- Bitcoin price hit $37,900 for the first time in eighteen months, fueling a bullish outlook among BTC traders.

- The impending BTC spot ETF approval and bullish on-chain metrics are likely drivers of gains in Bitcoin.

- Bitcoin whale transactions valued at $100,000 noted a spike on Thursday, as the supply on exchanges declined.

Bitcoin price rallied to $37,900 for the first time in a year and half on expectations that US regulators are moving to approve a spot Bitcoin exchange-traded fund. Sentiment among BTC traders has improved as the US Securities and Exchanges Commission (SEC) peruses 12 Bitcoin ETF applications.

Bitcoin is exchanging hands at $36,683 on Binance at the time of writing. The price of the largest crypto asset by market capitalization has climbed nearly 5% over the past week.

Also read: Bitcoin price targets the $49,000 level as analysts predict approval of BTC spot ETFs by SEC

Daily Digest Market Movers: Bitcoin price resumes climb despite rising whale activity

- Bitcoin price climbed past $37,900 despite an increase in whale transactions valued at $100,000 or higher.

- Bitcoin price posted nearly 35% gains since the current rally started in mid October.

- The US SEC could approve some Bitcoin ETF applications before the deadline on January 10 as the comment period for several applicants finished on Wednesday, Bloomberg analysts Eric Balchunas and James Seyffart said in a note. Some approving orders could happen from November 9 to November 17, the analysts said.

- Based on data from crypto intelligence tracker Santiment, large volume transactions peaked on November 8 and climbed past 8,600 early on Friday.

- Large volume BTC transfers are typically associated with profit-taking, which tends to lead to a price decline in Bitcoin. However, the asset’s uptrend resisted the selling pressure.

Whale Transaction Count (>$100,000) and BTC price

- Weighted sentiment among BTC holders, a metric from Santiment that measures sentiment across social media platforms, climbed from -1.97 to 0.95 between November 8 and 9, alongside Bitcoin’s price rally.

Weighted sentiment and BTC price

- Bictoin's supply on exchanges has recently fell significantly. According to Santiment data, BTC supply dropped from 1.32 million on May 10 to 1.07 million on November 10. A decline in supply tends to reduce the selling pressure.

Supply on exchanges and Bitcoin price

Technical analysis: Bitcoin price likely to extend its gains

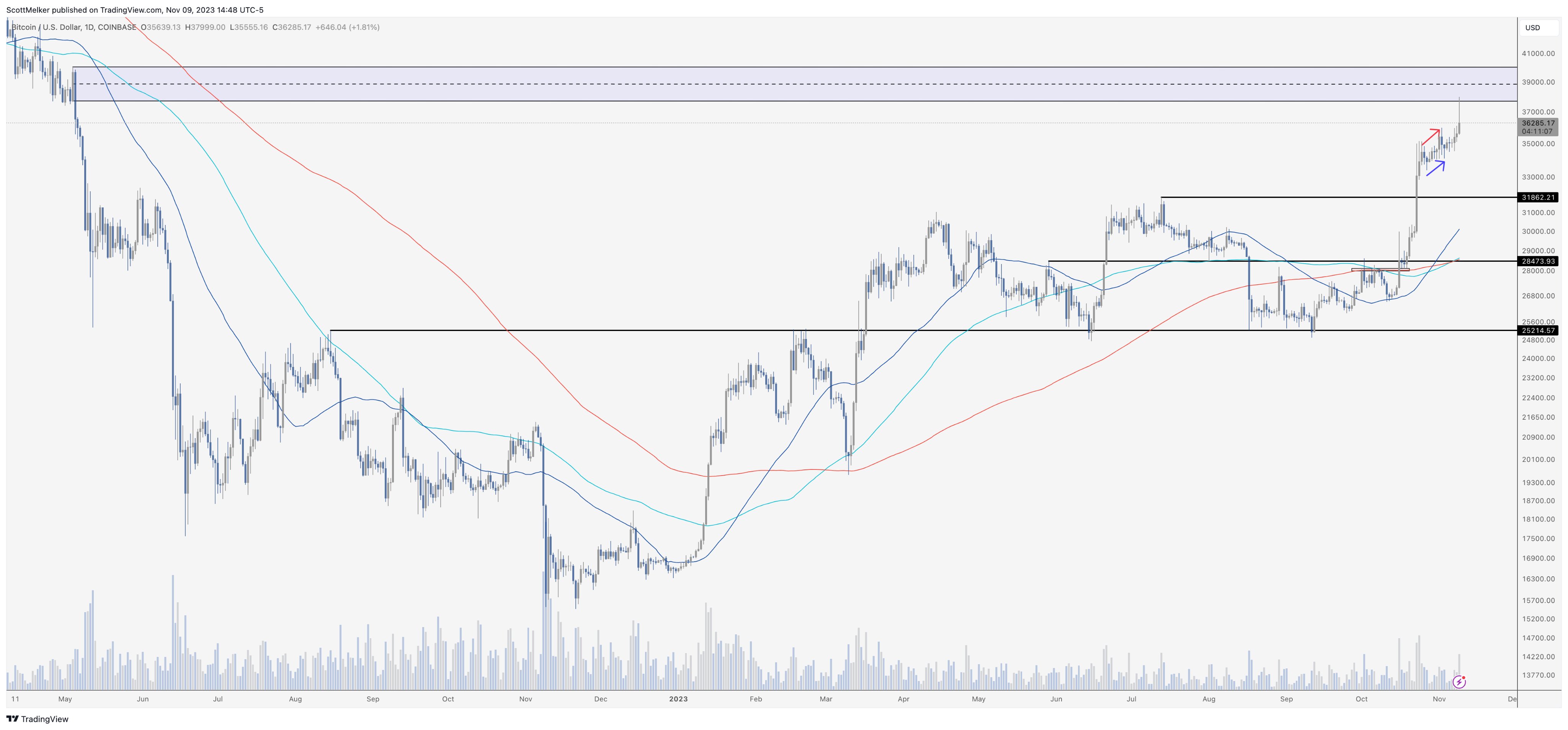

Bitcoin price is on track to climb higher after posting nearly 5% gains over the past week. The risk asset tapped the resistance at $38,000. Technical analyst, Scott Melker, considers the $38,000 level, the “mother of all resistances.”

Melker notes that the zone between $38,000 and $40,000 represents the pre-LUNA collapse levels and a rise past $40,000 could erase all contagion of 2022 from Bitcoin’s price chart.

BTC/USD 1-day chart

Melker considers this an area for profit-taking by traders.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP gains as traders gear up for futures ETFs debut this week

XRP climbs over 3% on Monday, hovering around $2.33 at the time of writing. The rally is likely catalyzed by key market movers like XRP futures Exchange Traded Funds (ETFs) approval by the US financial regulator, the Securities and Exchange Commission (SEC), and a bullish outlook.

Bitcoin Price Forecast: BTC eyes $97,000 as institutional inflow surges $3.06 billion in a week

Bitcoin (BTC) price is stabilizing above $94,000 at the time of writing on Monday, following a 10% rally the previous week. The institutional demand supports a bullish thesis, as US spot Exchange Traded Funds (ETFs) recorded a total inflow of $3.06 billion last week, the highest weekly figure since mid-November.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[11.15.57,%2010%20Nov,%202023]-638351931151983660.png)

%20[11.22.40,%2010%20Nov,%202023]-638351932262771832.png)

%20[11.05.04,%2010%20Nov,%202023]-638351932939235658.png)