Bitcoin Price Prediction: A day trader’s delight

- Bitcoin price has breached all of July and August liquidity levels.

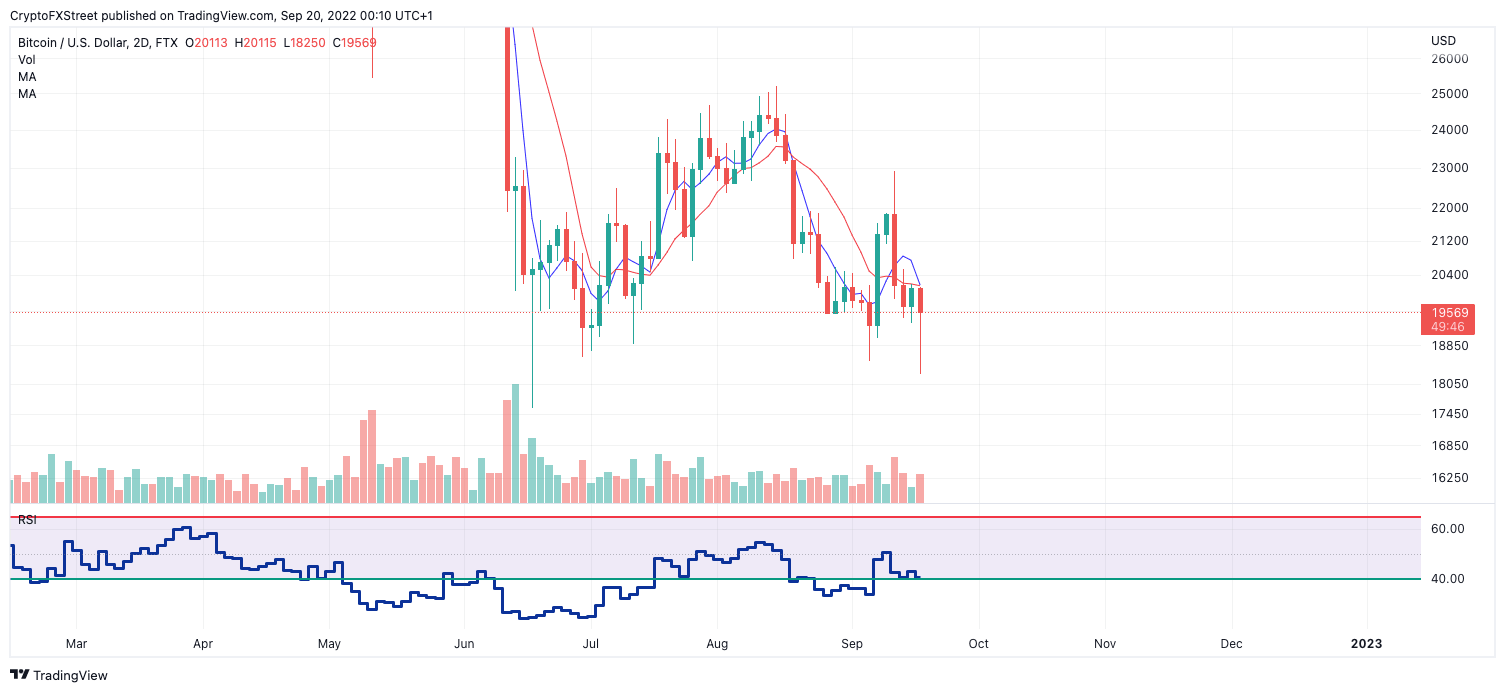

- A bullish hammer is minutes away from printing while the RSI hovers back into bullish territory.

- Invalidation of the bullish counter-trend idea is a breach of the swing low at $18,250.

Bitcoin price could witness an influx of volatility in the coming days, with the first directional bias leaning bullish.

Bitcoin price is set to get volatile.

Bitcoin price could be a favorable market for intraday traders for the remainder of September. Over the weekend, the BTC price fell 20%, tagging a new low for September at $18,250. The decline wiped out all of the previous swing lows established since July.

Based on Auction Market Theory, the liquidity hunt could reset the playing field between exchanges, retail traders, and smart money operatives. A very volatile market could surface throughout the remainder of September, creating high probability trade setups for day traders to partake in.

Bitcoin price currently auctions at $19,540 as the bulls are 90 minutes away from printing a bullish hammer on the 2-day chart. The Relative Strength Index has hovered back above the bullish territory, which suggests the bulls could reclaim more gains in the coming days. Using the hammer as a projective tool suggests a 10% rally could occur this week towards $21,600.

BTC USDT 2-Day Chart

Invalidation of the bullish counter-trend idea (targeting $21,200 and potentially $21,600) is a breach of the newly established swing low at $18,250. If the bears breach this level, they could prompt a further decline towards the June 18 swing low at $17,580, resulting in a 10% decline from the current Bitcoin price.

In the following video, our analysts deep dive into the price action of Bitcoin, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.