Bitcoin Price Prediction: BTC/USD consolidates as volatility is ousted – Confluence Detector

- Bitcoin price in consolidation as the weekend session deals with low trading activity.

- A significant resistance lies at $9,441 and must be broken for Bitcoin bulls to shift the focus back to $10,000.

The king of cryptocurrencies has in the last 24 hours remained stable between $9,300 and $9,500. On Saturday, there was an attempt to break the resistance at $9,500 but buyers lacked enough volume to sustain the gains above $9,400. Instead, Bitcoin retreated towards $9,300. At the time of writing BTC/USD is dancing at $9,394 with its immediate downside protected by the 50-day SMA.

The sideways trading action is also held in place by an ascending trendline. If the losses resume, more support is anticipated at $9,200 and $9,000. For now, declines are unlikely as observed with the sideways moving RSI. It also vital that traders are aware of the downward inclined MACD whose bearish divergence highlights the presence of selling pressure, although it is mild. All in all the most prominent trend is the ongoing consolidation.

BTC/USD daily chart

-637277194819505946.png&w=1536&q=95)

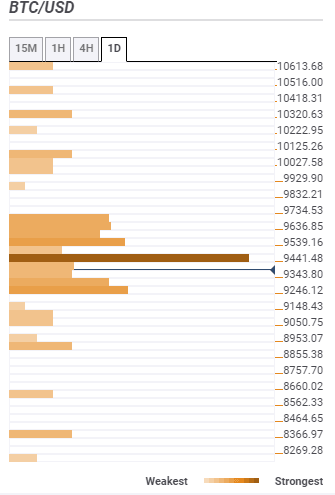

Bitcoin confluence support and resistance levels

Resistance one: $9,441 – Home to the Bollinger Band 1-hour lower curve, the Fibonacci 61.8% one-day, the SMA five one-hour, the previous low 4-hour as well as the SMA ten 15-minutes.

Resistance two: $9,539-9,734 – This is a wide resistance range that hosts a cluster of technical indicators including but not limited to the Bollinger Band one-day middle, SMA 100 1-hour, the Fibonacci 61.8% one week and the pivot point one-day resistance three.

Support one: $9,343 – Highlighted by the previous low one-day, previous low 1-hour, pivot point one-day support one and the previous low 15-mins.

Support two: $9,246 – Hosts the SMA 50 one-day, pivot point daily support three and the Fibo 23.6% one-week.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren