Bitcoin price posts a new range high as Gensler details economic difference between BTC and the US Dollar

- Bitcoin price put the $50,000 milestone behind it after recording an intraday high of $52,043 on Wednesday.

- BTC could extend the climb 5% to $55,000 amid rising momentum and a strong presence of bulls in the BTC market.

- The bullish thesis will be invalidated if the apex crypto breaks and closes below $45,554.

- Appearing on CNBC, SEC Chair Gary Gensler said Bitcoin is not decentralized, calling it a token of choice for ransomware.

Bitcoin (BTC) price remains northbound, pushing to higher highs as holders keep their profit appetite in check. Meanwhile, Gary Gensler has drawn a line separating BTC from other currencies.

Gensler questions whether BTC is decentralized

In an appearance with CNBC on Wednesday morning,US Securities & Exchange Commission (SEC) Chair Gary Gensler said Bitcoin is not decentralized. He described BTC as a clever accounting ledger.

Gensler also emphasized that Bitcoin has the leading market share among purveyors of ransomware. He describes the crypto field as an area rife with fraud and manipulation.

Comparing Bitcoin to the US Dollar, the Euro, and the Yen, the SEC executive said Bitcoin does not have the privilege these currencies enjoy, referring to a “support for one currency generally per economic region.” In his opinion, this economic difference makes BTC inferior.

Gensler highlights that the use case for Bitcoin is that it is a speculative investment, which makes it popular among investors.

₿: News anchor @JoeSquawk defends #bitcoin in a conversation with SEC Chair Gary Gensler this morning live on television. pic.twitter.com/DRIlWmTlxK

— Documenting ₿itcoin (@DocumentingBTC) February 14, 2024

Bitcoin price outlook

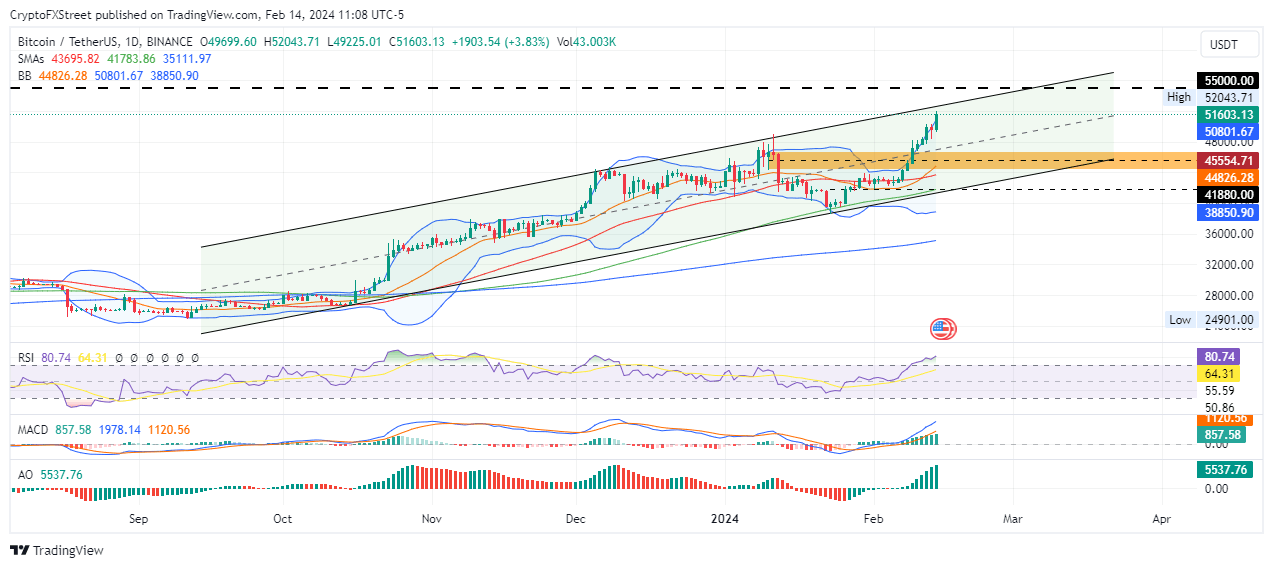

Bitcoin price remains broadly bullish, recording higher highs within the confines of an ascending parallel channel. The odds remain in favor of the bulls despite BTC being massively overbought, judging from the position of the Relative Strength Index (RSI) position at 80.

Considering the northbound inclination of the RSI, momentum is still rising, which means Bitcoin price could still have some upside potential. The bulls have also demonstrated fortitude, maintaining a strong presence in the market. This is seen in the presence of large volumes of histogram bars on both the Awesome Oscillator (AO) and the Moving Average Convergence Divergence (MACD).

Moreover, the MACD is still moving above its signal line (orange band), suggesting a strong bullish cycle in the works.

Increased buying pressure could see Bitcoin price enhance the climb, potentially breaking above the upper boundary of the channel to hit the $55,000 level. Such a move would constitute a 5% climb above current levels.

In a highly bullish case, Bitcoin price could extend the climb to the $60,000 psychological level. Such a move would constitute a 15% climb above current levels.

BTC/USDT 1-day chart

On the flipside, if the traders start cashing in on the gains made so far, Bitcoin price could drop to test the midline of the channel. An extended fall could send BTC to the supply zone turned bullish breaker between $44,300 and $46,760. A break and close below the midline of this order block at $45,554 would invalidate the bullish thesis, setting the pace for an extended fall.

Such a directional bias could send Bitcoin price to the $41,880 support, with such a move denoting a drop of nearly 20% below current levels.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.