Bitcoin Price Outlook: Analyst anticipates $35,000 retest for BTC as part of ‘respectable’ correction

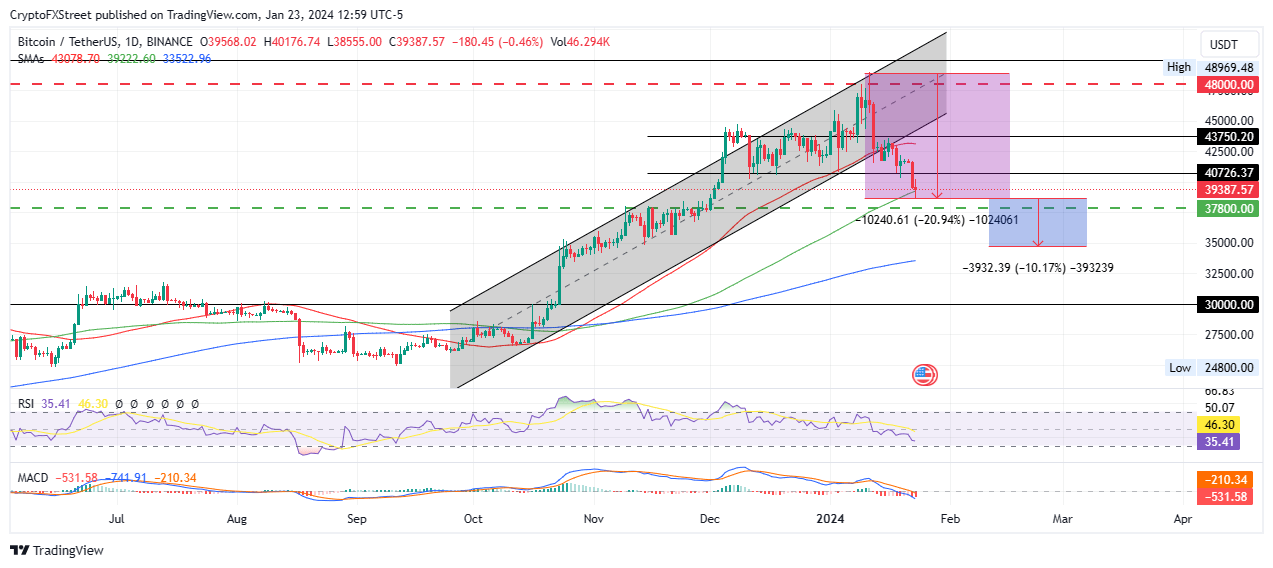

- Bitcoin price is down 20% since the intra-day high of $48,969 when spot ETFs started trading.

- An analyst says 10% more losses are likely, constituting 30% full-cycle correction in a bull market.

- Corrections are generally considered healthy for the long-term stability and balance of markets, says Sigma Labs.

- On-chain metrics also favor the downside with a significant plunge in BTC crowd interaction.

Bitcoin (BTC) price slipped below the ascending parallel channel on January 12 and continues to extend its fall with technical as well as on-chain indicators favoring the bears. It comes amid considerations that while history tends not to repeat itself, it often rhymes.

Bitcoin price displays respectable correction

Bitcoin (BTC) price is down 20% since the peak price of $48,969 recorded on January 11. This was when spot BTC exchange-traded funds (ETFs) started trading in the open market.

"The average respectable correction in a bull market is 30%,” said online analyst @cryptomanran, “which means that with 20% already spent, Bitcoin price may have an additional 10% crash in the works."

The average “respectable”correction in a bull market is 30%.

— Ran Neuner (@cryptomanran) January 23, 2024

We are 20% down already and there may be 10% left to go…

You’re not going to catch the bottom and if you miss the run up you will kick yourself!

My theory, start buying now. If we go down to $34k, buy all the way…

Bitcoin price could test the $35,000 psychological level, with the analyst urging traders to stay vigilant. Specifically, he cautions those waiting to buy the bottom, saying, “You’re not going to catch the bottom and if you miss the run-up you will kick yourself!” In his opinion, the slump is a buying opportunity in itself.

Sigma Labs, a DeFi3.0 ecosystem, reinforces the analyst’s assertions. The company suggests that while corrections are generally considered healthy for the long-term stability and balance of markets, they tend to cause short-term market volatility and investor anxiety. The firm also highlights that such market shifts offer entry opportunities for investors looking to capitalize on reduced prices, while others use it to reassess and realign their investment strategies.

Bitcoin price outlook from technical and on-chain perspectives

The Relative Strength Index (RSI) mirrors Bitcoin price action heading downhill to reflect falling momentum. This indicator remains below its signal line (yellow) band, which is also bearish, with the Moving Average Convergence Divergence (MACD) indicator sharing the same outlook. The latter is below its respective mean level and, therefore, in negative territory. These indicators add credence to the bearish thesis.

BTC/USDT 1-day chart

From an on-chain front, the daily active addresses have dropped from 969,000 to 594,000 between January 22 and 23, representing a 38% drop in the number of unique addresses in use.

The whale transaction count for movements above $100,000 has also dropped, recording reducing peaks, while exchange inflows are recording notable peaks to show increased intention to sell as BTC holders book profits.

BTC Santiment: Daily active addresses, whale transaction count, exchange inflows

Also Read: Bitcoin price recovery likely after BTC dips below $40,000, according to on-chain metrics

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.

%2520%5B20.45.57%2C%252023%2520Jan%2C%25202024%5D-638416384863675595.png&w=1536&q=95)