- BTC/USD may continue growing towards the next resistance of $9,600.

- The ultimate target of $10,000 is within reach now.

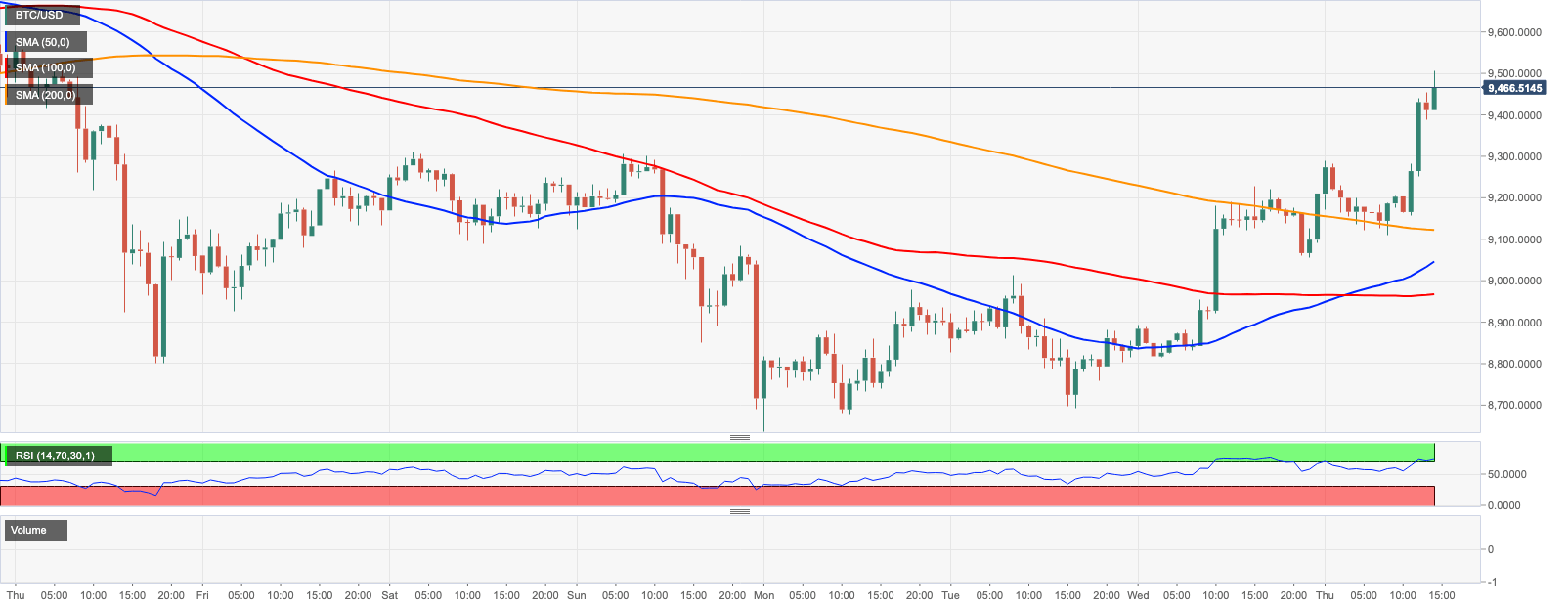

BTC/USD tested $9,500 during early US hours and settled at $9,450 by press time. The sustainable move above $9,300 improved the technical picture and opened up the way to the next resistance created by $9,500-$9,600 that separates the price from a straight move to $10,000. BTC/USD has gained over 2.5% in recent 24 hours, while its market share increased to 66.3%

The intraday chart shows that the RSI stays inside an overbought territory, though there are no signals of reversal as of yet. It means that the coin may repeat the attempt to break above $9,500-$9,600 in the nearest future.

BTC/USD 1-hour chart

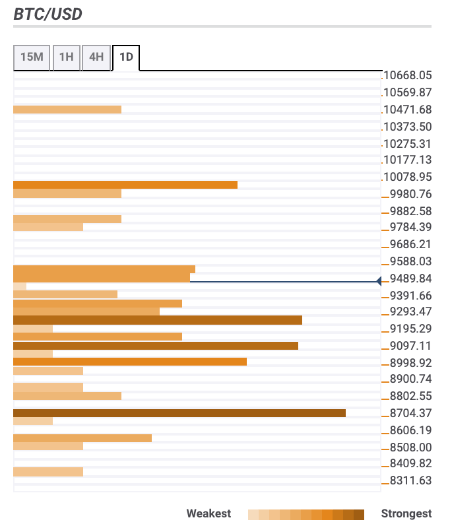

Let’s have a closer look at support and resistance levels clustered around the current price.

Resistance levels

$9,500 – 61.8% Fibo retracement weekly, Pivot Point 1-day Resistance 2

$10,000 – Pivot Point 1-month Resistance 1, the upper line of the daily Bollinger Band

$10,500 – Pivot Point 1-week Resistance 2

Support levels

$9,300 – 38.2% Fibo retracement weekly, the middle line of the daily Bollinger Band, the highest level of the previous day

$9,000 - 38.2% Fibo retracement daily, 23.6% Fibo retracement weekly, 4-hour SMA10

$8,700 - 23.6% Fibo retracement monthly, Pivot Point 1-day Support 2

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bulls target $100,000 BTC, $2,000 ETH, and $3 XRP

Bitcoin (BTC) is stabilizing around $95,000 at the time of writing on Wednesday, and a breakout suggests gains toward $100,000. Ethereum (ETH) and Ripple (XRP) followed BTC’s footsteps and hovered around their key levels.

Tether mints 3 billion USDT on Ethereum and TRON as markets stabilize

Tether ramps up its minting activity amid surging demand for stablecoins, often signaling heightened trading and liquidity needs. The issuer of the leading stablecoin by market capitalization has minted 2 billion USDT on Ethereum and an additional 1 billion USDT on the TRON network.

SEC delays decision on Franklin Templeton’s spot XRP ETF to June 2025

The Securities and Exchange Commission (SEC) has postponed its decision on Franklin Templeton’s spot XRP ETF, extending the review period to June 17, 2025. XRP traded at approximately $2.24 at press time, rising 7% over the past week, according to CoinGecko.

Trump Media announces new token launch and native crypto wallet in latest Shareholder letter

Trump Media unveils plans to launch a utility token and crypto wallet to monetize Truth Social and expand its streaming services. Markets react with a 10% drawdown on the Solana-hosted official TRUMP memecoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.