Bitcoin Price Forecast: BTC misses Santa rally even as on-chain metrics show signs of price recovery

- Bitcoin hovers around $97,000 on Friday after wiping out pre-Christmas gains on Thursday.

- On-chain metrics show an increase in taker buy volume and a rise in stablecoin deposits on Binance.

- BTC price recovery is likely as US spot Bitcoin ETFs end the outflow streak and the volume of staked Bitcoin climbs.

Bitcoin (BTC) price hovers around $97,000 on Friday, erasing most of the gains from earlier this week, as the largest cryptocurrency missed the so-called Santa Claus rally, the increase in prices prior to and immediately following Christmas Day.

BTC’s on-chain metrics offer hope for recovery as they show increased buying pressure on centralized exchange platforms.

Bitcoin gears for price recovery with revival of institutional interest

Experts consider capital inflow to Bitcoin spot Exchange Traded Funds (ETFs) a key driver of the token’s 2024 price rally. Institutional investors' interest in Bitcoin returned on Thursday after days of net outflows from ETFs.

Data from Farside Investors shows a net inflow of $475.2 million to spot Bitcoin ETFs on Thursday, ending the four-day outflow streak prior to the Christmas holidays. The revival of institutional interest suggests higher demand for BTC.

Bitcoin ETF flows. Source: Farside Investors

Post the market-wide Christmas dip, analysts at on-chain intelligence tracker Santiment observed a rise in whales moving stablecoins to exchanges. Stablecoins are typically used by crypto traders for fiat on/off-ramp across centralized exchange platforms.

An increase in stablecoin inflows to exchanges likely represents demand for crypto, suggesting increased “buying pressure” on Bitcoin.

The Santiment feed dashboard identified seven different stablecoin deposits to Binance, the largest centralized cryptocurrency exchange platform, in a 24-hour timeframe. The deposits were each worth at least $9 million, with the largest one valued at $50 million.

Analysts saw the move as demand for new altcoins listed on the exchange, as well as for Bitcoin. Such moves could mean that whales are preparing to buy Bitcoin, which is considered a bullish sign.

After the post-Christmas market-wide dip, crypto markets are seeing an encouraging trend of whales moving stablecoins to exchanges. According to the @santimentfeed top CEX deposits dashboard, there have been 7 different @binance deposits worth at least $9M in the past 24… pic.twitter.com/XpAn0BvrhM

— Santiment (@santimentfeed) December 27, 2024

Taker buy volume hints at buying pressure on Bitcoin

The taker buy volume metric provided by CryptoQuant gauges the level of demand for BTC on a particular exchange platform. An increase in taker buy volume could signal a rise in interest among traders and a growing buying pressure, which is positive for prices.

For Bitcoin, the taker buy volume in Binance has been in an uptrend between November 1 and December 25, forming higher lows and indicating increased buying pressure.

Bitcoin:Taker buy volume on Binance. Source: CryptoQuant

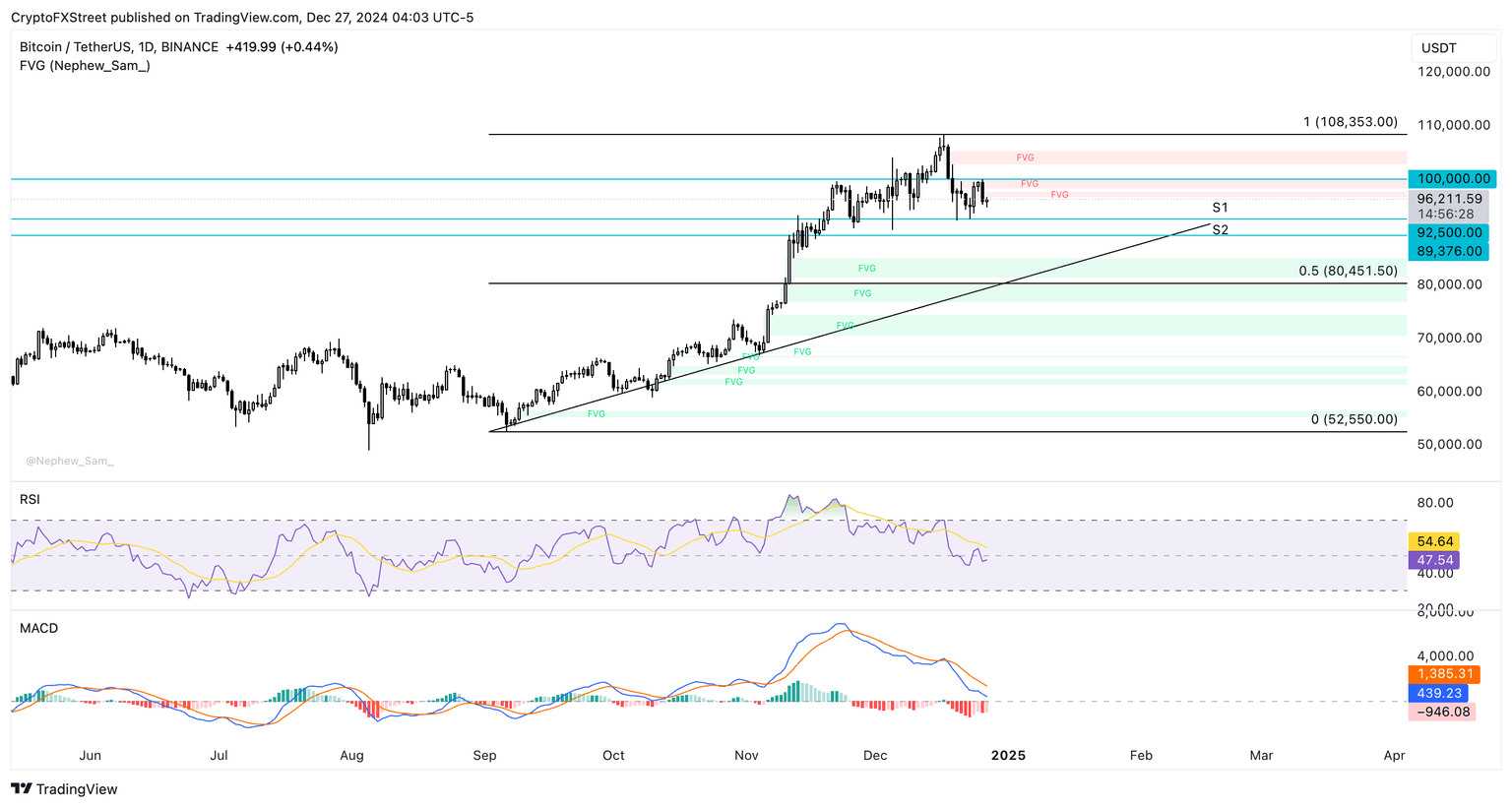

Despite the encouraging on-chain metrics, technical indicators on the daily price chart do not support a bullish thesis for BTC.

The Relative Strength Index (RSI) is broadly stable close to the neutral level of 50, indicating indecisiveness among investors. Meanwhile, the Moving Average Convergence Divergence (MACD) indicator flashes red histogram bars below the neutral line, implying that the Bitcoin price trend has an underlying negative momentum.

In case the recent correction resumes, Bitcoin could find support first at $92,500, a key support level since mid-December, and then at the November 18 low of $89,376.

BTC/USDT daily price chart

A daily candlestick close above resistance at the $100,000 milestone could invalidate the bearish thesis. In such a scenario, BTC could retest its all-time high at $108,353.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.