Bitcoin price prediction: BTC/USD bracing for more bumps after re-entering the $8,000’s – Confluence Detector

- Bitcoin Satoshi Vision’s BSV wants to be recognized as Satoshi Nakamoto but claims Nakamoto plagiarized his thesis paper.

- Bitcoin is still vulnerable to losses as the upside remains unconquered.

Bitcoin recently refreshed the levels under $8,000. However, an almost immediate correction pulled into the $8,000 range. While bulls are working hard to sustain the price above the critical $8,000, the upside has become a hard nut to crack.

As Bitcoin continues to find its space above $8,000, Craig Wright continues to fight for recognition as the true Satoshi Nakamoto. He even went ahead to say that Satoshi plagiarized his university thesis paper. Wright seems to be sure that the truth about his claims will come into light soon enough saying:

“The University still has my thesis from 2008, they still have my proposal. [….] On that alone, you can make a decision when it comes out, and it will.”

In yet another twisted angle, Wright added:

“[When the thesis comes out] Did Satoshi plagiarize me? Because there are sections in the [Bitcoin] whitepaper — whole paragraphs — [that can be found] in some of my work.”

Bitcoin confluence detectors

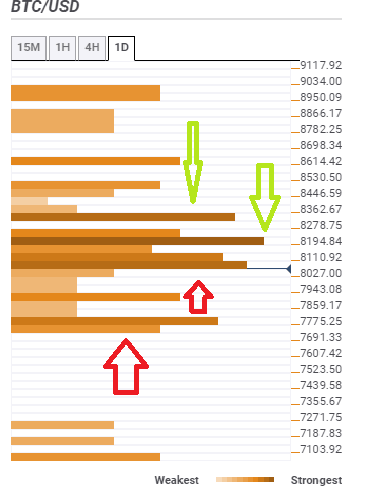

Bitcoin is trading at $8,067 on Friday in the early hours of the European session. The immediate resistance is placed at $8,110.92 characterized by the five Simple Moving Average (SMA) four-hours, Bollinger Band one-hour middle, SMA five 15-minutes, SMA 10 one-hour, SMA 50 15-minutes and previous high one-hour among others. As it stands the path of least resistance is downwards with the upside also limited at $8,194, $8,362, $8,614 and $8,950.

Bitcoin remains vulnerable to losses even after correcting above $8,000. The first weak support is observed at $8,027. Other key support areas are $7,943, $7,775.25 and $7,103.92.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren