- Bitcoin price could reach $318,000, according to a senior executive at US-based financial giant Citibank.

- Several on-chain metrics seem to support this bullish scenario in the long-term.

A new report from Citibank’s Managing Director, Tom Fitzpatrick, states that Bitcoin could reach $318,000 and that this cryptocurrency is the digital gold of the 21st century. Tom thinks BTC could touch that price by December 2021.

Although it is a high price target, some on-chain metrics could be suggesting something similar. The infamous Stock-to-Flow Bitcoin model would put Bitcoin price at least at $100,000 by the end of 2021.

What metrics support the idea of Bitcoin climbing above $100,000?

Citibank's report looks at the past price action of Bitcoin from 2011 until 2020. According to it, Bitcoin price seems to be quite symmetrical over the last seven years. The past rally from January 2015 to December 2017 had BTC price multiplied by 121 times.

The first significant rally from 2011 to 2013 was a 55,000% increase for Bitcoin price. Considering these ratios, it would seem that the next rally from 2018 until the top would put BTC at $318,000 by the end of 2021.

Other prominent analysts are also extremely optimistic about Bitcoin. Mike McGlone, a Bloomberg Intelligence analyst, sees Bitcoin at $100,000 by 2025. Although the outlook is less aggressive, it is still significantly bullish.

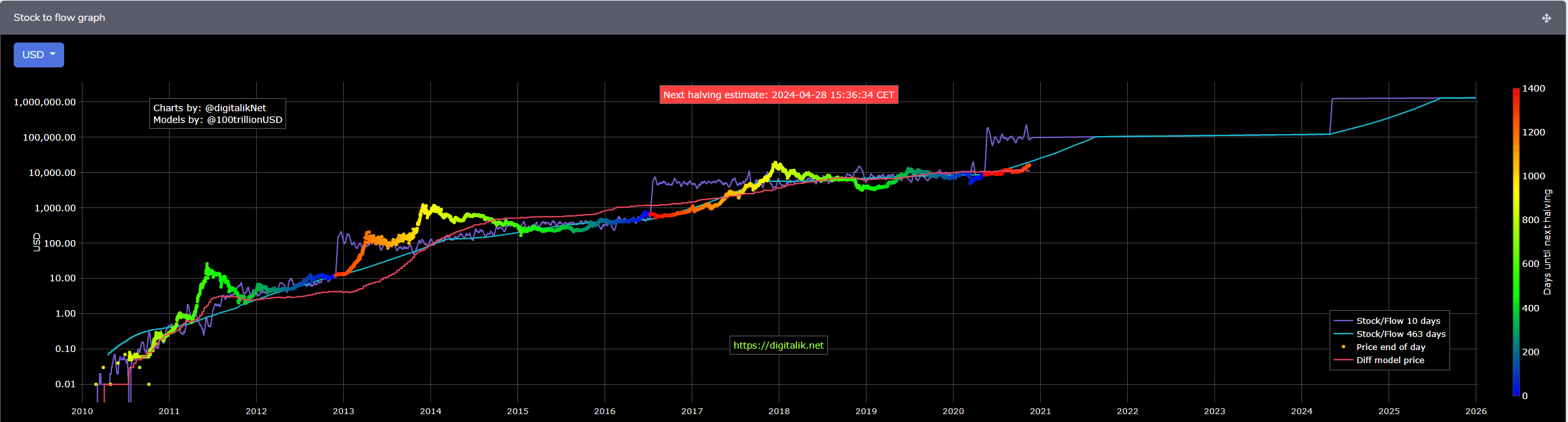

Bitcoin S2F chart

One of the most popular predictive models for Bitcoin is the Stock-to-Flow one, which calculates the average price of Bitcoin, keeping in mind past and upcoming halving events and the scarcity of BTC. The chart suggests BTC could reach $100,000 as early as September 2021.

Of course, this model doesn’t exclude the option of Bitcoin price spiking higher as it happened in December 2013 when BTC jumped to $1,000, while the model suggested the price should be around $100.

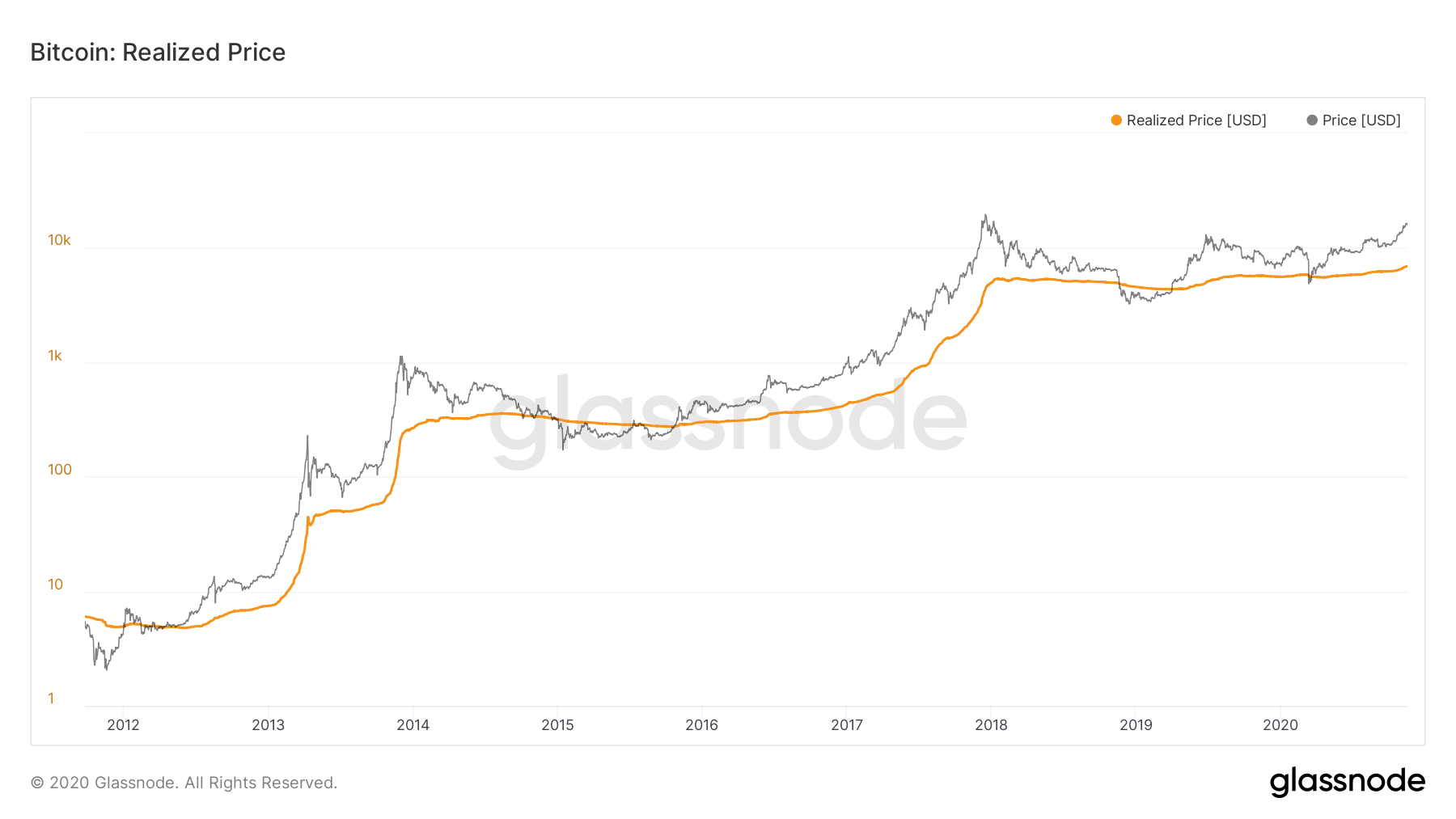

Bitcoin Realized Price chart

The Realized Price chart of Bitcoin shows an all-time high at $6,786. This metric calculates the average price investors paid for Bitcoin. The number is higher than it was in December 2017 at Bitcoin’s all-time high, indicating there is far more capital behind the recent rally, making it healthier and more sustainable in the long run.

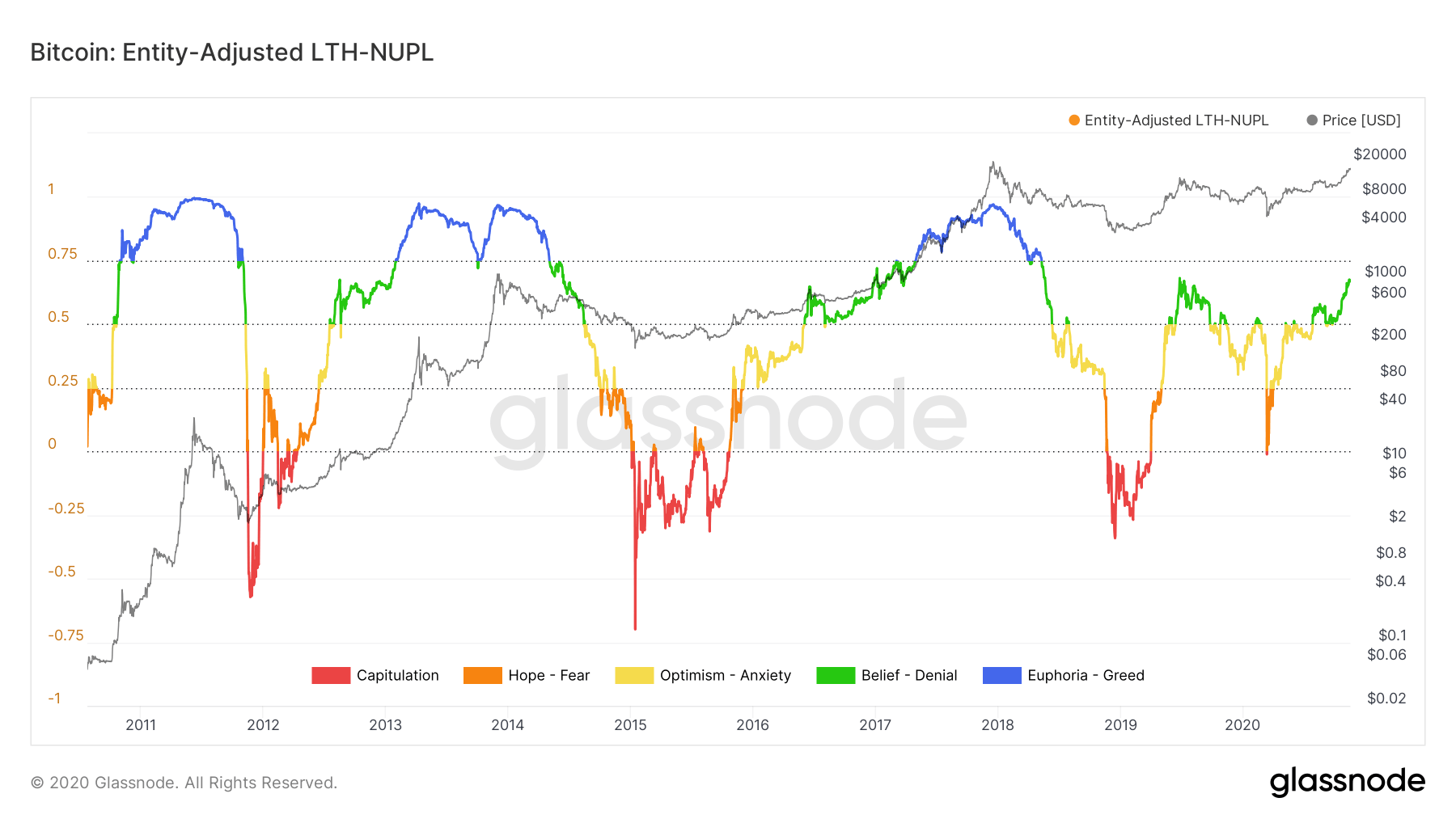

Bitcoin Entity-adjusted LTH-NUPL chart

The Entity-adjusted LTH-NUPL has also flipped bullish since July 2020. This metric basically shows the sentiment of market participants, ranging from capitulation to euphoria. It seems that the current state is belief, which indicates there is still more room for Bitcoin price to increase as market participants haven’t hit the euphoria phase yet.

Both Mike McGlone and Tom Fitzpatrick view Bitcoin as a potential alternative to gold. In fact, they suggest that Bitcoin could be a better version of the precious metal resembling its digital form. The current total value of gold is around $9 trillion, while Bitcoin sits at $300 billion, making the market capitalization of this last one too small for some important entities even to purchase it. These predictions might look far fetched at first, but many on-chain metrics are supporting them.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

XRP gains as traders gear up for futures ETFs debut this week

XRP climbs over 3% on Monday, hovering around $2.33 at the time of writing. The rally is likely catalyzed by key market movers like XRP futures Exchange Traded Funds (ETFs) approval by the US financial regulator, the Securities and Exchange Commission (SEC), and a bullish outlook.

Bitcoin Price Forecast: BTC eyes $97,000 as institutional inflow surges $3.06 billion in a week

Bitcoin (BTC) price is stabilizing above $94,000 at the time of writing on Monday, following a 10% rally the previous week. The institutional demand supports a bullish thesis, as US spot Exchange Traded Funds (ETFs) recorded a total inflow of $3.06 billion last week, the highest weekly figure since mid-November.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.