Bitcoin price in line for ‘impulsive bounce’ as Solana (SOL) leads altcoin surge

Bitcoin (BTC) volatility is again overdue, and one analyst is favoring an “impulsive” move toward $50,000.

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

Trader: “Chill and wait” for Bitcoin breakout

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD continuing to circle $46,000 on Thursd as an eerie calm lingered over the market.

Tuesday saw mass upheaval as a cascade of unwound positions sparked a huge $9,000 daily loss for Bitcoin, something analysts have since pinned on overleveraged traders.

While the event’s lows of $42,800 have not been retested, a breakdown is not off the cards, popular trader Crypto Ed says.

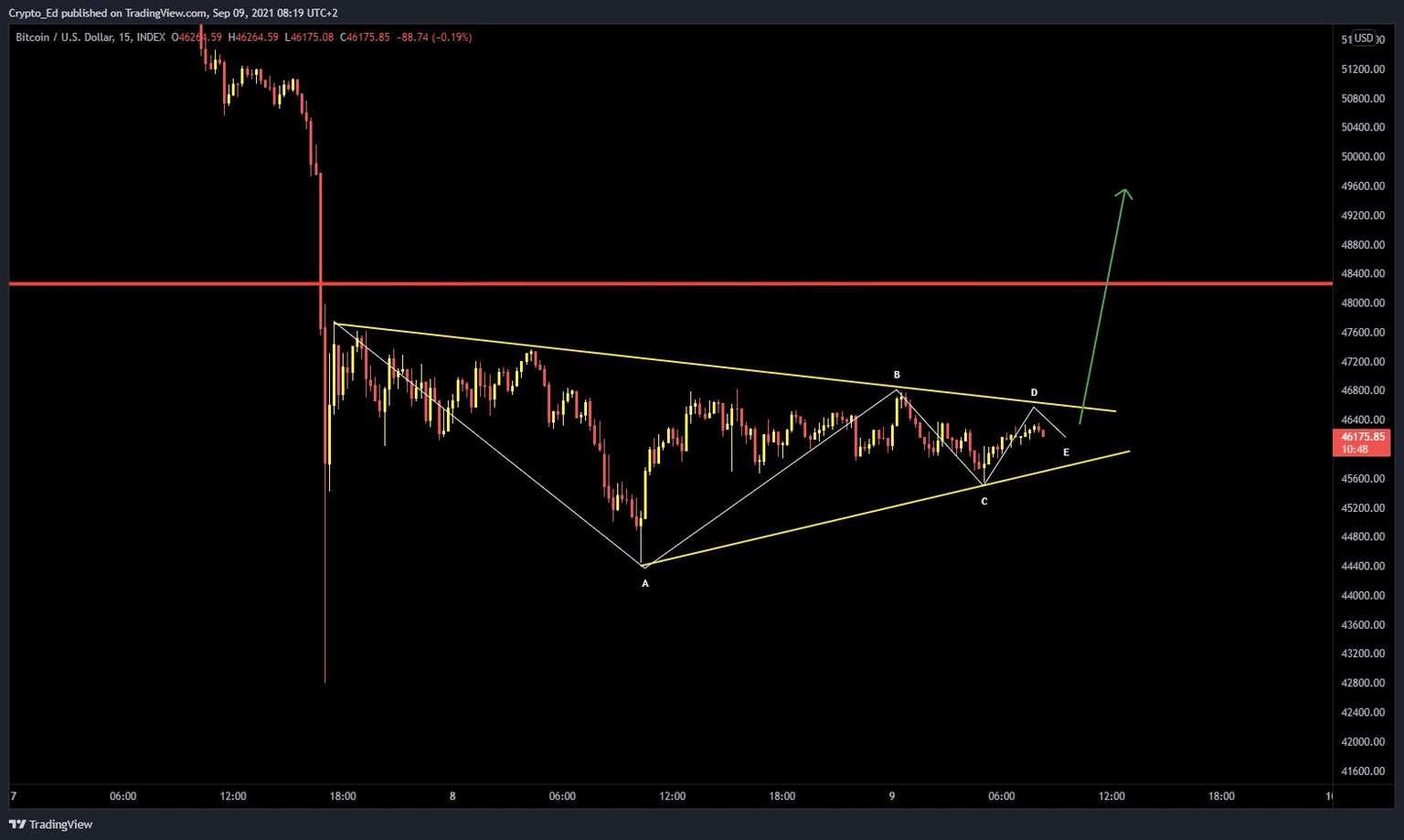

“Looks like a bullish pennant to me...Impulsive bounce followed by consolidation,” he summarized alongside an updated chart Wednesday.

“Chill and wait for the break out. Wrong when it breaks down.”

BTC/USD scenario. Source: Crypto Ed/Twitter

With expectations thus skewed to the upside, fellow trader and analyst Rekt Capital eyed an ongoing retest of Bitcoin’s 50-day exponential moving average (EMA) as a potential game-changer.

“This is the first time that BTC is retesting the blue 50-day EMA as support, after having reclaimed it as support in late July,” he noted.

“The 50-day EMA is useful for understanding bullish momentum as it tends to support established uptrends.”

BTC/USD 1-day candle chart (Bitstamp) with 50-day EMA. Source: TradingView

Altcoins recover as Solana passes $200

Improved performance across major altcoins, meanwhile, is giving hope to the bullish short-term case for Bitcoin.

While BTC/USD has stayed broadly flat overnight, all of the top 10 cryptocurrencies by market capitalization have posted solid gains of at least 4%.

Ether (ETH) added 4.5% to circle $3,470 at the time of writing, while Cardano (ADA) recovered above $2.50.

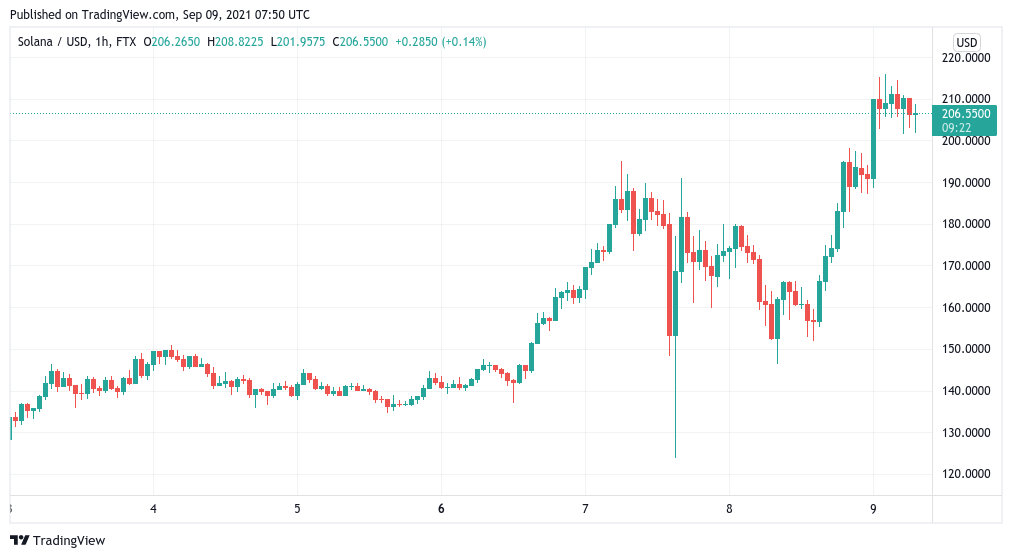

Still outshining the pack, however, is Solana (SOL), now trading above $200 on 32% gains in just 24 hours.

SOL/USD 1-hour candle chart (FTX). Source: TradingView

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.