Bitcoin price prediction: BTC/USD bears have the advantage as confluence detector shows lack of support levels

- BTC/USD fell from $8,357.40 to $8,162.80 this Tuesday.

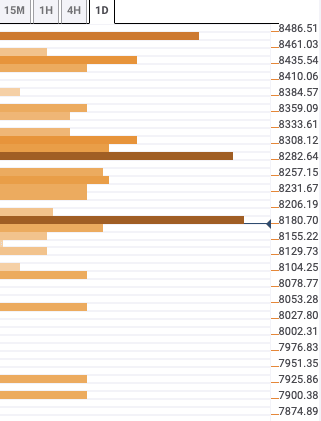

- There are three resistance levels on the upside at $8,185, $8,285 and $8,480.

Despite a bullish start to the day, the overall sentiment of the BTC/USD market definitely remains bearish. The asset faced a massive sell-off this Tuesday wherein the price dropped from $8,357.40 to $8,162.80. While it has since recovered to $8,173.45, the daily confluence detector shows that the bears are still in the driver seat. Since there are no visible support levels, a further drop in price can be expected. On the upside, the confluence detector has three resistance levels at $8,185, $8,285 and $8,480.

BTC/USD daily confluence detector

$8,185 has the one-hour previous high, 15-min previous high, 15-min Bollinger Band upper curve, four-hour previous high, one-week Fibonacci 61.8% retracement level and the 10-day Simple Moving Average (SMA 10) curve. $8,285 sees a confluence of the SMA 5, SMA 10 and SMA 200 curves while $8,480 has the one-month Fibonacci 23.6% retracement level.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.