Bitcoin price holds $65,000 as positive ETF inflows and positive on-chain data

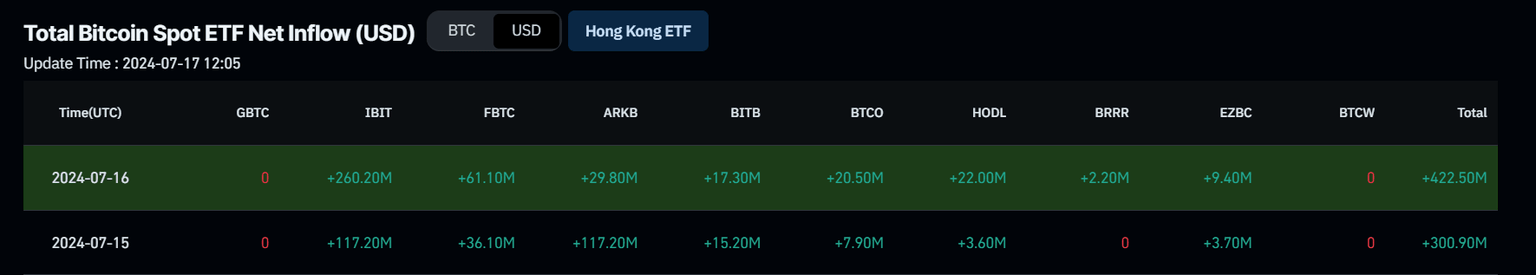

- US spot Bitcoin ETFs records inflows totaling $422.50 million on Tuesday, the largest since June 6.

- As reported by Tree News, Kraken notified Mt. Gox creditors that it had received its share of the funds.

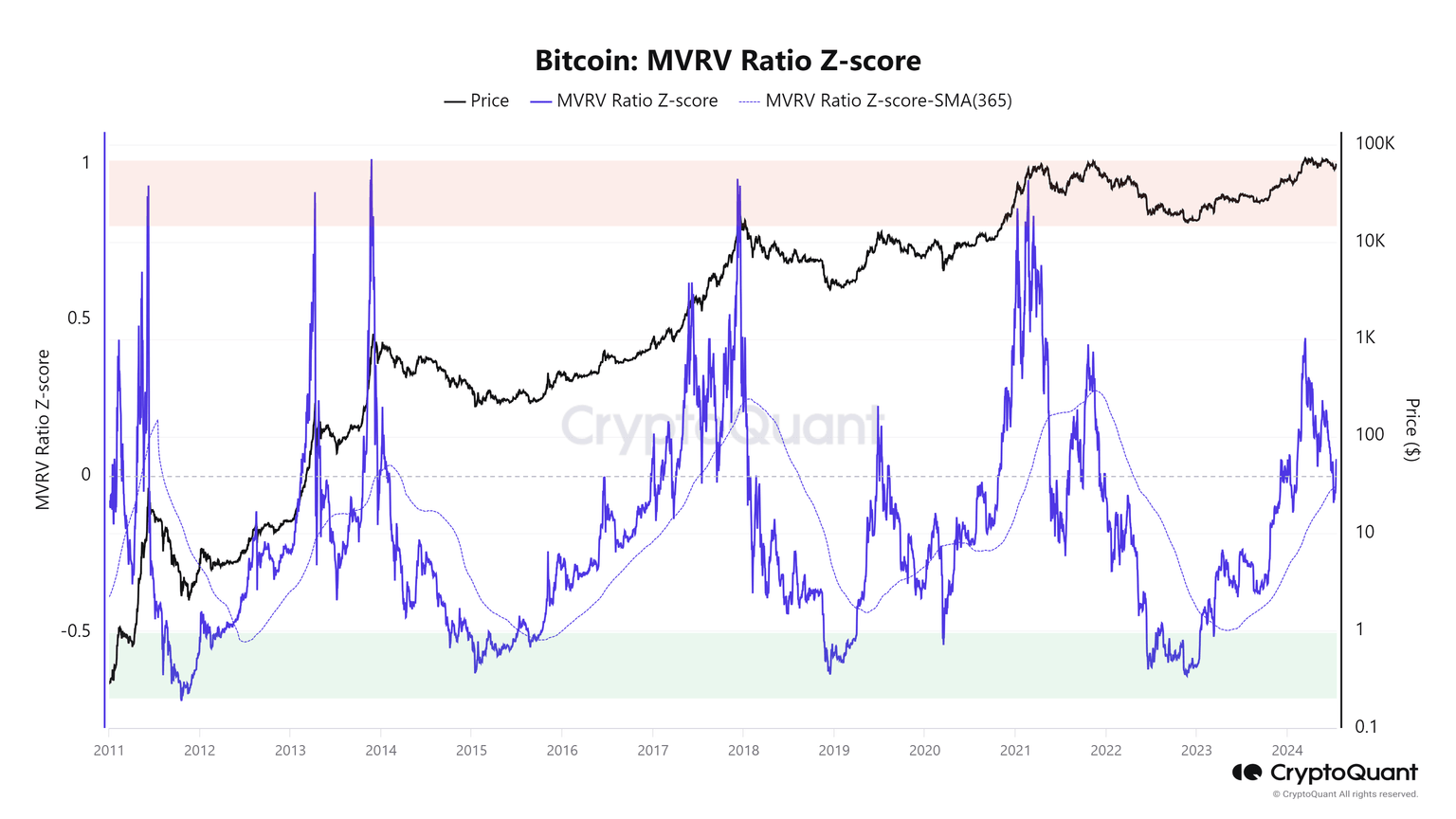

- On-chain data MVRV Z-Score shows that BTC is undervalued, suggesting a bullish move ahead.

- Hermetica, a Bitcoin DeFi protocol, launched its BTC-backed USDH on Bitcoin's L1 using the Runes protocol.

Bitcoin (BTC) trades slightly up at the time of writing on Wednesday, rising by 0.14% at $65,158 after closing above the daily resistance level of $64,913 the day before. On-chain data indicates that BTC is undervalued, and US spot Bitcoin ETFs recorded inflows totaling $422.50 million on Tuesday. According to Tree News, Kraken notified Mt. Gox creditors that it had received its share of the funds, while Hermetica, a Bitcoin DeFi protocol, launched its BTC-backed USDH on Bitcoin's L1 using the Runes protocol.

Daily digest market movers: Bitcoin price holds the $65,000 level as US Spot ETFs recorded a $422.50 million inflow

- According to Arkham Intelligence, Mt. Gox likely transferred 48,641 BTC, equivalent to $3.10 billion, to Kraken Exchange, prompting a minor bearish response in the market and resulting in a slight decline in cryptocurrency prices. Subsequently, Kraken notified Mt. Gox creditors that it had received its share of the Mt. Gox funds, as reported by Tree News. As of this morning, the remaining BTC transferred amounts to 43,114 BTC, valued at $2.74 billion, which is still under the control of the Mt. Gox trustee.

UPDATE ON MT GOX MOVEMENTS

— Arkham (@ArkhamIntel) July 16, 2024

We believe that 3JQieEzccKjFS34oW8KZSGBDndiH1YyFrE is most likely associated with Kraken, one of the exchanges involved in repaying Mt. Gox creditors.

This address received 48,641 BTC ($3.10B) from Mt. Gox this morning, which remains unspent.

The… https://t.co/FfFQcI9Xvr pic.twitter.com/4T3tuC3CSM

- According to Coinglass Bitcoin Spot ETF data, Tuesday saw inflows totaling $422.50 million, with Blackrock's ETF (IBIT) adding 4,020 BTC valued at $260.20 million. This marks the second day in a row of inflows this week and the largest since June 6. Monitoring these ETFs' net inflow data is crucial for understanding market dynamics and investor sentiment. The combined Bitcoin reserves held by the 11 US spot Bitcoin ETFs stand at $52.39 billion.

Bitcoin Spot ETF Net Inflow (USD) chart

- Hermetica, a Bitcoin-based decentralized finance (DeFi) protocol, has introduced its BTC-backed synthetic dollar, USDH, on Bitcoin's layer one (L1) using the Runes protocol. The initiative includes future scaling efforts through layer two (L2) solutions like Stacks to enhance Bitcoin-native DeFi operations. This development offers Bitcoin users alternatives that reduce reliance on centralized exchanges and fiat-backed stablecoins across other blockchain networks.

Hermetica x @LiquidiumFi $USDh is now live on Liquidium.

— Hermetica (@HermeticaFi) July 17, 2024

Borrow $BTC against USDh collateral, earn Hermetica & Liquidium points. pic.twitter.com/HfAxhjgzAU

- According to CryptoQuant, the Market Value to Realized Value (MVRV) Z-Score provides insights into whether the market is overvalued or undervalued. Historically, MVRV Z-Score around -0.5 has often resulted in significant returns, with the metric peaking at 0.8. When combined with the 365-day Simple Moving Average (SMA), the MVRV Z-Score acts as both support and resistance.

- Currently, the MVRV Z-Score stands at 0.05, finding support from the 365-day SMA indicator. This suggests a potential market bottom and continuation of the bullish trend. This upward movement could persist until it reaches overbought territory, potentially reaching the cyclical peak in the red zone.

Bitcoin MVRV Ration Z-score chart

Technical analysis: BTC price looks promising

Bitcoin price surged above a descending trendline on Sunday, marking a 7% rally over the following two days and achieving a close above the daily resistance level of $64,913 by Tuesday. At the time of writing on Wednesday, BTC is trading slightly up by 0.14% at $65,158. Such a strong upward momentum often precedes a retracement, presenting a potential buying opportunity for investors on the sidelines.

Sideline buyers seeking opportunities can consider positions between $59,200 and $57,800, where the previously broken trendline resistance now serves as support. However, should BTC sustain its bullish momentum, it may advance by 3% from its current trading price of $65,158 to test the weekly resistance of around $67,209.

On the daily chart, the Relative Strength Index (RSI) is currently above the neutral level of 50, and the Awesome Oscillator (A.O.) has also flipped above its neutral level of zero. These momentum indicators strongly indicate bullish dominance.

Furthermore, surpassing the $67,209 level could allow an additional 7% rise to retest its daily high of $71,997 from June 7.

BTC/USDT daily chart

Conversely, if BTC closes below $56,405 and forms a lower low in the daily timeframe, it may signal persistent bearish sentiment. This scenario could trigger a 7.5% decline in Bitcoin's price, targeting its daily support at $52,266.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.