Bitcoin Price Forecast: BTC hits $85K as Microstrategy announces largest ever single-day purchase

Bitcoin price reached a new all-time high of $85,000 on Monday, November 11, up 26% from the US election day. As the crypto market rally enters its seventh consecutive day of gains, on-chain data shows that Microstrategy’s fresh acquisition plan could potentially drive BTC further toward $100,000 in the coming weeks.

Key Points:

- Bitcoin price reached a new all-time high of $85,000 on Monday, up 26% from the US election day.

- MicroStrategy CEO Michael Saylor announced the purchase of 27,000 BTC valued at $2 billion, its highest single-day purchase ever since it kicked off its ‘Bitcoin strategy’ in 2020.

- On-chain data shows Bitcoin’s issuance rate has dropped to an average of around 500 BTC daily, following the April 2024 halving event.

Why is Bitcoin price going up?

Bitcoin hits $82,500 as Microstrategy announces 27K BTC purchase

On November 11, 2024, Bitcoin price reached a new global peak of $82,578, as the post-election market frenzy entered its second week.

In a recent interview with Bloomberg, the president of the OKX Exchange attributed the Bitcoin rally to investors’ optimism that Trump’s presidency could be good for the economy and offer a friendlier regulatory stance toward cryptocurrencies.

In further affirmation of this stance, Microstrategy, one of the largest corporate Bitcoin investors, has announced its largest ever single-day BTC purchase.

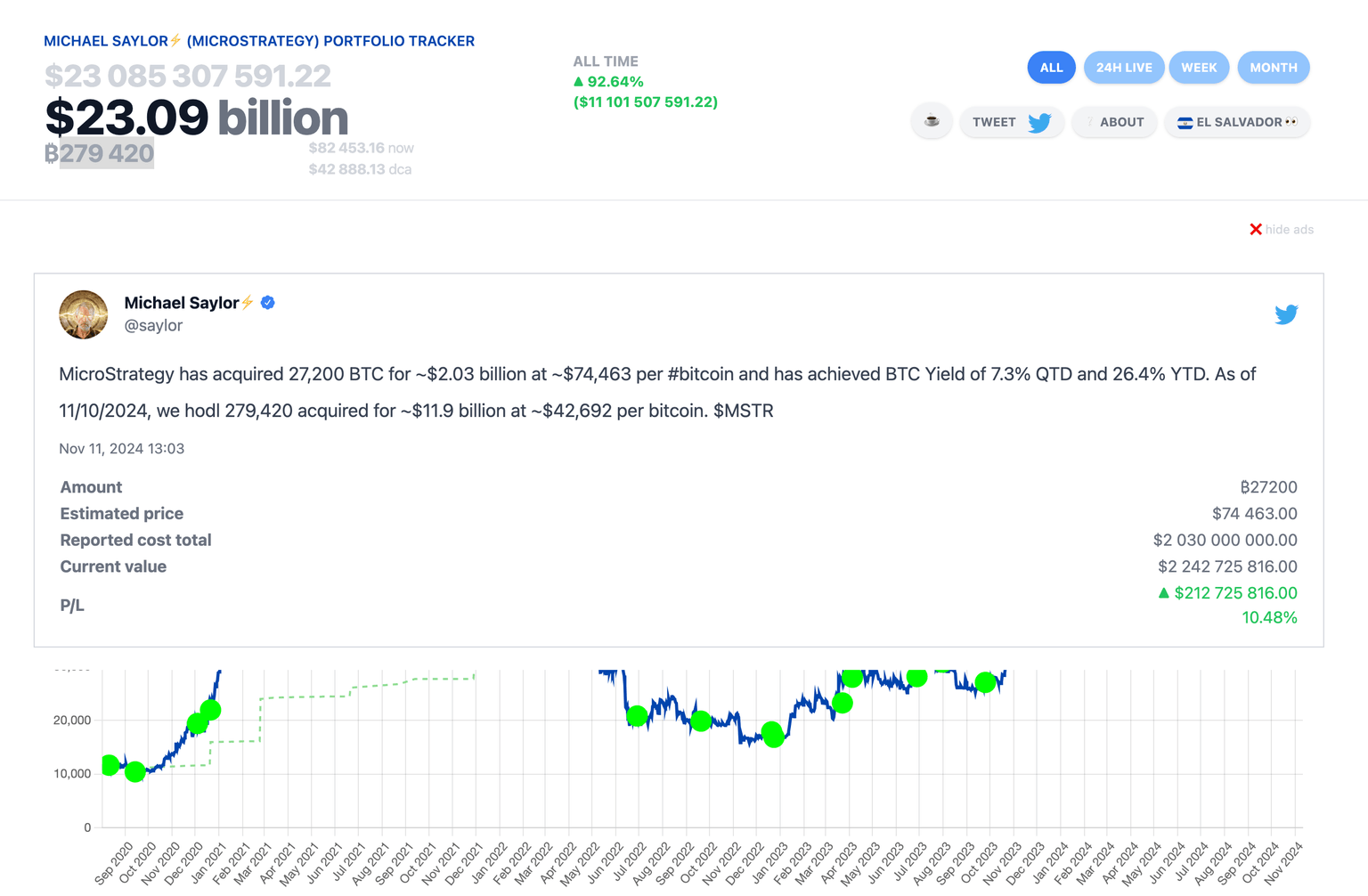

Microstrategy Bitcoin (BTC) holdings, November, 11, 2024 | Source: SaylorTracker

Posting on X on Monday, Microstrategy CEO Michael Saylor announced the purchase of 27,000 BTC at a cost price of $2.03 billion, its largest single-day purchase since it kicked-off its “Bitcoin strategy” in 2020.

According to on-chain data culled from SaylorTracker.com, this brings the firm’s total Bitcoin holdings to 279,420 BTC ($23.09 billion) at the time of publication.

This purchase comes just a week after Saylor announced a $21 billion stock offering of its own stock last week to raise capital as part of a strategic plan to buy $42 billion worth of BTC over the next three years.

Arithmetically, to hit the $42 billion target, Microstrategy is expected to purchase approximately $1.6 billion per month worth of BTC over the next 36 months.

Hence the $2 billion investment announced on Monday could be the start of a potential $5 billion acquisition plan before the end of 2024.

Microstrategy now acquiring 76% of newly-mined Bitcoin

Taking a cue from previous bull cycles, Bitcoin’s recent rally has raised fears of impending downward volatility.

However, Bitcoin 2024 halving and Microstrategy’s $42 billion acquisition plan could potentially cushion impending downward volatility.

On-chain data compiled by MacroMicro shows Bitcoin’s issuance rate has dropped to an average of ~500 BTC daily ($420 million), following the latest halving event executed in April 2024.

Bitcoin Daily issuance rate, November 2024 | MacroMicro

Arithmetically, at current prices of around $85,000 per coin, if Microstrategy follows through with its $42 billion acquisition plan, the US-based IT firm could be acquiring $390 million of BTC daily, which accounts for over 76% of newly-mined BTC.

By absorbing fresh BTC supply, Microstrategy could clear the path for Bitcoin price to rapidly advance toward $100,000, if demand remains steady in the coming months.

Bitcoin price forecast: Bulls now eyeing $90k breakout

Aside from positive speculations around Trump’s win, Bitcoin on-chain data trends show that the BTC rally has been supported by substantial buying interest from large investors, particularly Microstrategy’s recent record-breaking $2.03 billion purchase.

In terms of short-term BTC price forecast, the Parabolic SAR indicator, currently well below the price at $69,551, confirms a strong uptrend.

This suggests that bullish sentiment is still dominant. This level now acts as a critical support. As long as BTC holds above it, further upside momentum remains in play.

More so, the Bull-Bear Power (BBP) indicator, which measures the difference between the highest price and the exponential moving average (EMA) to assess the balance between buyers and sellers short-term activity, gives more credence to the thesis. Positive BBP values indicate bullish strength, while negative values signal bearish pressure.

In the current setup, Bitcoin’s BBP is trending at six-month peaks, confirming that buying pressure remains at unusually high levels despite the recent rally.

Given the bullish BBP readings, rising trading volumes, and large acquisitions from whale investors like Microstrategy, BTC could soon break past $84,000, setting the stage for a potential rally toward the next psychological resistance at $90,000.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.