- Bitcoin’s daily confluence detector lacks substantial resistance upfront.

- The MACD shows increasing bullish momentum.

Over the last six days, Bitcoin bulls have been in full control of the market as the price rose from $11,340 to $12,835. This Wednesday, the premier cryptocurrency had the largest single-day gain since July 27. The MACD shows increasing bullish momentum, so further price growth is anticipated.

BTC/USD daily chart

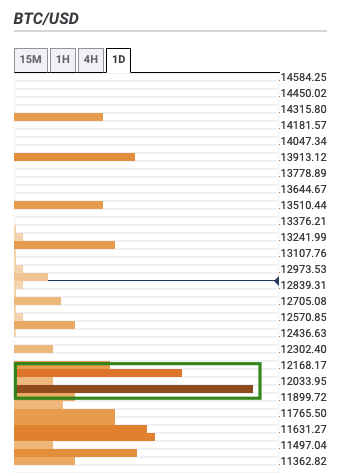

The confluence detector is a handy little tool that helps us visualize strong resistance and support levels. As per the daily confluence detector, there is a lack of strong resistance levels on the upside. This should be encouraging news for the buyers as they aim to take BTC into the $13,000-zone.

BTC daily confluence detector

The Flipside: Can the bears spoil the party?

Even if the bears take control, their downside is limited by the strong support zone between $12,000-$12,100. Even if they manage to break below this stretch, there is another robust support at $11,000, which benefits from both the 50-day and 100-day SMAs. Adding further credence to this bearish outlook is the way the whales have been behaving.

BTC holders distribution

Santiment’s holders distribution graph shows you the number of addresses belonging to a particular token bracket. As per the chart, the number of addresses holding 10,000-100,000 tokens fell from 111 on October 8 to 104 on October 20. This is a heavily bearish sign as it shows that the whales are selling off their holdings.

Key price levels to watch

Bitcoin buyers have the freedom to take the price into the $13,000 and even the $14,000 obstacle. The daily confluence detector shows a complete lack of strong resistance barriers upfront.

For the bears, the downside is capped off at the $12,000-$12,100 support wall. A break below that zone will take the price down to $11,000, which has both the 50-day and 100-day SMAs.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Shiba Inu eyes positive returns in April as SHIB price inches towards $0.000015

Shiba Inu's on-chain metrics reveal robust adoption, as addresses with balances surge to 1.4 million. Shiba Inu's returns stand at a solid 14.4% so far in April, poised to snap a three-month bearish trend from earlier this year.

AI tokens TAO, FET, AI16Z surge despite NVIDIA excluding crypto-related projects from its Inception program

AI tokens, including Bittensor and Artificial Superintelligence Alliance, climbed this week, with ai16z still extending gains at the time of writing on Friday. The uptick in prices of AI tokens reflects a broader bullish sentiment across the cryptocurrency market.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

XRP price could renew 25% breakout bid on surging institutional and retail adoption

Ripple price consolidates, trading at $2.18 at the time of writing on Friday, following mid-week gains to $2.30. The rejection from this weekly high led to the price of XRP dropping to the previous day’s low at $2.11, followed by a minor reversal.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

[05.47.07, 22 Oct, 2020]-637389253955871217.png)