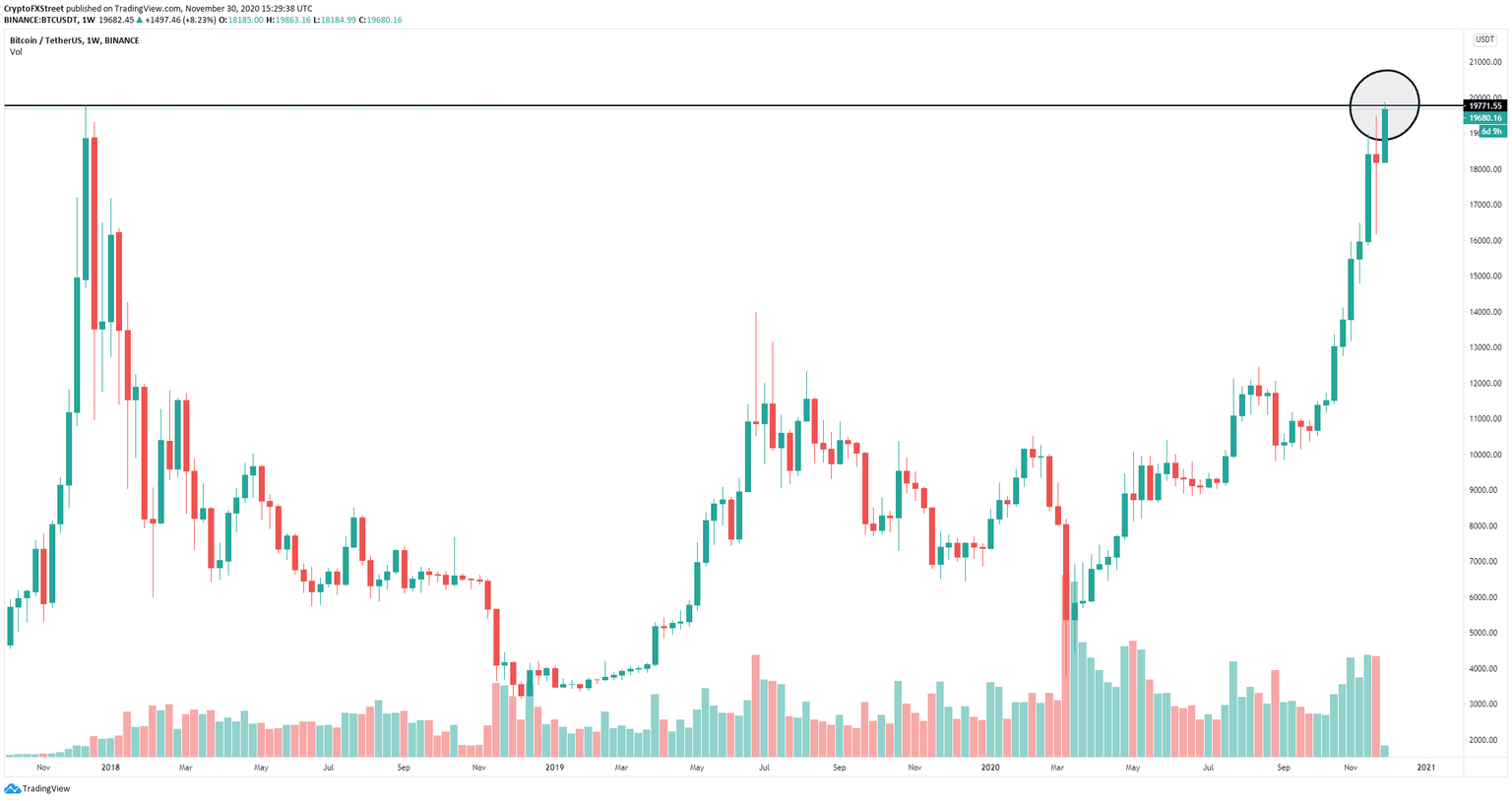

Bitcoin price hits a new all-time high at $19,863 on Binance

- Bitcoin price just crossed the previous all-time high on Binance surging towards 19,863

- The flagship cryptocurrency faces practically no resistance after this point.

Bitcoin price managed to recover strongly from its last dip at $16,188 and has hit a new all-time high on Binance and a few other exchanges but not all. The flagship cryptocurrency got slightly rejected from the new top but remains trading at $19,700 aiming to crack the psychological resistance level at $20,000.

Bitcoin price facing a potential double top

Despite the current run towards $20,000 and hitting a new all-time high on Binance at $19,863, the potential of a double top is still a real option unless bulls can push the flagship cryptocurrency well above $20,000 and close there on all exchange.

BTC/USD weekly chart

On the 4-hour chart, the TD Sequential indicator is on the verge of presenting a sell signal which is adding selling pressure. Confirmation and validation of the signal followed by strong bearish price action could indicate that this is simply a dead cat bounce and Bitcoin is not yet ready to crack $20,000.

BTC/USD 4-hour and 3-hour charts

The TD Sequential indicator already presented a sell signal on the 3-hour chart which adds credence to the upcoming signal on the 4-hour chart. Due to the magnitude of the bounce, there is very little support towards $16,000. Additionally, there seems to be a significant CME Bitcoin Futures gap formed between $17,000 and $18,000 which might need to be filled first.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.