- The cryptocurrencies bleed courtesy of Bitcoin’s drop from highs above $8,400.

- Bitcoin is facing acute resistance towards $8,400 but the downside is equally protected.

Bitcoin is wallowing in red stormy waters after wondering downstream in the wake of the rejection from $8,400. The entire cryptocurrency market is following suit by posting losses ahead of the weekend session. For instance, all the top three coins are suffering under the hands of the bears with Bitcoin trading 1.1% lower on the day, Ethereum at -1.23% and Ripple at -1.25%.

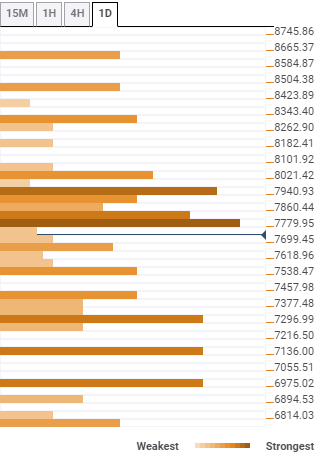

Bitcoin confluence levels

The confluence tool display of support and resistance levels highlights how strongly Bitcoin has been barred from actioning a reversal. The initial resistance at $7,779 is host to various indicators including the previous high 15-minutes, SMA 10 15-mins, previous low one-day, previous low 4-hour and the Bollinger Band 15-mins middle.

The bulls must ready for a fight their lives considering that higher movement will come face to face with more hurdles at $7,860, $7,940, $8,021 and $8,343. However, on breaking the key $8,400 barrier, the journey to $9,000 will be relatively smooth.

On the downside, there are stacks of support areas ready to cushion Bitcoin against a possible drop to $7,000. Such support zones range from $7,699 as highlighted by the pivot point one-day support one, $7,538, $7,457, $7,296 and $7,136.

On the other hand, consolidation is expected in the coming weekend session. However, more action towards $8,400 and the psychological $9,000 is expected next week.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

BNB Price Forecast: Shows signs of weakness as development activity reaches its lowest level in four months

BNB faces rejection from its previously broken ascending trendline around $686 on Wednesday, hinting at a downturn ahead. The technical outlook suggests a bearish move as its momentum indicators show weakness.

Bitcoin expects volatility on Fed interest rate decision

Bitcoin (BTC) price recovers and hovers around $102,800 on Wednesday after declining for four consecutive days. A K33 Research explains how Nvidia’s big drop in stock valuation this week, driven by DeepSeek, affected Bitcoin’s price.

Dogwifhat Price Forecast: WIF bounces off $1 key level

Dogwifhat price trades 20% higher on Wednesday after retesting its key psychological level of $1 the previous day. WIF’s RSI emerged from its oversold condition, signaling a potential shift in momentum as selling pressure eases.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH and XRP volatility spikes expected on Fed rate decision

Bitcoin (BTC) price hovers around $101,700 on Wednesday after declining for four consecutive days since Saturday. Ethereum (ETH) price follows BTC’s footsteps, closing below its key level, hinting at a correction ahead.

Bitcoin: BTC holdings of large investors surges as Trump takes the Oval Office

Bitcoin (BTC) trades in the green and hovers above $105,000 on Friday after hitting a new all-time high of $109,588 on Monday. CryptoQuant’s weekly report highlights that the demand for BTC from large investors surges as US President Donald Trump takes the Oval Office.

Trusted Broker Reviews for Smarter Trading

VERIFIED Discover in-depth reviews of reliable brokers. Compare features like spreads, leverage, and platforms. Find the perfect fit for your trading style, from CFDs to Forex pairs like EUR/USD and Gold.