- Bitcoin price is floating around without a strong conviction of direction.

- BTC price needs to overcome two bearish elements before bulls can gear up.

- Expect more sideways price action as traders must make up their minds.

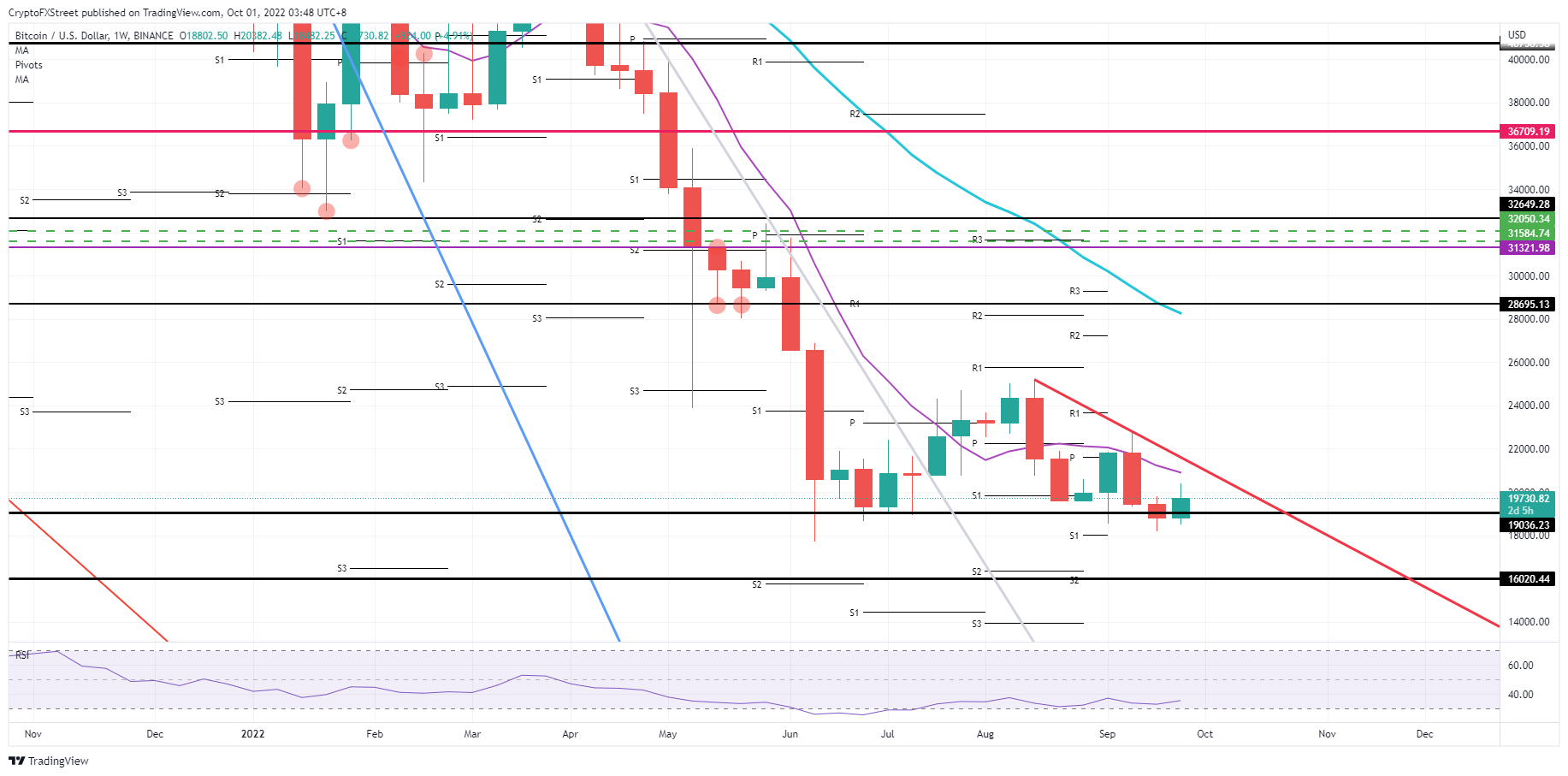

Bitcoin (BTC) price is trading sideways for the second week in a row as two bearish caps are still hanging over the price action while the price action itself is not making new lows. Seeing the current market turmoil with the forex market for pound sterling hitting a new low in over 30 years, equities in a bear market and the situation in Europe entering a higher phase in its tit-for-tat war with Russia, it does not look like there is a real catalyst for Bitcoin price to move upwards. Expect to see price action floating, awaiting that catalyst next week or the week after, in favor of a break to the downside.

BTC price expect to trade sideways in the waiting game

Bitcoin price is trading a bit as if traders are puzzled on what to do next as several tail risks are hanging over the price action while BTC price itself is trading in profit. This points to not much conviction from traders in a rally as the upticks do not see any follow-through; it could be common sense to see the current negative elements and tail risks escalating further into levels not seen in multiple decades.

BTC price is thus handed over at the mercy of the markets, and seeing a perfect storm brewing, this could be the eye of the storm. With markets currently licking their wounds and seeing pullbacks from those multiple-decade-lows, expect to see some sideways price action for now. Once one tail risk escalates another level higher, be it Russia, the UK or any other country or entity, expect a sharp drop in BTC price towards $16,020.

BTC/USD Weekly chart

Traders could be seen buying into the price action slowly but surely as possibly the markets have reached rock bottom and, with that, the awaited turning point. Should buying into the price action trigger a breakout to the upside above the 55-day Simple Moving Average (SMA). That would be the ideal breakout scenario and will see follow-through into next week certainly should equity markets back that move by trading away from bear market territory and creating tailwinds for cryptocurrencies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto Today: Metaplanet raises $10M to buy BTC, ETH price moves below $1,600 as Tron gains signals panic

The cryptocurrency aggregate market capitalization stabilized around $2.7 trillion on Wednesday, with Bitcoin’s $84,000 support momentarily anchoring the market against external bearish discourses.

Chainlink active addresses drop as whale selling spikes, could LINK crash below $10?

Chainlink active addresses slide dramatically to 3,200 from February’s peak of 9,400. The downtrend in network activity coincides with increasing selling activity among whales with between 10 million and 100 million LINK.

Bitcoin stabilizes around $83,000 as China opens trade talks with President Trump’s administration

Bitcoin is stabilizing around $83,500 at the time of writing on Wednesday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. A breakout of this strong level would indicate a bullish trend ahead.

Binance Chain completes $914M BNB token burn, hinting at a potential rally

Binance Chain has finalized its programmed 31st quarterly BNB token burn, potentially setting the stage for the world’s fifth-largest cryptocurrency, with a market capitalization of $81.45 billion, to rally in the coming weeks.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.