Bitcoin price shows weakness, but new BTC whales have created solid support at $56,400

- Bitcoin’s new large wallet investors have bought BTC at an average price of $56,400, mostly via Spot ETFs.

- Bitcoin’s realized capitalization data shows nearly 50% of realized cap is dominated by short-term holders, new investors.

- BTC halving is 30 days away and inflow to Spot ETFs has climbed to $2.5 billion in the past week.

Bitcoin (BTC) price downside momentum continues to gain strength, giving sidelined and late bulls a chance to buy the dip. The market remains focussed on the oncoming halving, expected to kick off the next bull cycle. For the meantime, however, spot BTC ETFs remain the main play in the market.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

New Bitcoin whales have created solid support at $56,400

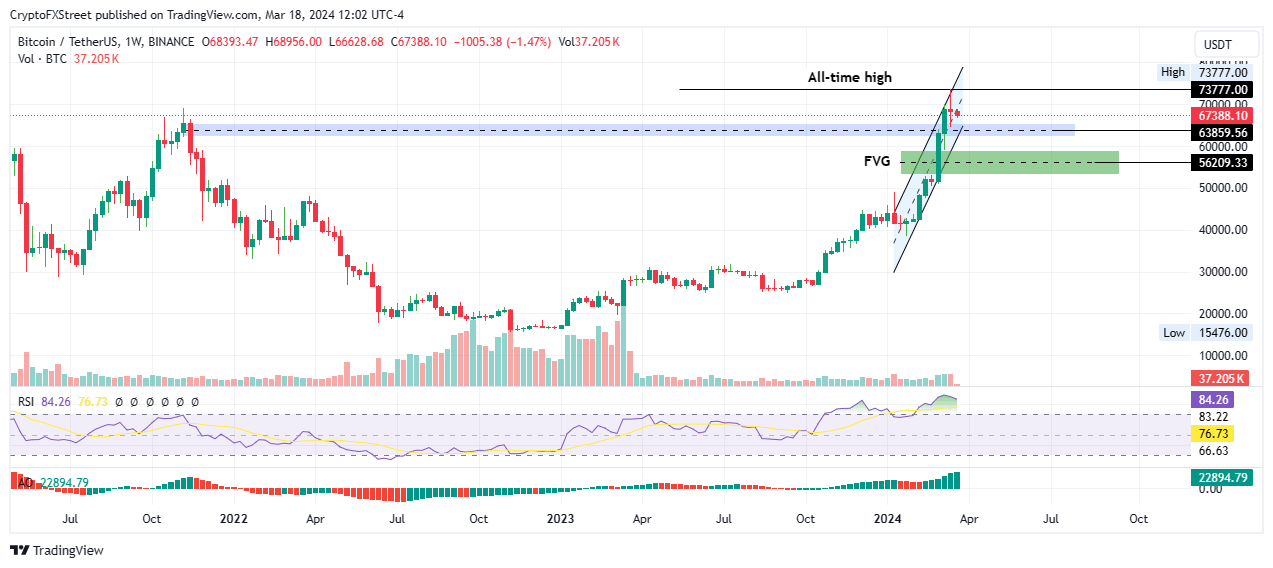

Bitcoin price is down a fraction in the last day with trading volume dropping nearly 20%. It continues to slide lower after losing critical support due to the midline of the ascending parallel channel. Amid falling buying pressure, BTC is likely to provide a lower buying opportunity before the next leg up.

With reports that spot BTC exchange-traded funds (ETFs) raked in more than $2.5 billion dollars in net inflows last week alone, ascribed to institutional FOMO, their buyer congestion level could be the pivot BTC is looking for before a trend reversal.

The #Bitcoin ETFs raked in over 2.5 BILLION dollars in net inflows last week alone.

— Jelle (@CryptoJelleNL) March 18, 2024

Institutional FOMO.

Ki Young Ju, founder and CEO at CryptoQuant, indicates the new whales bought Bitcoin at $56,400 on average mostly via spot ETFs, whereas the old whales, who acquired BTC pre- spot Bitcoin ETFs, entered near $21,300.

New whales bought #Bitcoin at $56.4K on average mostly via spot ETFs; old whales at $21.3K. pic.twitter.com/WfWHQUGEuY

— Ki Young Ju (@ki_young_ju) March 18, 2024

The new TradFi whales include customers of BlackRock and Fidelity. As different generations of whales foray into the BTC market at various price points, the diversity in investment strategies and perspectives within the crypto space becomes apparent.

In a March 17 report by CryptoQuant, researchers determined, “The enthusiasm and accumulation of Bitcoin by new investors have sharply increased” during the recent month, with short-term holders only holding just about 48% of the Realized Cap distribution in the Bitcoin market.

While this increase is bullish for BTC, it also points to the likelihood of a correction once these short-term holders decide it is time to sell.

Bitcoin price outlook with BTC fate in the hands of short-term holders

Bitcoin price has breached a key support, flipping the midline of the ascending channel into resistance. The market is leaning toward the downside in the short term, providing sidelined investors a low entry point as the countdown to the halving continues, approximately 31 days out.

The Relative Strength Index (RSI) is leaning south, forming a dome to signify falling momentum. Coupled with the dwindling size of the volume indicator, this shows that the upward trajectory is losing steam.

Nevertheless, Welles Wilders, the father of several technical indicators, says an asset is only ripe for selling when the RSI crosses below 70. Traders with current open long positions for BTC should probably leave them open as the upside potential remains viable.

Those looking to open new long positions, however, should probably exercise caution as the overbought status, seen with the RSI above 70, puts Bitcoin price in high risk of an extended fall.

If BTC price slips below the $63,859 mean threshold, it could roll over to the weekly imbalance extending from $59,005 to $52,985. Notice that Young Ju’s $56,400 buyer congestion level falls within this range.

BTC/USDT 1-week chart

Conversely, if traders looking to buy the correction decide it is now time to enter, the ensuing buying pressure could send Bitcoin price north. Flipping the midline of the channel back into support could set the tone for a continuation, with Bitcoin price likely to reclaim the $73,777 peak on Binance Exchange.

In a highly bullish case, the gains could extend to $75,000 or higher to set a new all-time high at $80,000. Such a move would denote a 20% move above current levels.

Even as the $80,000 target seems likely for Bitcoin price with the oncoming halving, Standard Chartered has presented an overly ambitious target of $150,000 for BTC this year and $250,000 by 2025.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.