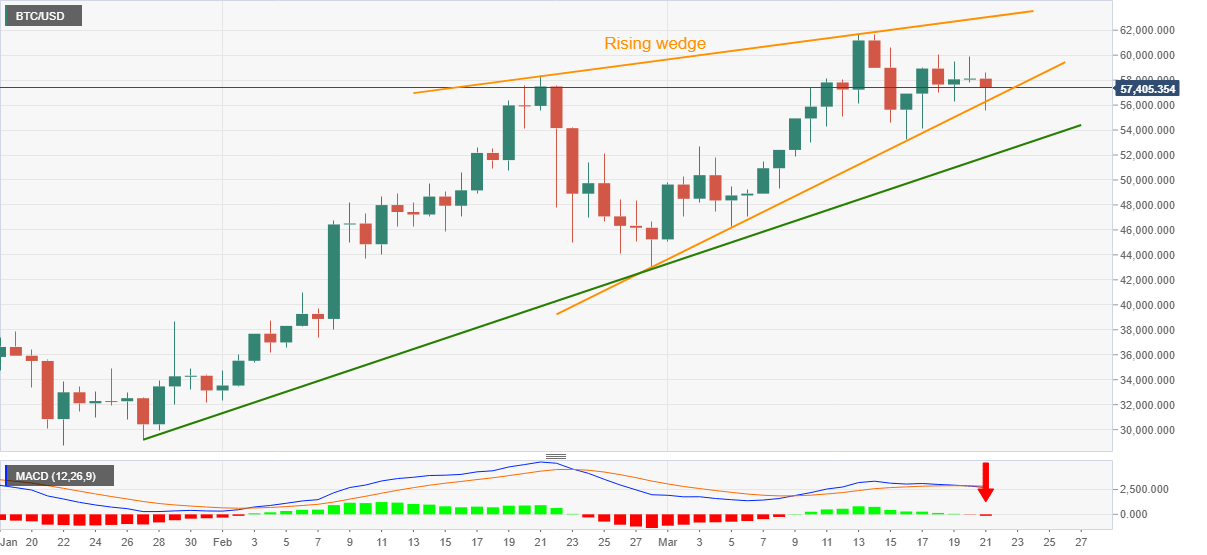

- BTC/USD fades weekend bounce off $55,540 inside a bearish chart pattern.

- MACD turns negative for the first time in two weeks.

- Seven-week-old support line can offer intermediate halt during further downside, $60,000 guards immediate upside.

Bitcoin bulls seem tiring as the quote wavers around $57,750 during early Monday. In doing so, the cryptocurrency major teases a bearish chart formation, rising wedge, which becomes critical to follow, if confirmed, near the top.

Not only the rising wedge but MACD weakness also suggests BTC/USD traders stay cautious before taking any long entries.

However, a daily closing below $56,280 becomes necessary for the Bitcoin sellers to retake controls, which highlights the theoretical target surrounding $36,000.

It should be noted though that the estimated fall below $56,280 towards $36,000 can pause around a short-term rising support line, at $51,843 now, as well as the late February lows near $43,000.

On the contrary, corrective pullback needs to cross the $60,000 psychological hurdle before challenging the recently flashed record top around $61,800.

Overall, BTC/USD is up for witnessing a pullback but sellers wait for a clear vision.

BTC/USD daily chart

Trend: Pullback expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Bitcoin Weekly Forecast: Will the “Uptober” rally reach a fresh all-time high?

Bitcoin continues to climb this week after breaking its resistance barrier, aiming for a new all-time high. US spot Bitcoin ETFs posted $1.86 billion in inflows until Thursday, the largest streak of inflows since mid-July.

Crypto Today: Main tokens gain as Bitcoin is less than 10% away from all-time high

Bitcoin climbs above $68,000 and pulls back as market participants turn greedy, according to the indicator that checks trader sentiment. Ethereum holds gains above $2,600 and XRP hovers around $0.55 on Friday.

Solana Price Forecast: SOL gains 2% as community discusses Firedancer validator for better performance

Solana gains 2% as its community discusses performance improvements through its new validator, Firedancer. Bitcoin’s Layer 2 project Solv Protocol launched BTC staking token on the Solana blockchain.

Bitcoin: Will the “Uptober” rally reach a fresh all-time high?

Bitcoin (BTC) rallied nearly 8% so far this week until Friday after breaking its resistance barrier, aiming for a fresh all-time high (ATH). This rise in Bitcoin’s price is supported by an increase in institutional demand, which showcased a $1.86 billion inflows this week, the largest streak of inflows since mid-July. Rising apparent demand and institutional reports suggest that the current BTC cycle resembles the third halving, when prices increased sharply.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.