Bitcoin Price Forecast: BTC targets $44,000 after slicing through crucial resistance

-

Bitcoin price established a new uptrend as it stepped out of the descending triangle pattern.

-

Key on-chain metric signals the importance of this breakout as it turns bullish after almost a year.

-

BTC could rise to $44,000 if buying pressure continues to build up.

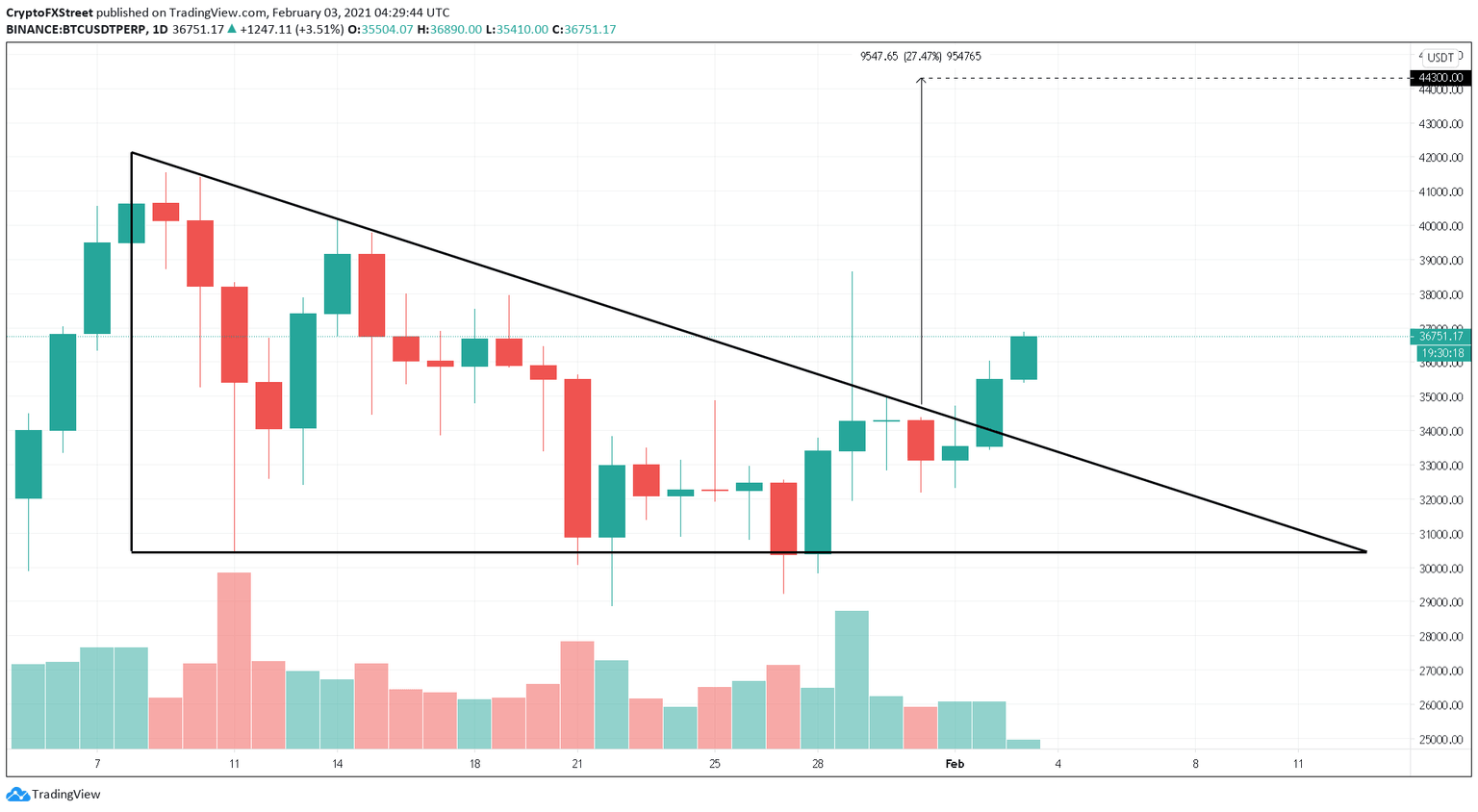

Bitcoin price has been trading inside a descending triangle pattern since it hit a new all-time high of $42,100 on January 8. Although Elon Musk’s involvement caused a sudden surge in BTC’s market value, it was ephemeral, and a correction came quickly. Regardless, this cryptocurrency recently printed a higher high as it closed outside a consolidation pattern.

Bitcoin price on the verge of a new all-time high

BTC price has broken a crucial supply barrier around $35,000, where 700,000 addresses previously purchased 415,000 tokens. The upswing was followed by a spike in buying pressure that pushed Bitcoin’s market value by 7% as it sliced through the triangle’s hypotenuse.

If buying pressure continues rising, Bitcoin price could surge by another 20% to hit a target of $44,300.

BTC/USDT 1-day chart

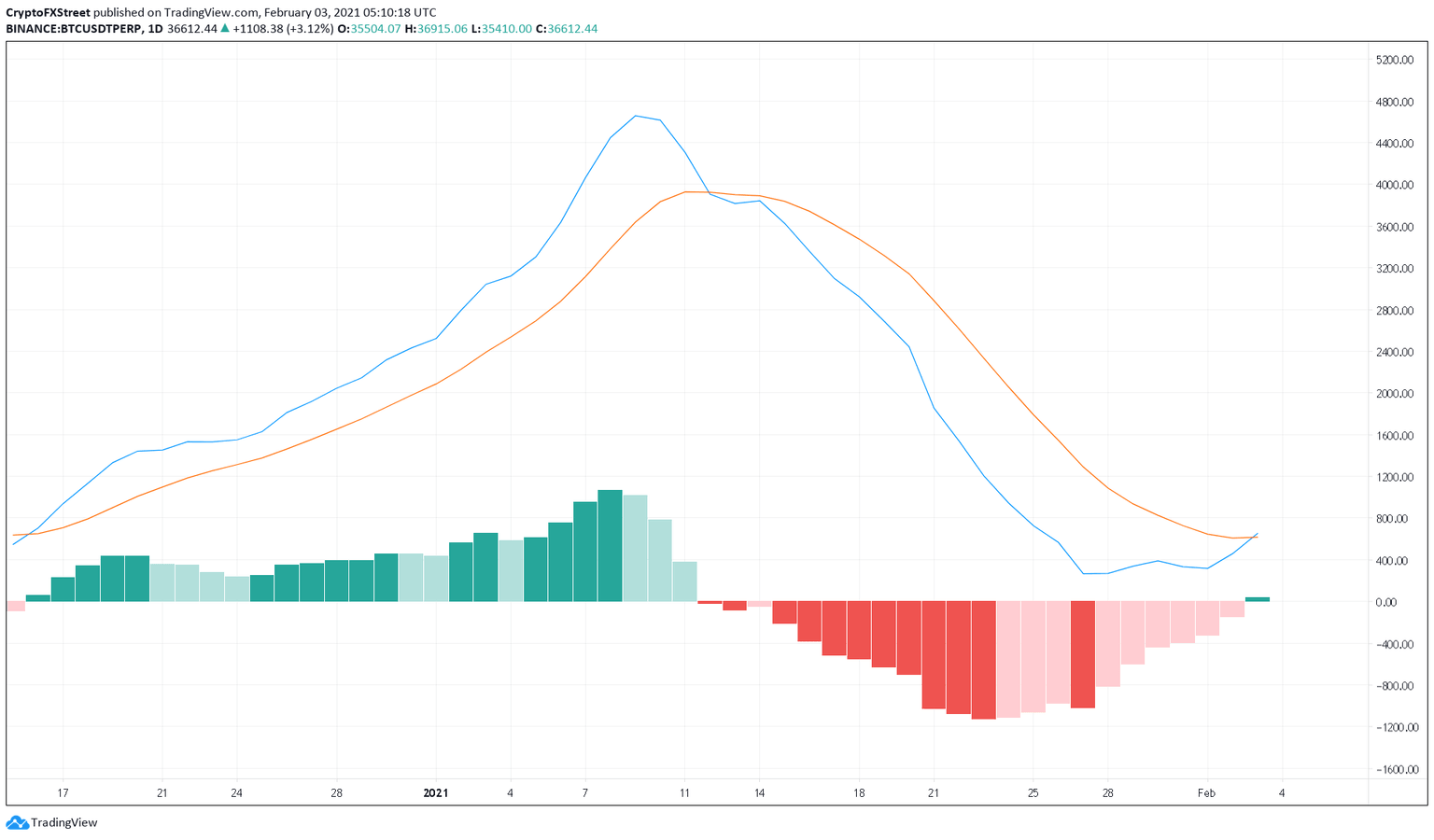

The MACD's bullish crossover on the 1-day chart supports the optimistic view. As the green histogram above the zero-line begins to form for the first time after almost a month, the odds for a further upside momentum increased drastically.

BTC/USDT 1-day chart

On-chain metrics remain strong

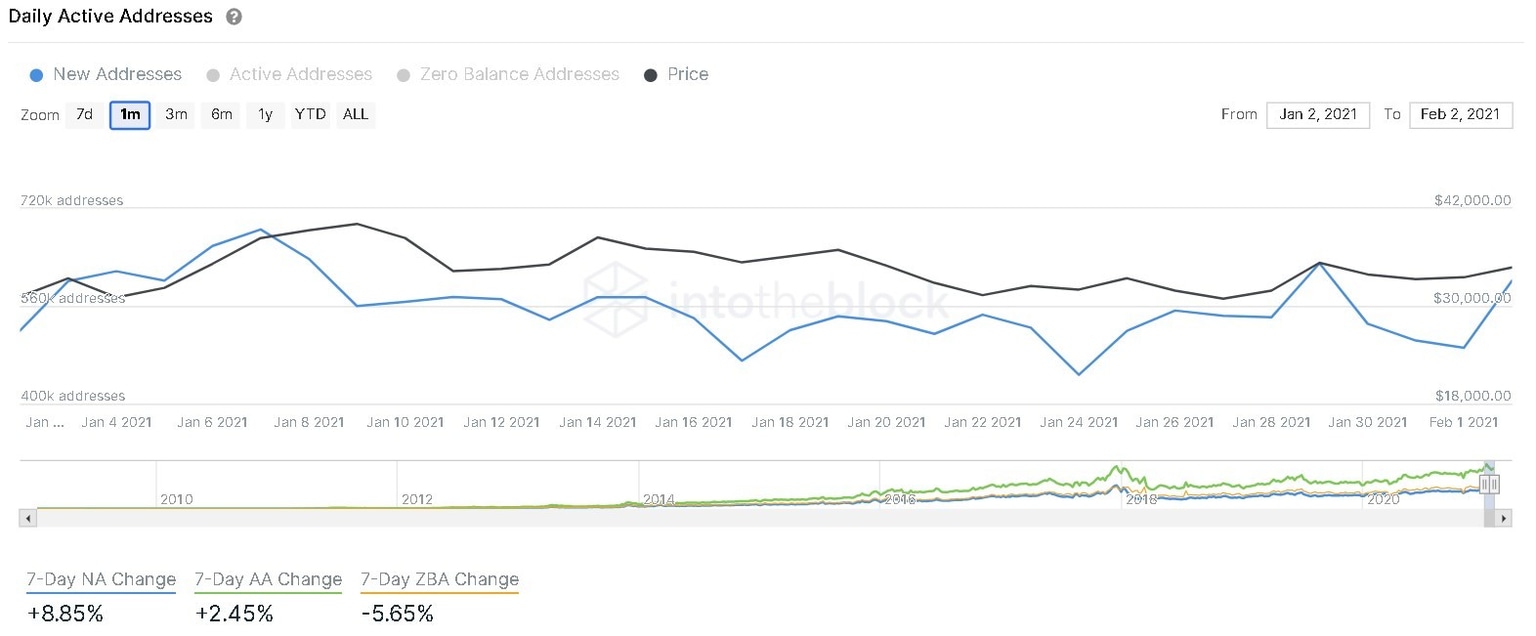

Based on IntoTheBlock’s daily active addresses chart, there has been notable growth in market participants’ interest. The number of new BTC addresses being created on a daily basis increased by 21% within 24 hours. It went from 491,000 to 601,0000, indicating that investors are confident in Bitcoin's future price action.

BTC New Daily Addresses chart

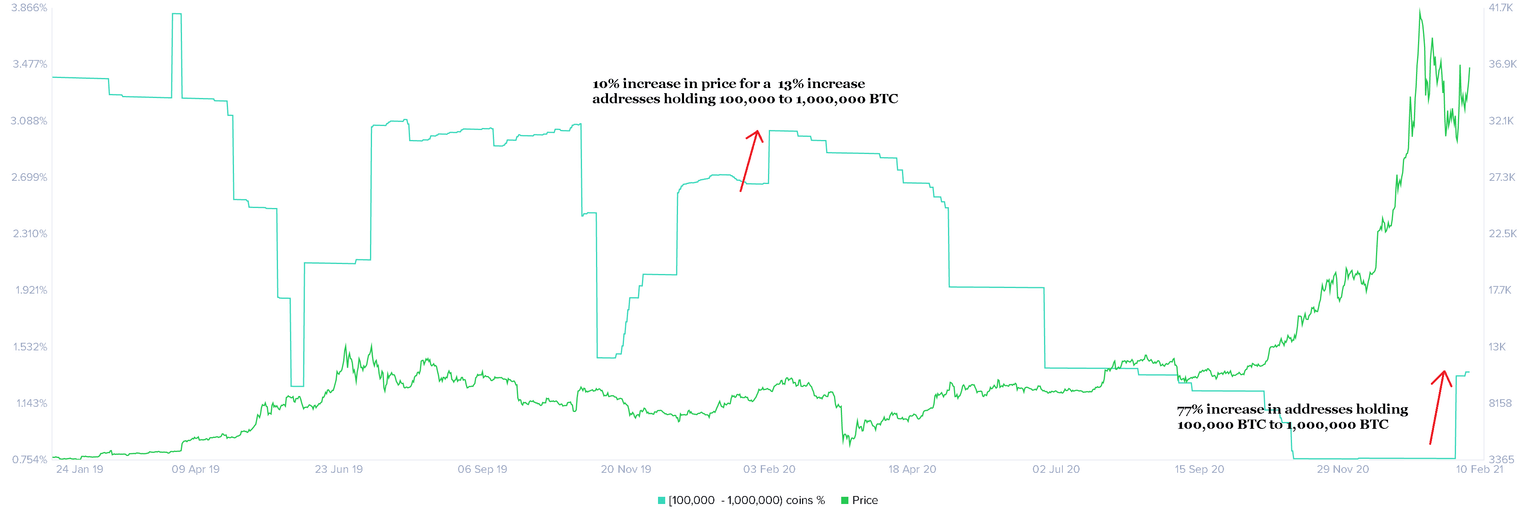

Moreover, whales appear to be back in accumulation mode. The number of addresses holding 100,000 to 1,000,000 BTC has increased by over 77% in the past week. Similar market behavior happened in February 2020, which led to a 10% price increase.

Therefore, the recent spike in buying pressure could help Bitcoin price achieve its upside potential especially now that institutional investors such as MicroStrategy continue increasing their BTC holdings. The firm recently bought 295 BTC worth approximately $10,000,000, which could soon reflect on the market value of the underlying asset.

Bitcoin Hodler Distribution Combined Balance chart

While everything seems to be looking up for Bitcoin price, the bearish outlook cannot be disregarded. An increase in selling pressure around the current price levels is a possibility and can stunt BTC’s growth. If this comes to pass, the flagship cryptocurrency could pullback and revisit the $35,000 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.