Bitcoin price gets help from equities, but positive weekly close unlikely

- Bitcoin price action will close the week with a loss unless the weekend brings more bullish surprises.

- BTC price action helps avoid a meltdown from US inflation and equities.

- Expect to see a recovery back to $19,036 by Sunday.

Bitcoin (BTC) price action is trying to avoid a meltdown, as seen in June and May earlier this year. After Binance’s failed takeover of FTX, the whole cryptocurrency asset class went into meltdown mode. Luckily on Thursday, a lower US inflation print triggered a massive stock rally that created a tailwind for cryptocurrencies, which traders are using to pair back some incurred losses from earlier this week.

BTC price will need time to recover to $20,000

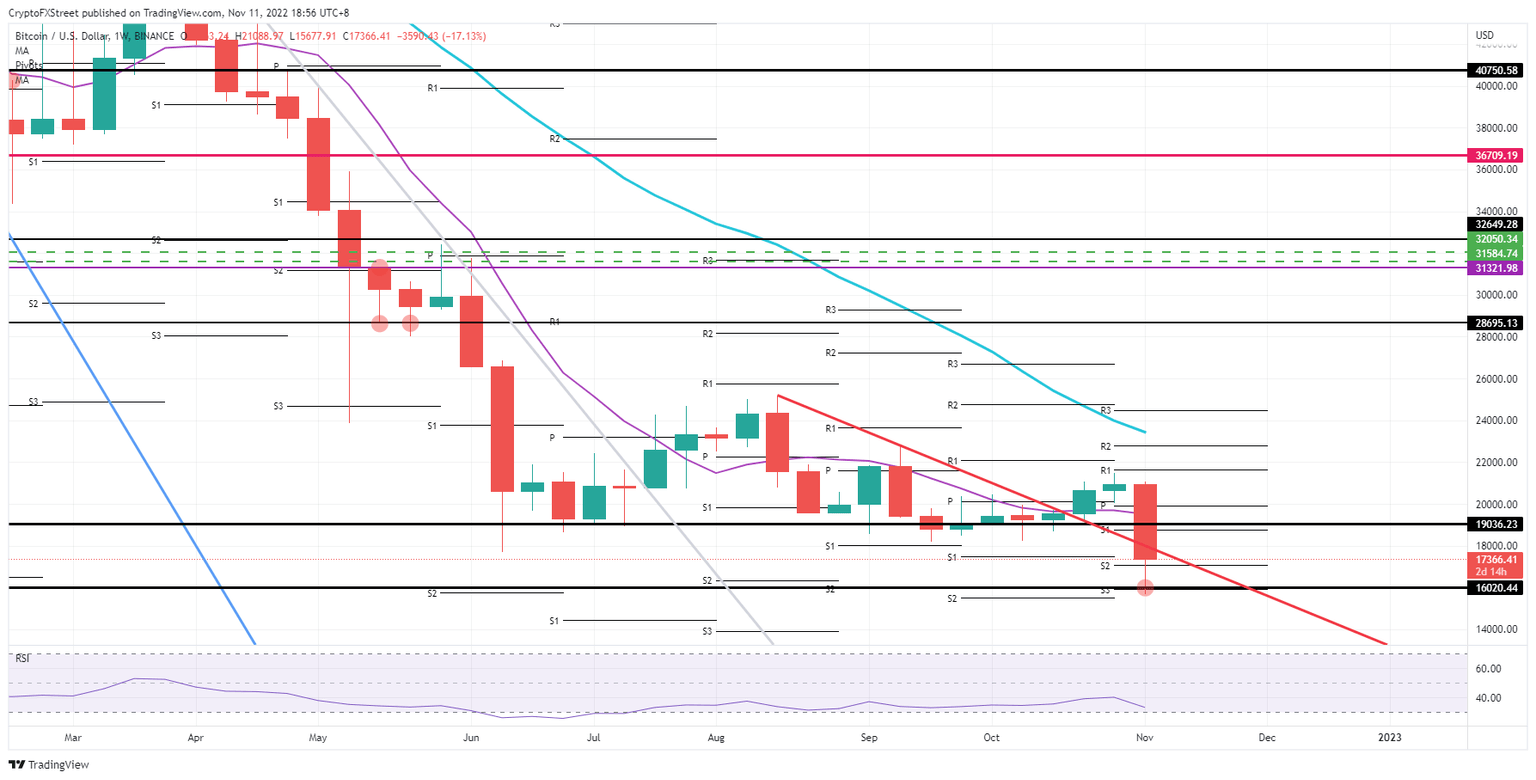

Bitcoin price on the weekly chart paints a less interesting picture against the daily performance from Thursday at the US closing bell. Cryptocurrencies, in general, had helped regain some control and stop the selling frenzy that was taking place after the FTX fiasco. With the Dow Jones rallying over 1000 points after a lower US inflation print, Bitcoin enjoyed a supportive tailwind that helped it regain its footing near a key technical level.

BTC price action going into the weekend has a good chance to get back to $19,036. That level is key as it acted as a pivotal level for most of 2022. Where Bitcoin closes on Sunday will determine whether $21,000 is to be forecasted for next week and should be possible if stocks can continue their rally.

BTC/USD weekly chart

Risk to the downside will come when BTC price action slips below the red descending trend line. That would put Bitcoin price back into bear market territory and build up selling pressure again at $16,020. That level did not hold up this week. On the next firm test for the end of this week or next week, it looks quite fragile with $15,000 up next.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.