- Bitcoin price edges below $95,500 on Monday after declining nearly 5% the previous week.

- President Donald Trump’s tariffs on major trading partners, including China, Canada, and Mexico, wipes $2.26 billion from the crypto market.

- Nick Forster, Founder of Derive.xyz, told FXStreet that recent tariffs imposed are likely to increase inflation, which could dampen investor sentiment in crypto markets.

Bitcoin (BTC) price edges below $95,500 on Monday after declining nearly 5% the previous week. Fears caused by United States (US) President Donald Trump’s tariffs on major trading partners, including China, Canada, and Mexico, wipe $2.26 billion from the crypto market. Nick Forster, Founder of Derive.xyz, told FXStreet that recent tariffs imposed are likely to lead to increased inflation, which could dampen investor sentiment in crypto markets.

Bitcoin crashes below $96,000 as Trump implements tariffs on imports from Canada, Mexico, and China

Bitcoin’s price declined on Friday as it dropped below a key support level. This correction was fueled by the implementation of US President Trump’s announced tariffs on major trading partners, including China, Canada, and Mexico, on Saturday, which exerted some selling pressure on the overall crypto market.

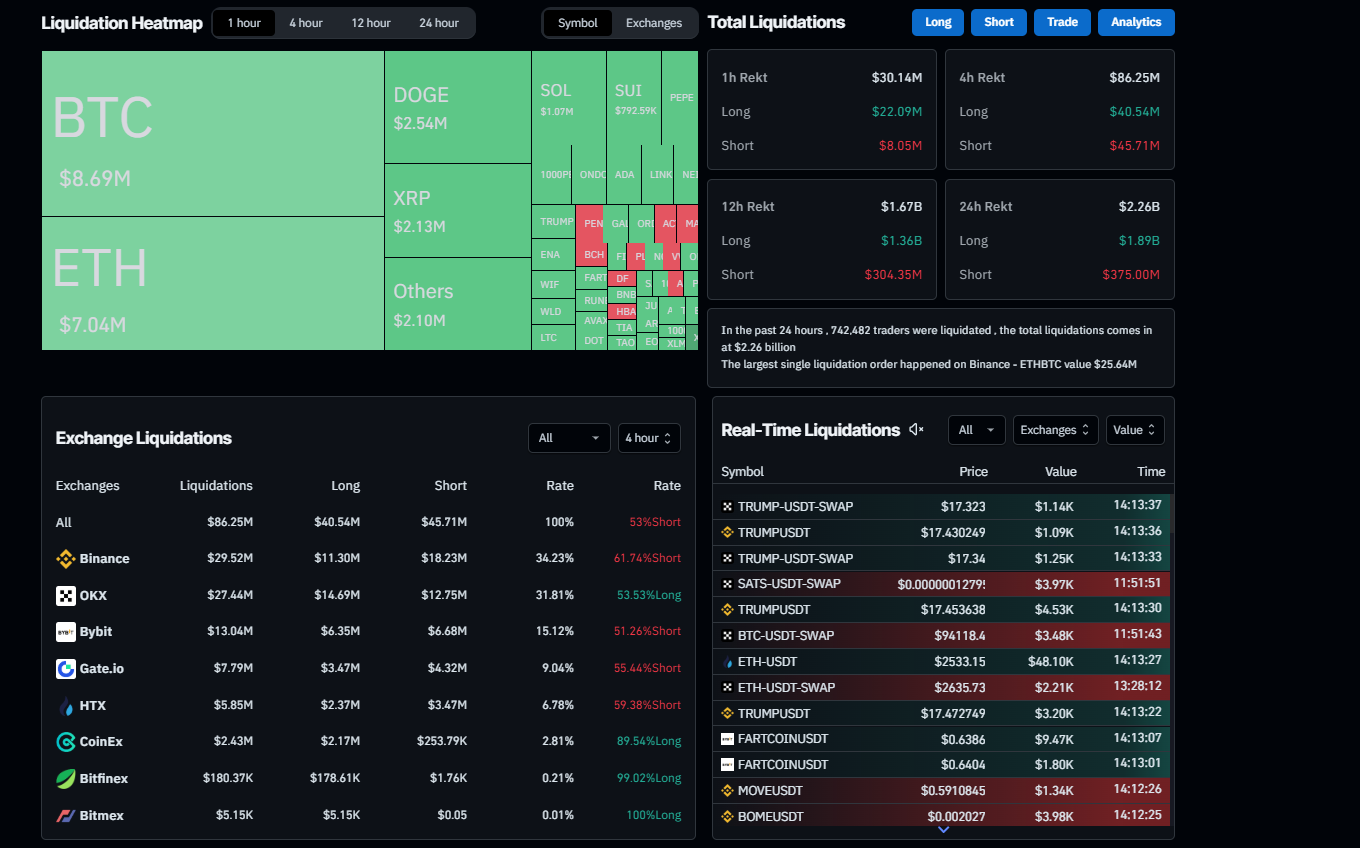

At the time of writing on Monday, Bitcoin continued its decline, reaching a low of $91,231 in the early Asian trading session. This downturn triggered a wave of liquidations, resulting in over $2.26 billion in total liquidations and more than $416 million specifically in BTC, according to data from CoinGlass.

Liquidation Heatmap chart. Source: Coinglass

BTC exchange liquidations chart. Source: Coinglass

In an exclusive interview with FXStreet, Nick Forster, Founder of Derive.xyz, said, “The recent tariffs imposed by Trump are likely to lead to increased inflation, which could dampen investor sentiment in crypto markets.”

Forster continued that as inflationary pressures rise, the Fed may maintain or even increase interest rates, which historically has led to less favorable conditions for crypto assets. This could result in a contraction for the digital asset sector over the next few quarters.

“Derive’s options market is currently pricing in a 22% chance of BTC reaching $75K during the same period. There’s an 11% chance that BTC will drop below $65K by June 27 and a 25% chance it will fall below $80K,” says Forster.

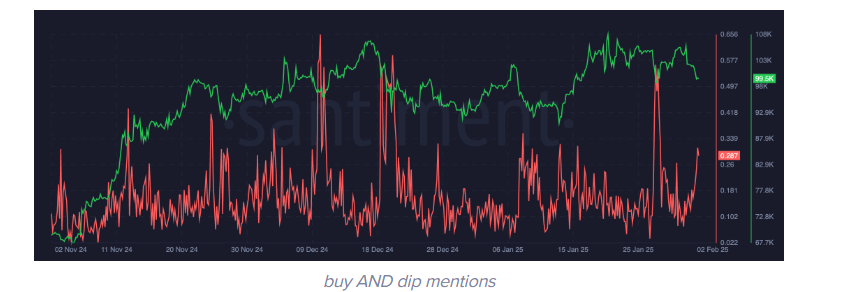

According to Santiment’s data, the talks about buying the dip have calmed down. The crowd seems less excited about buying at these prices, and big targets like $110,000–120,000 for Bitcoin are getting less attention, suggesting some investors are stepping back from the market.

Bitcoin crowd reaction chart. Source: Santiment

Some optimistic signs of Bitcoin

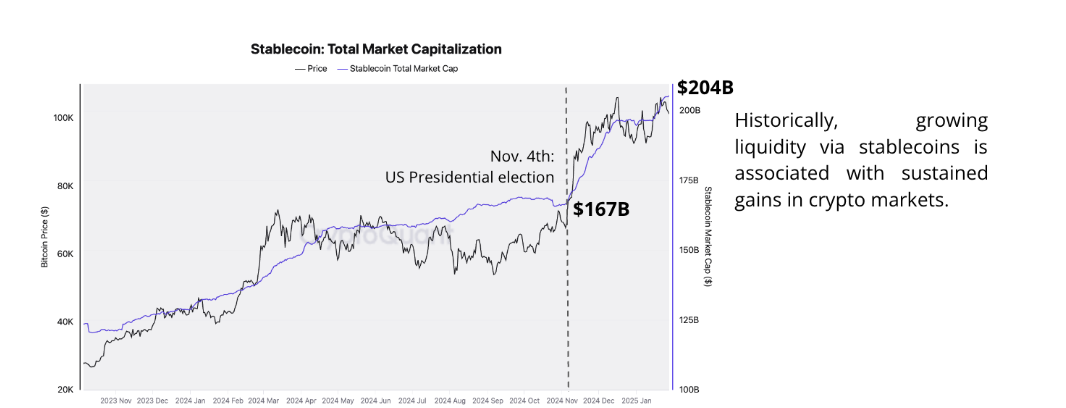

A CryptoQuant report provides some optimistic signs for Bitcoin. According to the report, the liquidity in the crypto market has continued to expand, with the total market capitalization of stablecoins surpassing the $200 billion mark.

The graph below shows that the total value of USD-denominated stablecoins reached $200 billion last week, and currency reads $204 billion, a record high. This metric has grown by $37 billion since November 5, when Donald Trump won the US presidential election.

Stablecoin: Total market capitalization chart. Source: CryptoQuant

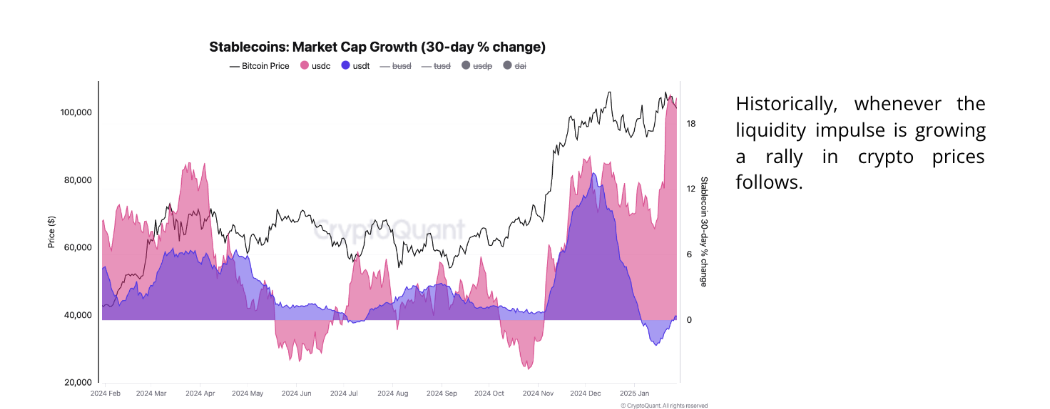

The report explains that the next leg up for Bitcoin and crypto prices could be around the corner as the stablecoin liquidity impulse expands again. USDT’s liquidity impulse (30-day % change in market capitalization) is now slightly positive after contracting by 2% at the start of 2025. Further acceleration typically drives higher crypto prices. Meanwhile, USDC’s liquidity impulse is expanding by 20%, its fastest pace in at least a year.

Stablecoins: Market cap growth (30-day % change) chart. Source: CryptoQuant

Bitcoin Price Forecast: Bitcoin bears take the lead

Bitcoin price broke below the $100,000 support level and closed below its 50-day Exponential Moving Average (EMA) at $98,674 on Sunday. At the time of writing on Monday, it continues to trade down by 2.28% in the day at around $95,500.

If BTC continues its correction, it could retest its next key support at $90,000. A successful close below this level would extend an additional decline to test the $85,000 level.

The Relative Strength Index (RSI) on the daily chart reads 38, below its neutral level of 50, and points downwards, indicating a strong bearish momentum. Moreover, the Moving Average Convergence Divergence (MACD) showed a bearish crossover on Friday, hinting at further correction ahead.

BTC/USDT daily chart

However, if BTC finds support around $90,000 and recovers, it would extend the recovery to retest its 50-day EMA at $98,674.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto fraud soars as high-risk addresses on Ethereum, TRON networks receive $278 billion

The cryptocurrency industry is growing across multiple facets, including tokenized real-world assets, futures and spot ETFs, stablecoins, Artificial Intelligence (AI), and its convergence with blockchain technology, as well as the dynamic decentralized finance (DeFi) sector.

Bitcoin eyes $100,000 amid Arizona Reserve plans, corporate demand, ETF inflows

Bitcoin price is stabilizing around $95,000 at the time of writing on Tuesday, and a breakout suggests a rally toward $100,000. The institutional and corporate demand supports a bullish thesis, as US spot ETFs recorded an inflow of $591.29 million on Monday, continuing the trend since April 17.

Meme coins to watch as Bitcoin price steadies

Bitcoin price hovers around $95,000, supported by continued spot BTC ETFs’ inflows. Trump Official is a key meme coin to watch ahead of a stakeholder dinner to be attended by President Donald Trump. Dogwifhat price is up 47% in April and looks set to post its first positive monthly returns this year.

Cardano Lace Wallet integrates Bitcoin, boosting cross-chain capabilities

Cardano co-founder Charles Hoskinson announced Monday that Bitcoin is integrated into the Lace Wallet, expanding Cardano’s ecosystem and cross-chain capabilities. This integration enables users to manage BTC alongside Cardano assets, providing support for multichain functionality.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.