Bitcoin price extends retreat from $69K as old whales shift their holdings to new whales

- Bitcoin “old whales” are moving their holdings to “new whales,” mainly TradFi big-wigs such as Fidelity and BlackRock via ETFs.

- A definitive sell-off is not confirmed, with retail playing safe by watching old whales selling or mitigating risk.

- BTC price is less than 5% away from its ATH, rising slowly despite a standing CME gap.

Bitcoin (BTC) price continues to move further away from the $69,000 threshold, gaining ground as BTC bulls hope for a retest of the $73,777 peak. This is because of the general assumption that clearing this blockade would set the tone for a reach higher, marking a new all-time high.

Also Read: Bitcoin Price Outlook: Will $150 billion bank Morgan Stanley send BTC to new ATH?

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Old whales shift their Bitcoin holdings to new whales

Bitcoin price is holding above the $70,000 threshold, with BTC holders’ eyes peeled on the $73,777 peak, which if reclaimed, could reinvigorate the uptrend. However, there appears to be a split of emotion among whales, with the old ones selling while the new ones actively buy.

According to CryptoQuant founder Ki Young Ju, Bitcoin “old whales” could be moving their holdings to “new whales,” mainly traditional finance big-wigs such as Fidelity and BlackRock. These two issuers pass as choice candidates given the wave of inflows reported.

Old whales are selling #Bitcoin to new whales(TradFi), not retail investors. This can be clearly observed on-chain.

— Ki Young Ju (@ki_young_ju) March 28, 2024

Chart by @AxelAdlerJr pic.twitter.com/L8tWWvcmfb

Community members responding to Young Ju’s observation say that these old whales are moving their holdings as part of a risk mitigating risk. Specifically, taking out holdings from self-custody and putting them in a regulated investment vehicle such as spot BTC ETFs is a better measure of covering unexpected eventualities.

Meanwhile, analysts acknowledge that Bitcoin price continues to rise despite the presence of an open CME gap.

#Bitcoin CME Gap remains open as price is moving higher.

— Daan Crypto Trades (@DaanCrypto) March 28, 2024

Shows you why it's important not to fixate on these too much, it can really throw you off.

Fact is, during bull markets, gaps get created and often don't get closed.

Same in bear markets with gaps above that sometimes… https://t.co/2DP0Cgq1U1 pic.twitter.com/IGNQ2p0NkO

When a Bitcoin CME gap remains open, it means that the price at which BTC futures contracts are traded on the Chicago Mercantile Exchange (CME) did not align with the spot price of Bitcoin. This creates a "gap" in the trading charts where the price of Bitcoin moved significantly between the closing of one trading session and the opening of the next one.

The general expectation is that these gaps are filled eventually. This means that Bitcoin price will move back to fill the gap left on the chart. Notably, however, this pullback is not guaranteed as not every gap is filled.

Bitcoin price prediction as old whales mitigate risk

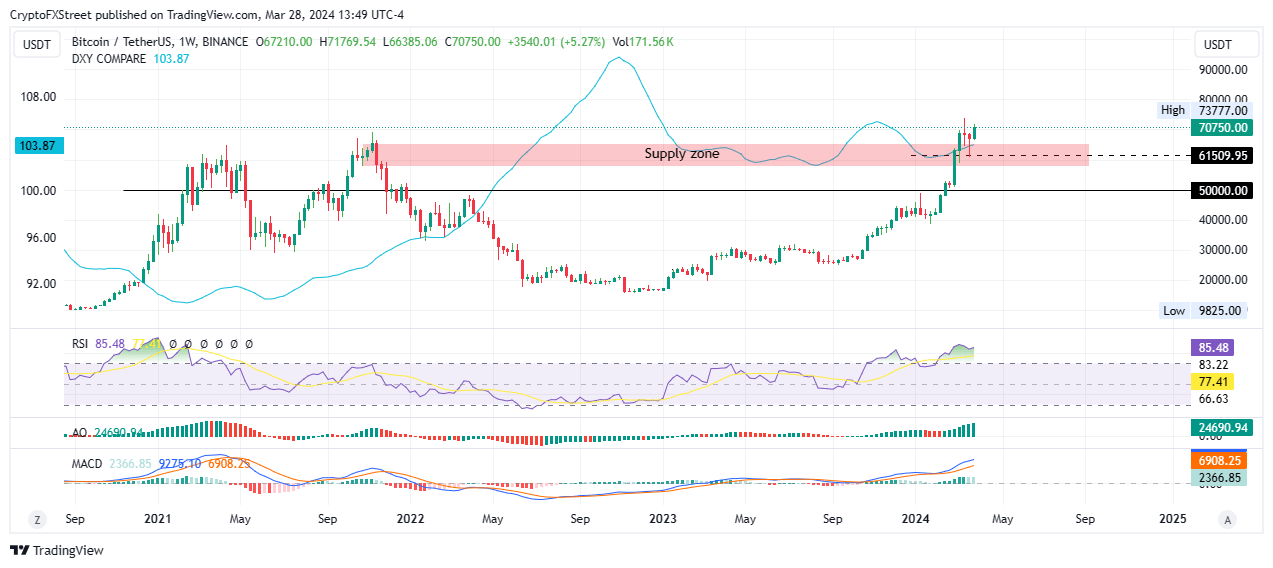

Bitcoin price is moving above the supply zone that extends from $57,518 to $65,501. A decisive candlestick close above this order block on the weekly time frame could confirm the continuation of the uptrend.

If BTC price reclaims the $73,777 peak, it could encourage more buying pressure, likely sending it to the $74,000 to $75,000 range or higher.

The sustained green histograms of both the Awesome Oscillator (AO) and the Moving Average Convergence Divergence (MACD) show a growing bullish sentiment, accentuated by the position of the MACD above the orange band of its signal line. The Relative Strength Index (RSI) is also recording higher highs, enhancing the bullish thesis as it signifies rising momentum while moving well above the yellow band.

BTC/USDT 1-week chart

On the other hand, if traders start to cash in on the gains made so far, Bitcoin price could retract. A weekly candlestick close below the midline of the supply zone at $61,509 would encourage more sell orders, causing BTC price to fold toward the $50,000 range.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.