A recent Fidelity Digital Assets report questioned whether Bitcoin’s price had already seen its cyclical “blow off top” or if BTC (BTC $83,522) is on the cusp of another “acceleration phase.”

According to Fidelity analyst Zack Wainwright, Bitcoin’s acceleration phases are characterized by “high volatility and high profit,” similar to the price action seen when BTC pushed above $20,000 in December 2020.

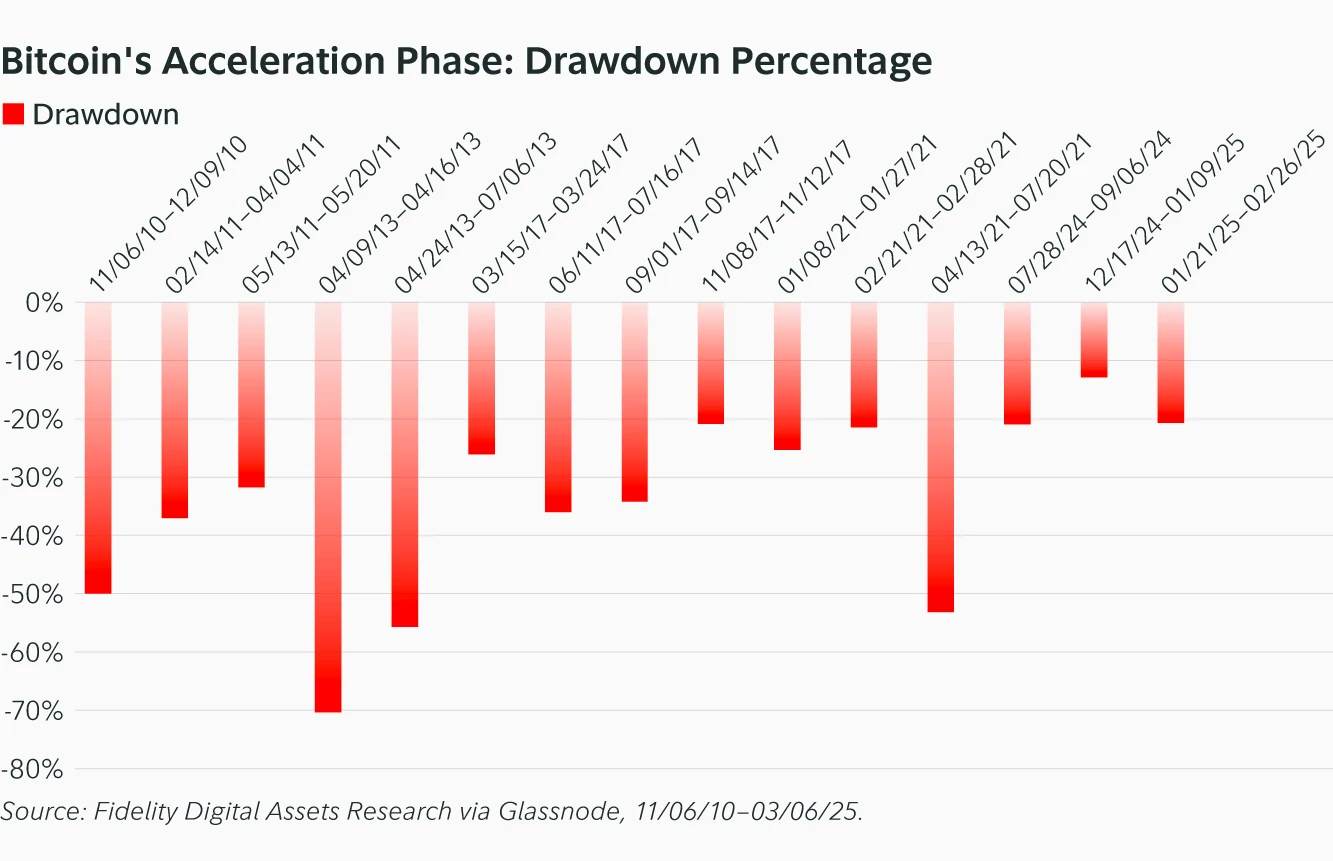

While Bitcoin’s year-to-date return reflects an 11.4% loss, and the asset is down nearly 25% from its all-time high, Wainwright said the recent post-acceleration phase performance aligns with BTC’s average drawdowns, compared with previous market cycles.

Bitcoin historical downside after acceleration phases. Source: Fidelity Digital Assets Research

Wainwright suggests that Bitcoin is still in an acceleration phase but is moving closer to the completion of the cycle, as March 3 represented day 232 of the period. Previous peaks lasted slightly longer before a corrective period set in.

The acceleration phase of 2010 - 2011, 2015, and 2017 reached their tops on day 244, 261, 280, respectively, suggesting a slightly more drawn-out phase each cycle.

Is another parabolic rally in the cards for Bitcoin?

Bitcoin’s price has languished below $100,000 since Feb. 21, and a good deal of the momentum and positive sentiment that comprised the “Trump trade” has dissipated and been replaced by tariff-war-induced volatility and the markets’ fear that the US could be heading into a recession.

Despite these overhanging factors and the negative impact they’ve had on day-to-day Bitcoin prices, large entities continue to add to their BTC stockpiles.

On March 31, Strategy CEO Michael Saylor announced that the company had acquired 22,048 BTC ($1.92 billion) at an average price of $86,969 per Bitcoin. On the same day, Bitcoin miner MARA revealed plans to sell up to $2 billion in stock to acquire more BTC “from time to time.”

Following in the footsteps of larger-cap companies, Japanese firm Metaplanet issued 2 billion yen ($13.3 million) in bonds on March 31 to buy more Bitcoin, and the biggest news of March came from GameStop announcing a $1.3 billion convertible notes offering, a portion of which could be used to purchase Bitcoin.

The recent buying and statements of intent to buy from a variety of international and US-based publicly listed companies show a price-agnostic approach to accumulating BTC as a reserve asset, and highlight the positive future price expectations among institutional investors.

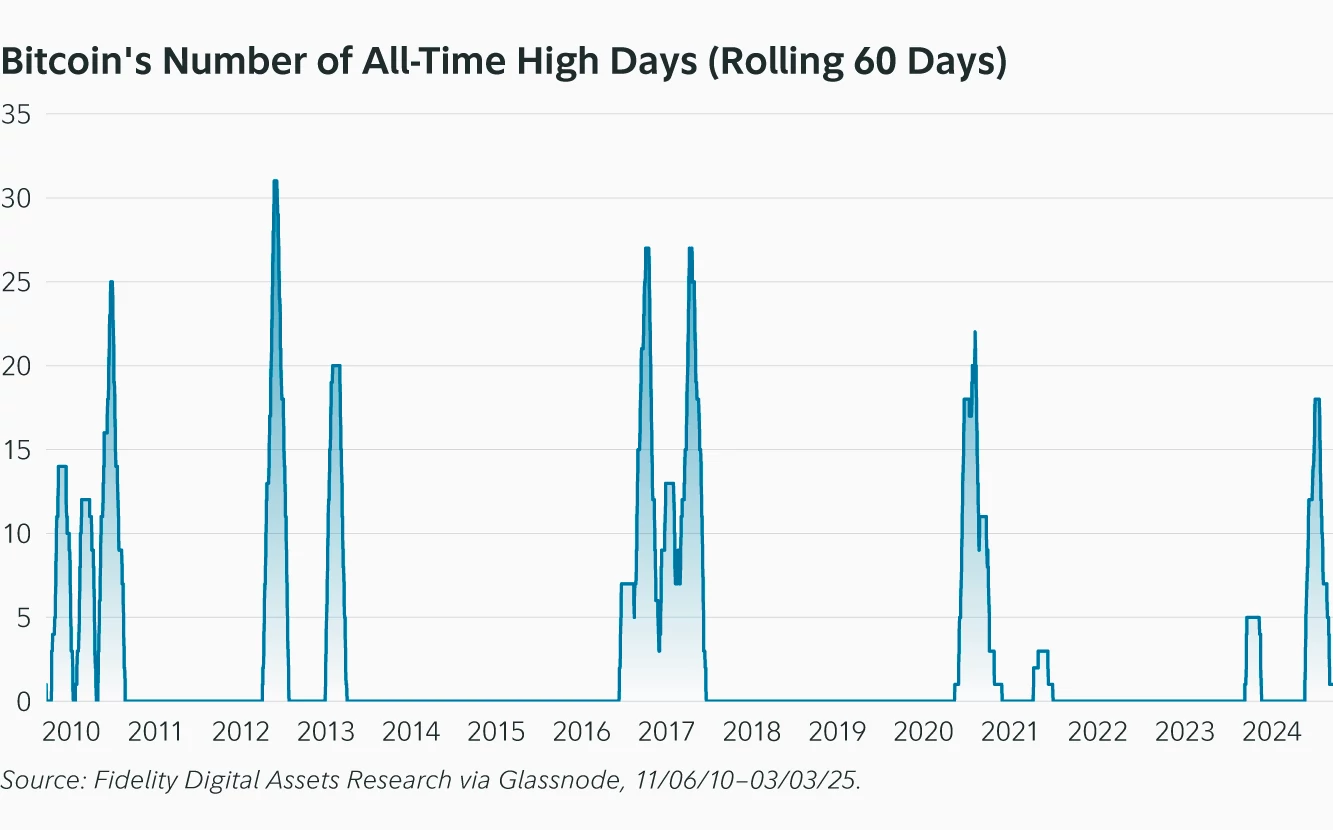

While it is difficult to determine the impact of institutional investor Bitcoin purchases on BTC price, Wainwright said that a metric to watch is the number of days during a rolling 60-day period when the cryptocurrency hits a new all-time high. Wainwright posted the following chart and said:

Bitcoin has typically experienced two major surges within previous Acceleration Phases, with the first instance of this cycle’s following the election. If a new all-time high is on the horizon, it will have a starting base near $110,000.

Bitcoin’s number of all-time high days (rolling 60 days). Source: Fidelity Digital Assets Research

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.