Bitcoin Price Prediction: BTC/USD holds above $7,500 as $8,000 beckons – Confluence Detector

- Bitcoin breaks above $7,600, test $7,700 in readiness for the much-need jump above $8,000.

- The key support areas T $7,444 and $7,287 will ensure losses are mitigated, defending $7,000 crucial support.

Bitcoin corrected higher over the weekend alongside other major cryptoassets. Following the remarkable recovery from $6,500 last week to highs near $7,500, BTC consolidated between a narrow range from $7,000 to $7,250. The breakout pushed the price past key barriers at $7,250, $7,400 as well as $7,600. However, $7,700 remains unconquered although it has been tested severally.

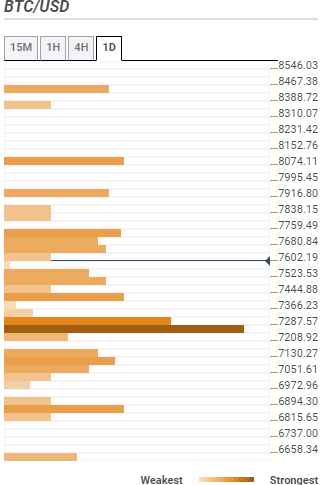

According to the confluence detector tool, BTC is trading above most of the critical barriers, which have turned into support levels. The only hurdle preventing a breakout above $7,700 is $7,680 where the pivot point one-day resistance one and the Bollinger Band one-day upper meet. Further movement towards $8,000 will come into contact with $7,759, $7,995. The break above $7,500 has renewed interest in the largest cryptocurrency even as the holiday mood sets in.

On the downside, Bitcoin is strongly supported after key resistances turned into critical support levels. The first support is observed at $7,444 as highlighted by the Fibo 23.6% one-day. On the other hand, the strongest support is placed at $7,287 and hosts the pivot point one-day support one, SMA five one-day, SMA ten 4-hour and the Fibo 61.8% one-day. Other subtle support areas include $7,130, $6894 and $6,658.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren