Bitcoin Price Prediction: BTC aims for massive 18% upswing if key support holds

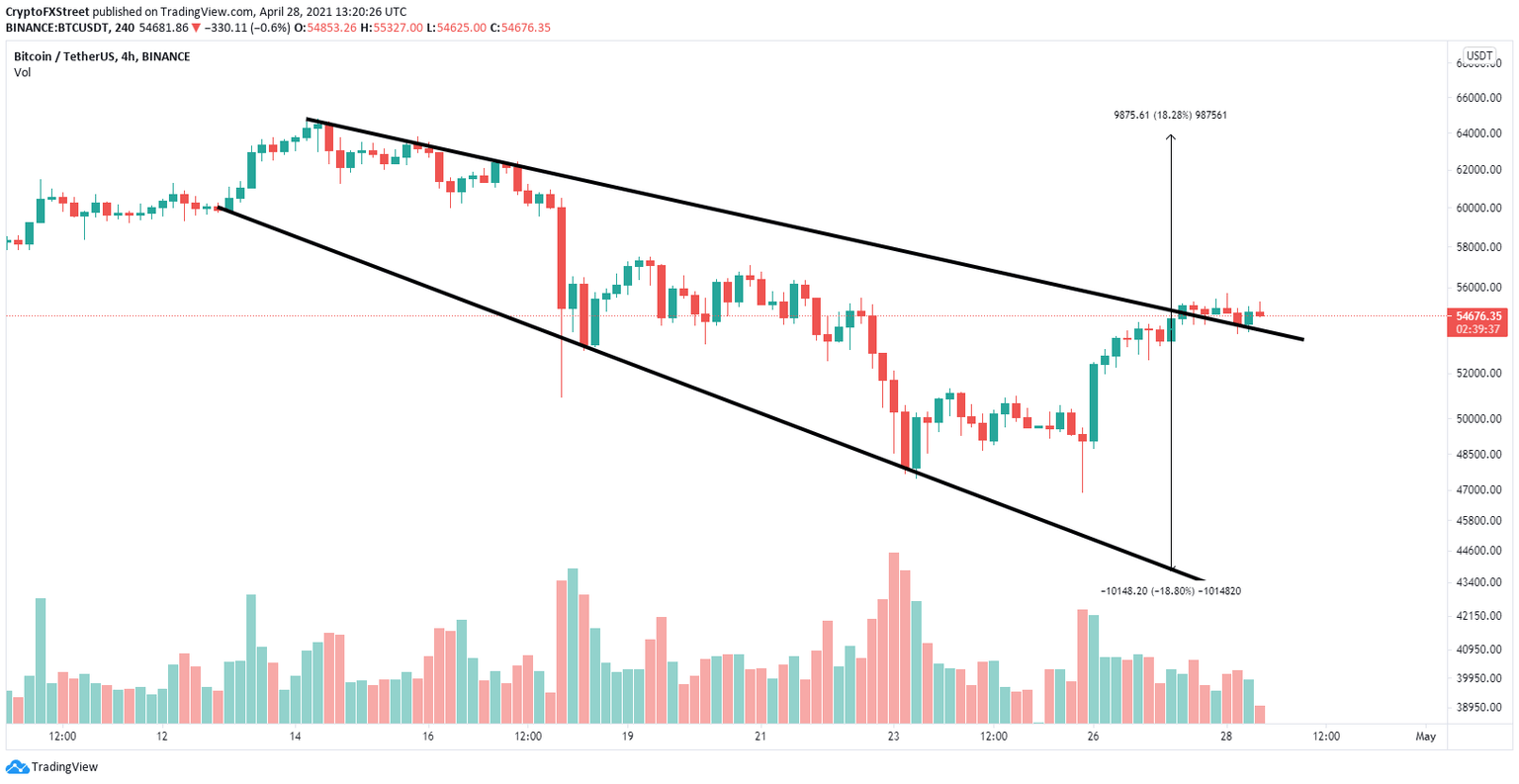

- Bitcoin price had a breakout from a descending broadening wedge pattern on the 4-hour chart.

- The digital asset doesn’t face a lot of resistance ahead but must defend key support level.

- The number of BTC inside exchanges has plummeted in the last week.

Since April 23, Bitcoin price had a major recovery toward $55,000. The flagship cryptocurrency shifted its momentum in favor of the bulls and aims for a significant 18% upswing.

Bitcoin price faces almost no resistance ahead

On the 4-hour chart, Bitcoin had a breakout from a descending broadening wedge pattern on April 27. This breakout has a price target of $64,000 in the long-term. However, Bitcoin needs to hold the previous resistance trend line which acts as support now.

BTC/USD 4-hour chart

One of the most significant on-chain metrics in favor of Bitcoin is the percentage of the total supply of BTC inside exchanges which has fallen by 0.73% in the past month.

BTC Supply on Exchanges

Additionally, the MVRV (30d) ratio which measures the average profit or loss of BTC coins moved in the last 30 days, remains below 0% despite the recent surge. This indicates that most traders in the short-term are not likely to sell.

BTC MVRV (30d) ratio

The only risk for Bitcoin in the short-term is a potential sell signal on the 9-hour chart. The TD Sequential indicator has presented a green ‘8’ candlestick which is usually followed by a sell signal.

If Bitcoin price loses the critical support trend line at $54,000 the digital asset could quickly fall toward $50,000 as there is weak support below this level.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B17.15.37%2C%252028%2520Apr%2C%25202021%5D-637552157323084799.png&w=1536&q=95)

%2520%5B17.59.10%2C%252028%2520Apr%2C%25202021%5D-637552157161365075.png&w=1536&q=95)