Bitcoin Price Prediction: All eyes on the Fed

- BTC price auctions with an uptick in bullish volume.

- Bitcoin price has space to fall on the Relative Strength Index, which confounds the Fed’s demand for higher interest rates.

- Invalidation of the bearish thesis is a breach above $23,742.

Bitcoin price shows reasons to believe in one more sell-off. The invalidation point is tight enough to participate in the opposing idea.

Bitcoin price is not the knife to catch

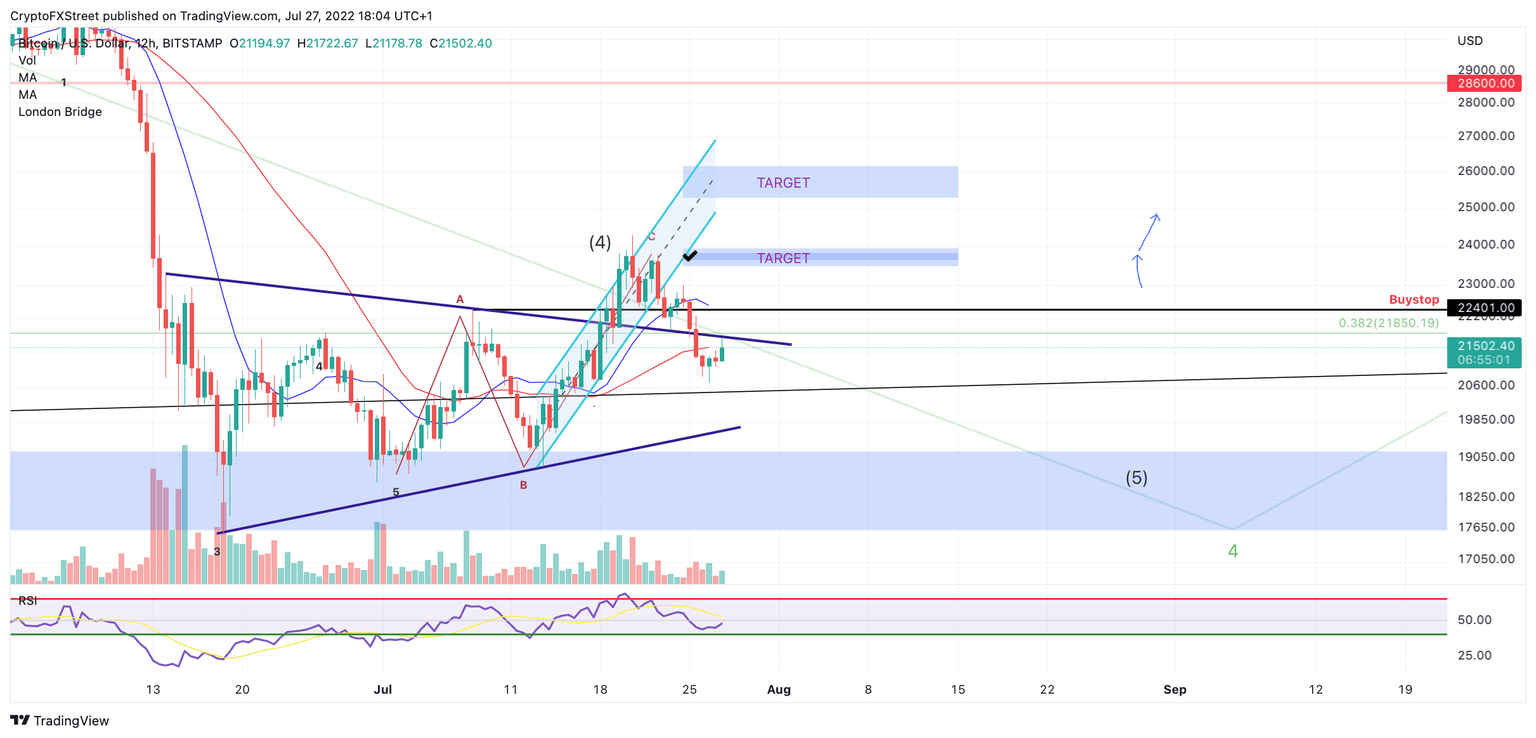

Bitcoin price shows concerning signals during the final trading week of July. After rallying 18% this month, the original peer-to-peer cryptocurrency has retraced into a previous congestion zone. Usually, this kind of occurrence demonstrates trend failure. What many traders expect will hold as support inevitably turns into quicksand.

Bitcoin price currently trades at $21,610 as the world awaits an upcoming Fed interest rate decision. The Fed is expected to raise rates by 75 bps to lift the fed funds rate to the 2.25-2.5% range.

BTC/USDT 12-Hour Chart

Based on the technicals and for the safety of our readers, this thesis will remain bearish until newfound strength enters the market. In trading terms “Bitcoin price is not the knife to catch” there is a subtle uptick in bearish volume that is worth noting. Additionally, The Relative Strength Index still has space to fall. The bearish targets of $17,000 and $16,200 have been outlined in a previous outlook. The catalyst maker would be a breach through $20,850.

Invalidation of the bearish thesis is a breach above $23,742. If the bulls can conquer this barrier, they may be able to rally as high as $27,750, resulting in a 29% increase from the current Bitcoin price.

In the following video, our analysts deep dive into the price action of Bitcoin, analyzing key levels of inerest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.