Bitcoin price prediction: BTC/USD hibernates under $8,300 – Confluence Detector

- BTC/USD is vulnerable to further losses as the recovery falters.

- A sustainable move below $8,000 will take the price to $7,700.

Bitcoin (BTC) is paralyzed in the middle of $8,200-$8,300 range. The first digital coin attempted a recovery above $8,300 on Monday, but the gains proved to be unsustainable so far. We will need to witness a breakthrough outside of the range to inspire trading activity on the market.

Read also: Banks may stop servicing Facebook due to Libra concerns - ING

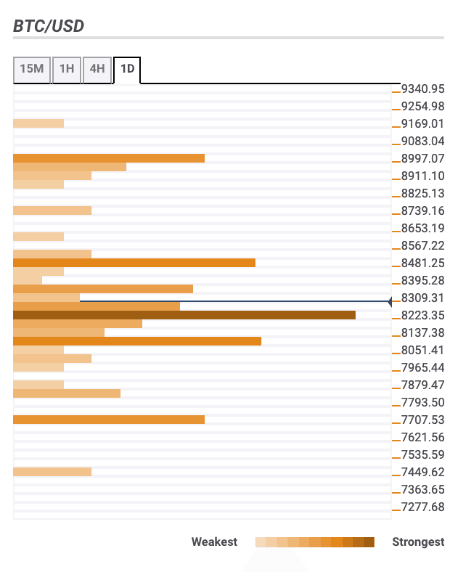

Bitcoin confluence levels

During early Tuesday hours, BTC/USD tried to develop an upside momentum but stopped short of the upper boundary of the channel at $8,300. Bulls' inability to push the price above the resistance area bodes ill for the near-term forecasts and implies that the coin may be vulnerable to further losses with the initial aim at psychological $8,000.

Let’s have a closer look at the technical levels that may serve as resistance and support areas for the coin.

Resistance levels

$8,350 - 61.8% Fibo retracement weekly, the highest level of the previous day;

$8,500 - 23.6% Fibo retracement monthly, 161.8 Fibo projection daily, the highest level of the previous week;

$9,000 - Pivot Point one-week Resistance 3.

Support levels

$8,200 - 61.8% Fibo retracement weekly, 23.6% Fibo retracement daily, SMA100 (Simple Moving Average) and SMA10 four-hour, the middle line of one-hour and daily Bollinger Bands, SMA10 one hour;

$8,000 - Pivot Point one-day Support 2,

$7,700 - Pivot Point one-week Support 1, the lowest level of the previous month.

Author

Tanya Abrosimova

Independent Analyst