“SEC is engaging with Ark Invest on Bitcoin ETF” says Cathie Wood; Bitcoin price to likely crash

- Bitcoin price has historically retraced in the six months before the anticipated halving, setting the target at $20,000.

- Investors are highly bearish, awaiting a correction of the fake rally, with 51% of all open BTC futures positions going short.

- Bitcoin dominance shot up to 51.95%, the highest since April 2021 and last grazed by BTC in June, which suggests trouble for altcoins.

Bitcoin price may see a decline soon unless the market stabilizes around the current levels. The next bullish momentum will most likely come from the approval of spot BTC ETFs, which are anticipated in January 2024, and Cathie Wood recently imbued confidence in this theory.

Other factors, including data from the BTC futures market and historical patterns ahead of Bitcoin halvings – the next halving is expected in early-to-mid 2024 – point to bearish pressure for the big crypto.

Daily Digest: Traders want Bitcoin to crash

- Even before Bitcoin price rallied on October 16, traders were betting on a decline, but this sentiment intensified over the past 48 hours thanks to the fake report-induced rise in Bitcoin price. The Long/Short ratio on Binance showed that close to 51% of all traders with an open BTC futures position are looking to short the cryptocurrency.

Bitcoin Long/Short ratio

Given that Bitcoin price is trading at $28,325 at the time of writing, hovering around the support line of $28,354, it is likely that the digital asset may decline. This could send BTC back to $27,418.

- But this bearish outlook is not just for the micro timeframe but macro as well. According to popular analyst Rekt Capital, BTC is probably going to see another 30% decline by the time Bitcoin halving takes place. This prediction is based on the historical move of the cryptocurrency about 180 days before the halving occurs.

Bitcoin price crashed by 24.45% in 2015 and 38% in 2019 between the halving event and the 26 weeks before it. This sets the macro target for the digital asset at $20,000.

#BTC

— Rekt Capital (@rektcapital) October 17, 2023

Bitcoin is ~180 days away from its Bitcoin Halving

At this point in the cycle, Bitcoin retraced -25% in 2015/2016 and -38% in 2019

History suggests a retrace is possible

A -30% retrace from current prices would see Bitcoin drop to ~$20,000$BTC #Crypto #Bitcoin pic.twitter.com/B3ROO6FJEr

- Nevertheless, there are other factors that could still invalidate this prediction, such as the spot Bitcoin ETFs. Although the Securities and Exchange Commission (SEC) has delayed its decision on the recent applications, Ark Invest’s founder, Cathie Wood, recently stated that the SEC is showing a change in its behavior. According to Wood, the regulator is engaging with Ark Invest on their spot BTC ETF, which is a bullish signal concerning its approval.

- But while it may be good news for Bitcoin price, it is not the best news for altcoins. The reason behind this is the growing dominance of Bitcoin, which increased after the Monday rally. At the moment, the BTC dominance stands at 51.93%, which is a 30-month high, and has only been touched by Bitcoin once in June.

Bitcoin dominance

This translates to trouble for altcoins since the altcoin season will be pushed further, leaving non-BTC investors facing losses.

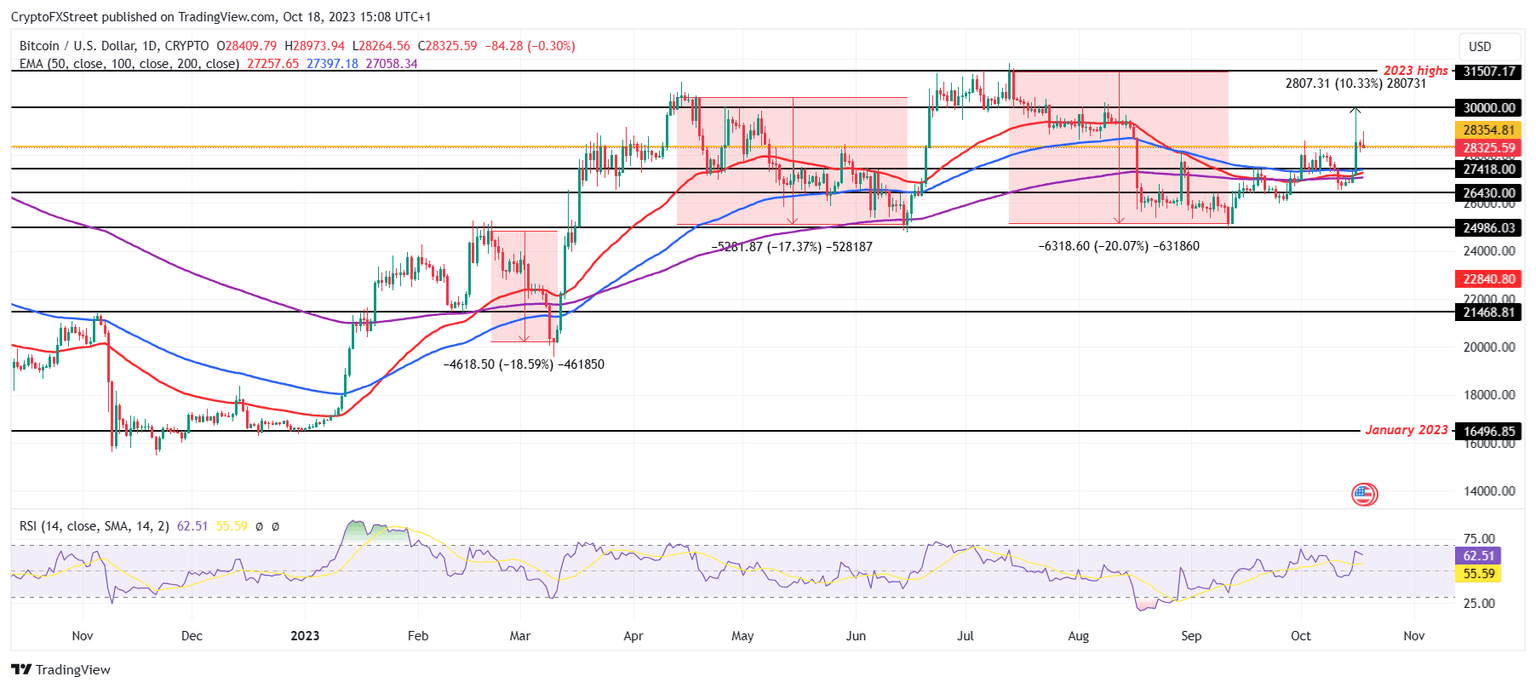

Technical Analysis: Bitcoin price to likely correct its recent rally

Bitcoin price may have completed an exhaustion bar after retreating from the unexpected rise on Monday but it has so far failed to follow through lower. This could lead to further downside, however, so far bearish action has been tame and contained.

BTC remains above the support line at $27,418, and the 50,100 and 200-day Exponential Moving Averages (EMA). It is still overall in an uptrend given the key June lows at $24,750 have so far held.

Losing the clutch of EMAs would be a bearish sign, however, and could result in BTC hitting $26,430.

BTC/USD 1-day chart

Despite the fake out and subsequent retraction spelling bad news for BTC, if Bitcoin price can find some bullish support, it could continue higher. The longer-term trend is marginally bullish despite the sideways activity throughout most of the year. A reclaim of the $28,354 level as support and rise to an intra-day high of $29,000 is possible. If BTC can sustain said levels, it could reconfirm the bullish bias and continue higher.

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.