Bitcoin price likely heads into volatile territory with Federal Reserve interest rate decision on Wednesday

- Bitcoin price is making steady gains, heading toward the $27,000 level after bearish August.

- BTC holders are closely watching the Federal Reserve interest rate decision at the FOMC meeting that concludes on September 20.

- Bitcoin price could benefit from upside volatility if there is no change in rates, but rate hike could increase selling pressure on BTC.

Bitcoin price action of late has fueled optimism among traders as the asset climbs toward $27,000 after a weak performance throughout August and the first two weeks of September. BTC holders are likely watching the Federal Open Market Committee (FOMC) meeting on Wednesday closely for cues on where the asset’s price is headed next.

The US Federal Reserve’s interest rate decision could act as a potential volatility driver for the asset as macroeconomic factors have had an impact on BTC prices throughout 2023.

Also read: XRP price fights risk of decline, sustains above $0.50 despite NYDFS action

Bitcoin price eyes $27,000 ahead of Fed rate decision

Bitcoin price is heading into a volatility-filled week with the Federal Reserve meeting on Wednesday. This event is key to BTC as the US Central bank will make a decision on interest rates, a macroeconomic factor that has typically influenced the cryptocurrency’s price.

Market participants do not expect the Fed to pivot from its stance on interest rates. CME’s FedWatch Tool has gathered a 99% probability of no hike and a 1% probability of an increase to 5.5% to 5.75%.

Target rate probabilities for Fed’s interest rate decision on September 20

No interest rate hike could result in Bitcoin price recovery gaining strength. An interest rate hike on the other hand could spring a surprise on BTC holders and increase the selling pressure on Bitcoin. Additionally, hawkish rhetoric may increase the odds of a hike later this year and thus lead to a sell-off in crypto assets.

The knee-jerk reaction in the past to interest rate hikes by the US Central bank has been a downside surprise to BTC price as market participants rapidly pull capital out of risk assets like cryptocurrencies.

Traders’ focus will be on the Summary of Economic Projections (SEP), a consensus among Fed governors for how the economy will shape up during the current calendar year and the next two years. This forecast is likely to set the tone for the rest of 2023 and help determine the direction in which BTC price is headed for the end of the year.

Whales sit on the sidelines, await FOMC outcome

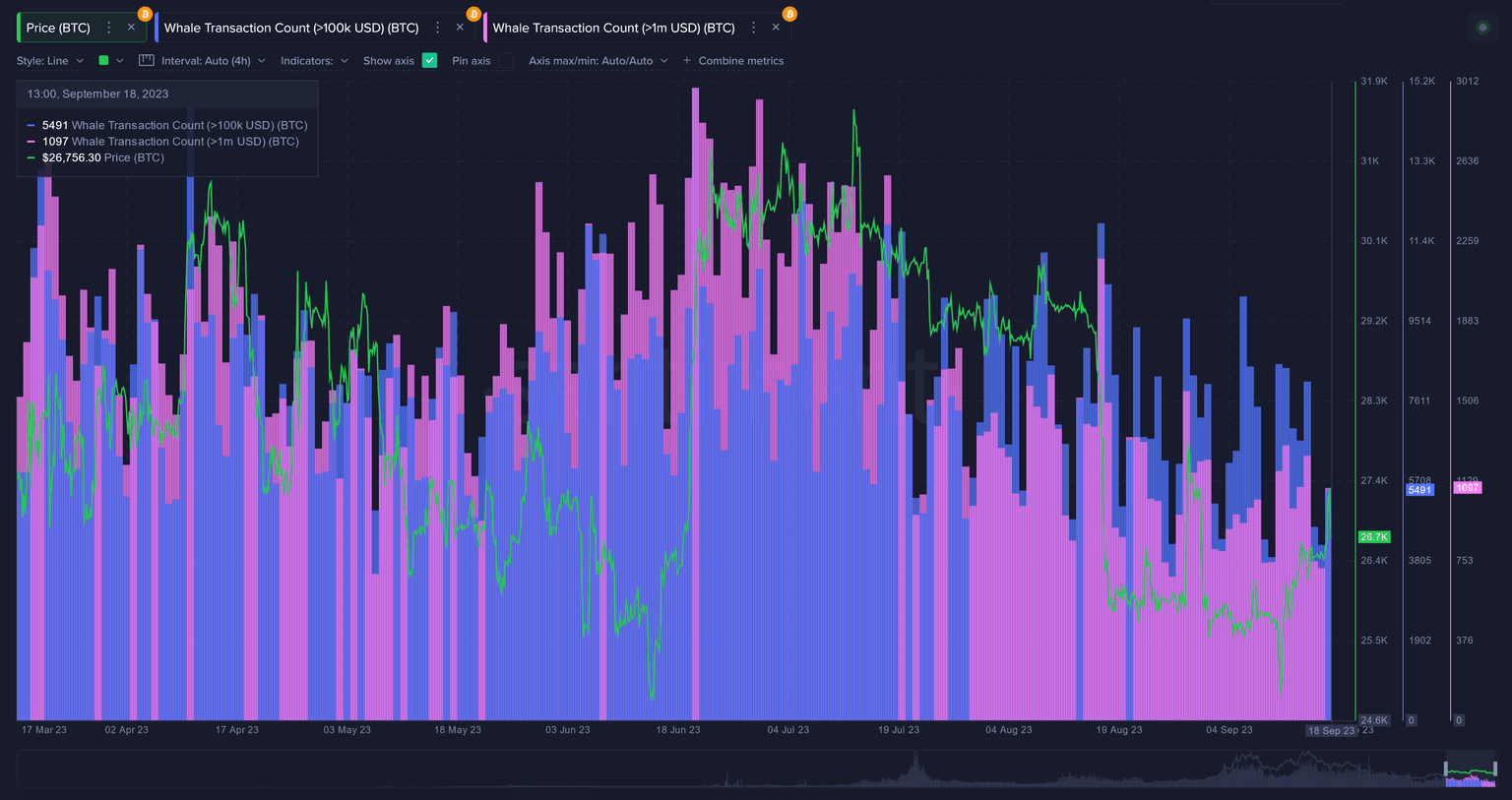

Based on data from crypto intelligence tracker Santiment, as of Tuesday, Bitcoin’s large wallet investors are sitting on the sidelines. The surge in Bitcoin address activity and the short-lived price rally in response to the US CPI report acted as volatility drivers for BTC in September.

The Whale transaction activity chart shows relatively low movement ahead of the FOMC decision.

Whale transaction count vs BTC price

As the FOMC approaches, on-chain analysts at Santiment highlight the need of a catalyst to drive BTC price recovery. In the short-term, there has been an increase in profit-taking among cryptocurrencies with large market capitalization.

Among these assets, BTC has recorded the highest ratio of profit vs. loss since the first week of July. This is typically considered a warning sign of an upcoming decline in BTC. The interest rate decision by the US Federal Reserve could alleviate BTC holders’ concerns,while the absence of an interest rate hike could drive the asset’s price higher and aid recovery.

Interest rates FAQs

What are interest rates?

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%.

If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

How do interest rates impact currencies?

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

How do interest rates influence the price of Gold?

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank.

If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

What is the Fed Funds rate?

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure.

Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.