- Bitcoin price faces headwinds as traders fail to support price action above $29,000.

- BTC could drop next week as another fade is underway.

- With all eyes on the financial system next week, risk sentiment could eat into the 28% gains from Bitcoin last week.

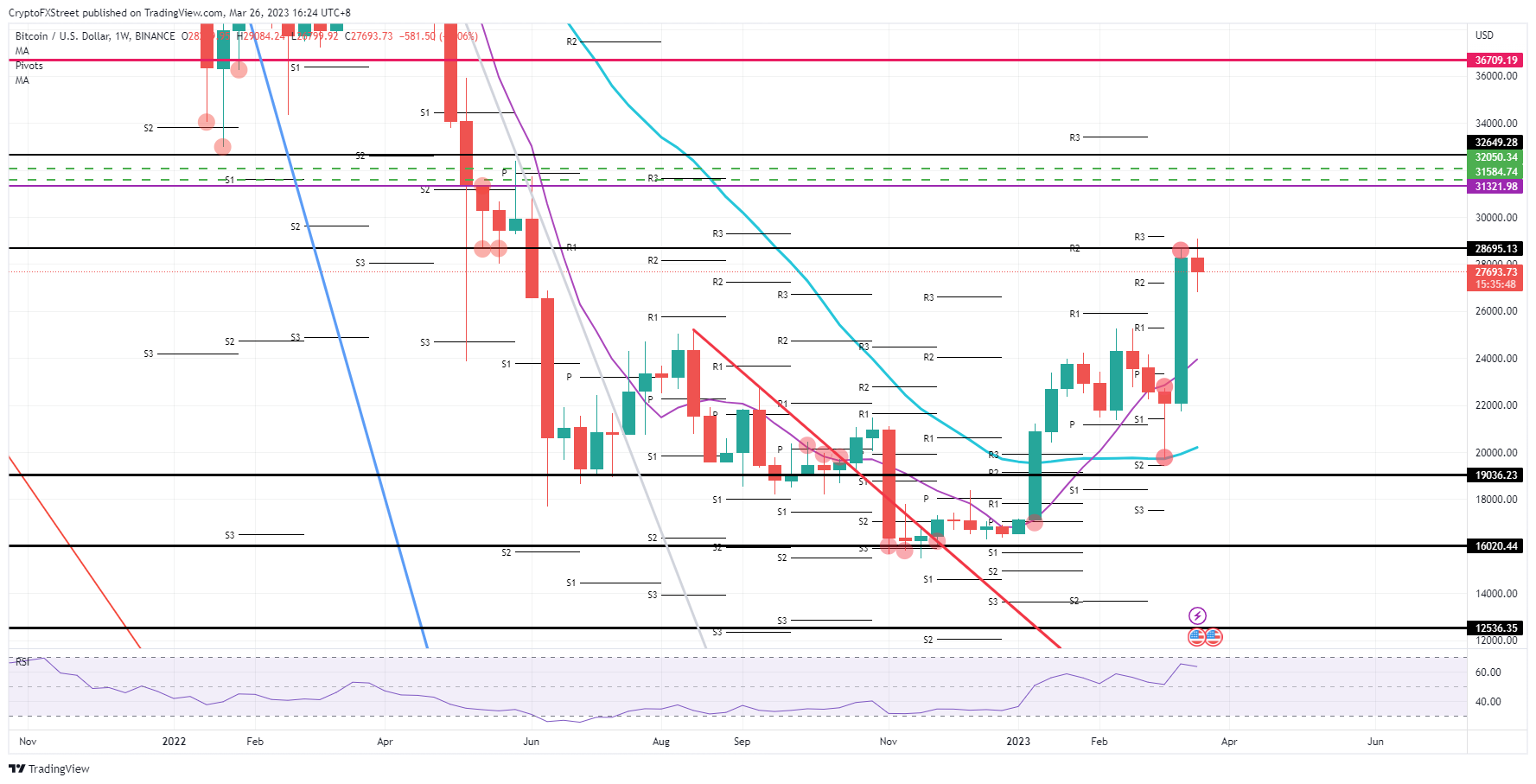

Bitcoin (BTC) price had a stellar performance last week, with over 28% gains in its books. Bulls, however, saw their dream crushed of $30,000 as $290,000 brought a firm rejection, and bulls have been unable to trade back at that level ever since. Expect going into next week to see another leg lower in the fade toward $25,300 as a support level.

Bitcoin price needs traders to hold $25,300, or else all is lost

Bitcoin price jumped firmly higher last week as Bitcoin bulls got unleashed and triggered a massive tailwind for nearly all crypto- and altcoins. Unfortunately, this week's performance is a bit of a hangover as BTC price tanks while smaller brother XRP is booking gains near the end of the weekend. All eyes will be on the financial system at the start of next week as Bitcoin could take another step back.

BTC will fade lower, but support should be nearby. A 10% drop towards $25,300 would be a good deal for bulls that were late to join the rally to do it then. A side note to be made here is that if a negative headline or another bank defaults, Bitcoin will give up all the gains it booked last week and slide back to $22,000.

BTC/USD weekly chart

With the fade still somewhat contained, should the ASIAPAC print green numbers and a recovery across the board, expect Bitcoin price to gain a tailwind. Price action would break back above $29,000. Expect $30,000 to be very difficult, but a quick gap towards $31,321 will materialize with 11% gains once broken.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Lukas Enzersdorfer-Konrad, Bitpanda deputy CEO: “Crypto needs Gary Gensler gone”

Lukas Enzersdorfer-Konrad is the deputy CEO at Bitpanda, a broker based in Europe with more than five million users. At the European Blockchain Convention held in Barcelona, the executive shared with FXStreet his views on the current state of the crypto industry and its regulation.

Bitcoin still consolidates despite positive spot ETFs demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

Why is ONDO’s price outlook bullish?

DefiLlama data shows that Ondo TVL reached a new ATH of $613.75 million. Ondo’s Supply Distribution metric shows whale accumulation. On-chain data shows that ONDO’s daily trading volume is rising, and the supply of exchanges is decreasing.

Maker price eyes a rally on technicals and on-chain metrics

Maker trades above $1,500 on Thursday, suggesting a potential rally as technical indicators show bullish divergence. This positive outlook is reinforced by MKR’s Exchange Flow Balance, which shows a negative spike, indicating growing investor confidence in the platform.

Bitcoin: Fed-led rally could have legs towards $65,000

Bitcoin is poised for a second consecutive week of gains, supported by the recent 50-basis-point cut in interest rates by the Federal Reserve. Bitcoin broke above several key technical resistances this week, signaling a rally continuation.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.