.

- The sell-off will speed up once $9,000 is broken.

Bitcoin (BTC) resumed the decline after a short-lived recovery attempt. At the time of writing, BTC/USD is changing hands at $9,140, down nearly 1% since the beginning of the day. The first digital coin has been drifting lower since the start of the day as the upside momentum has faded away on approach to $9,200. Cuttently, BTC/USD is moving within a short-term bearish trend, the volatility is low.

BTC/USD 1-hour chart

On the intraday charts, BTC/USD may be vulnerable to further losses if the price settles below 50-hour SMA at $9,150. However, from the longer-term point of view, BTC is still in the range as long as the lower boundary of the recent consolidation channel $9,000 remains unbroken.

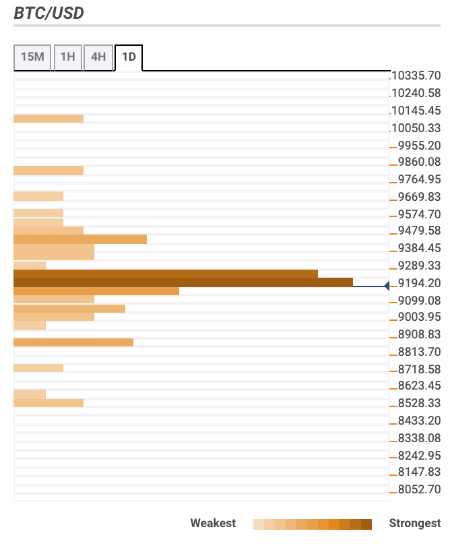

Bitcoin confluence levels

There are a few technical barriers clustered above the current price, while the downside is practically clear. It means Bitcoin risks are tilted to the downside at this stage, while the bulls may have a hard time building momentum.

Resistance levels

$9,200 — 1-hour SMA100, the middle line of the 4-hour, 61.8% Fibo retracement daily

$9,300 — the upper lines of the 4-hour and 1-hour Bollinger Bands, 23.6% Fibo retracement monthly and daily, 4-hour SMA200, 61.8% Fibo retracement weekly

$9,450 — the upper line of the daily Bollinger Band, 38.2% Fibo retracement monthly

Support levels

$9,000 -the lowest level of the previous week, the lower line of the daily Bollinger Band

$8,870 — the lowest level of the previous month, Pivot Point 1-week Support 2

$8,500 — Pivot Point 1-month Support 2

BTC/USD, 1-day

Author

Tanya Abrosimova

Independent Analyst

-637308511622858830.png&w=1536&q=95)