- Bitcoin price reaches a new all-time high of $106,648 on Monday but retreats afterward.

- The US Federal Reserve is widely expected to cut interest rates on Wednesday, but the outlook for 2025 is uncertain.

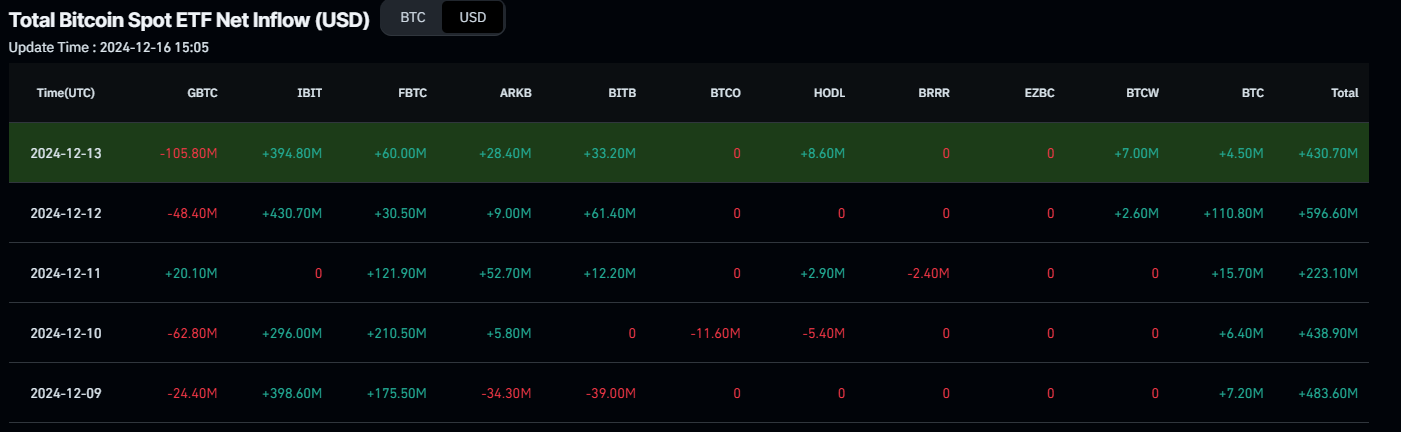

- US Bitcoin Spot ETFs recorded a total inflow of $2.17 billion last week, in a sign of continued strong demand.

- Technical indicators show signs of early bearish divergence in RSI and AO, suggesting weakness in bullish momentum.

Bitcoin (BTC) price retreats on Monday after reaching a new all-time high (ATH) of $106,648 in the early Asian session. The main factor impacting BTC price this week is likely to be the decision of the US Federal Reserve (Fed) on interest rates on Wednesday. The US central bank is expected to slash rates (a positive for risk assets such as BTC) but also signal fewer-than-previously-anticipated cuts for 2025.

The recent rally to a new ATH has been supported by continued strong inflows to the US Bitcoin Spot Exchange Traded Funds (EFTs) of $2.17 billion last week. Still, traders should remain cautious as technical indicators such as the Relative Strength Index (RSI) and Awesome Oscillator (AO) show early bearish divergence, suggesting that bullish momentum is weakening.

Bitcoin reaches all-time high of $106,600 ahead of Fed decision

Bitcoin price reached a new all-time high of $106,648 at the start of this week on Monday after rallying 3.2% the previous week. A further rise in Bitcoin price could be fueled by the upcoming decision of the Fed on interest rates on Wednesday.

According to the CME’s Fed watch tool, which tracks the probabilities of changes to the Fed rate as implied by Fed Funds future prices, there is a 97.1% likelihood of a 25 basis point cut, while the remaining 2.9% points for the rate to remain stable.

-638699502896679972.png)

Target Rate Probabilities chart. Source: CME Fed watch tool

An interest-rate cut tends to favor risky assets like Bitcoin because lower rates tend to stimulate the economy. However, markets’ reaction to Wednesday’s Fed decision isn’t likely to be driven by the rate decision itself (unless there was a huge surprise) but rather the Fed projections about how interest rates will head in 2025.

If these projections reflect slower or fewer rate cuts next year, Treasury yields and the US Dollar will likely be stronger, making it harder for risk assets, including BTC, to be more attractive to investors.

ETFs provide continued support

Looking into Bitcoin’s institutional flows, these remained strong last week. According to Coinglass, Bitcoin Spot ETF data recorded a total net inflow of $2.17 billion last week. Bitcoin could rally further in the coming days if this inflow trend persists or accelerates.

Total Bitcoin Spot ETF Net Inflow chart. Source: Coinglass

According to Santiment’s data, since the start of the bull rally on October 10, the wallets holding at least 100 BTC have increased almost 10% from 16,062 to 17,644 in 9 weeks. This rise in BTC wallets shows investors’ confidence and contributed heavily to its current rise.

Wallets holding at least 100 BTC chart. Source: Santiment

In an exclusive interview, Darius Sit, Founder & Chief Investment Officer of QCP Singapore’s digital assets firm, told FXStreet that he has never been more bullish on Bitcoin. Darius explained that his bullish outlook was mainly because of the liquidity rush into Bitcoin.

“This year, crypto or bitcoin is being brought into traditional markets, infrastructure, and traditional market liquidity,” Darius said to FxStreet.

“I think now it's starting to impact debt financing; equity financing is starting to impact how everything from individuals to corporates to countries think about their future and how they think about, you know, raising money, how they think about their treasuries,” Darius explain

Darius said the signs the traders should watch for are “One possibly volatile possible downside from deleveraging but at the same time increasing influence and increasing impact that it's having with real institutions, quasi-sovereigns and sovereigns having it on their balance sheet.”

Despite Bitcoin reaching new highs, traders should be cautious as CryptoQuant data shows that the Estimated Leverage Ratio (ELR) reached annual highs, indicating a chance of a correction is likely due to leverage overheating.

-638699504613782039.png)

Bitcoin Estimated Leverage Ratio chart. Source: Santiment

Bitcoin Price Forecast: Rise towards $119K or pullback to $90K?

Bitcoin price reaches a new all-time high (ATH) of $106,648 in the early Asian trading session but retraces to around $103,600 during the Europen session on Monday.

Despite reaching new highs, traders should remain cautious as the chances of a pullback are likely high, as shown by the momentum indicators. The Relative Strength Index (RSI) and the Awesome Oscillator (AO) indicators on the daily chart show signs of an early bearish divergence, where the higher high in the prices are not reflected in higher highs in RSI and AO, indicating signs of weakness in bullish momentum.

If BTC faces a pullback and closes below $100,000, it could extend the decline to retest its $90,000 support level.

BTC/USDT daily chart

However, if BTC continues its upward momentum, it could extend the rally to test a new ATH of $119,510. This level aligns with the 141.4% Fibonacci extension line drawn from the November 4 low of $66,835 to the December 5 high of $104,088.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto fraud soars as high-risk addresses on Ethereum, TRON networks receive $278 billion

The cryptocurrency industry is growing across multiple facets, including tokenized real-world assets, futures and spot ETFs, stablecoins, Artificial Intelligence (AI), and its convergence with blockchain technology, as well as the dynamic decentralized finance (DeFi) sector.

Bitcoin eyes $100,000 amid Arizona Reserve plans, corporate demand, ETF inflows

Bitcoin price is stabilizing around $95,000 at the time of writing on Tuesday, and a breakout suggests a rally toward $100,000. The institutional and corporate demand supports a bullish thesis, as US spot ETFs recorded an inflow of $591.29 million on Monday, continuing the trend since April 17.

Meme coins to watch as Bitcoin price steadies

Bitcoin price hovers around $95,000, supported by continued spot BTC ETFs’ inflows. Trump Official is a key meme coin to watch ahead of a stakeholder dinner to be attended by President Donald Trump. Dogwifhat price is up 47% in April and looks set to post its first positive monthly returns this year.

Cardano Lace Wallet integrates Bitcoin, boosting cross-chain capabilities

Cardano co-founder Charles Hoskinson announced Monday that Bitcoin is integrated into the Lace Wallet, expanding Cardano’s ecosystem and cross-chain capabilities. This integration enables users to manage BTC alongside Cardano assets, providing support for multichain functionality.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.