Bitcoin Price Forecast: BTC extends gains toward $90,000 as ETFs inflows exceed $381 million

- Bitcoin price extends its gains on Tuesday following a nearly 3% rise the previous day.

- US spot ETFs recorded an inflow of $381.40 million on Monday, the highest since January 30.

- Microstrategy announced on Monday that it had acquired 6,556 BTC for $555.8 million.

Bitcoin (BTC) is extending its gains, trading above $88,000 at the time of writing on Tuesday after rising nearly 3% the previous day. Institutional demand seems to be supporting BTC’s recent price rally, with US spot Exchange Traded Funds (ETFs) recording an inflow of $381.40 million on Monday. Moreover, Microstrategy (MSTR) announced a new purchase of Bitcoins, in this case 6,556 BTC for $555.8 million.

Bitcoin spot ETFs record highest inflow in three months

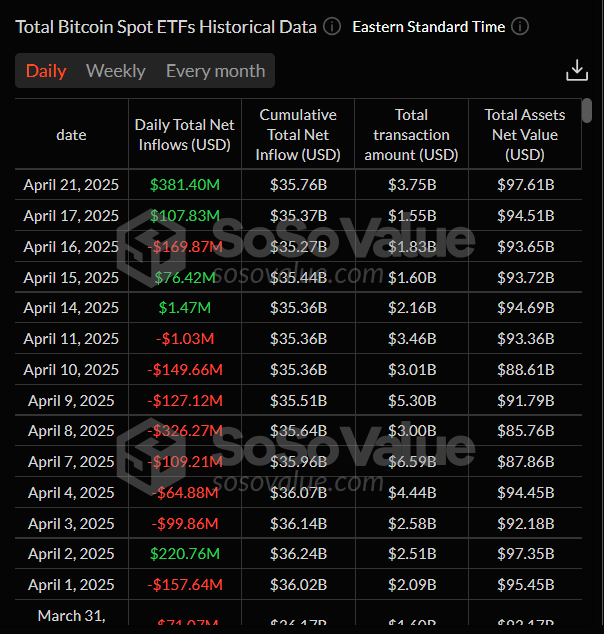

According to the SoSoValue data, the US spot Bitcoin ETF recorded a net inflow of $381.40 million on Monday, the highest daily inflow since January 30. These inflows are a positive sign for Bitcoin, indicating a rise in institutional demand, but are relatively small compared to the inflows seen during early November. For Bitcoin’s price to recover further, the demand from institutional investors should intensify.

Total Bitcoin Spot ETFs daily chart. Source: SoSoValue

Meanwhile, MicroStrategy announced on Monday that it has acquired 6,556 BTC for $555.8 million. The firm currently holds 538,200 BTC, acquired for $36.47 billion at an average price of $67,766 per BTC. During the same period, Japanese investment firm Metaplanet (MTPLF) also acquired an additional 330 BTC for $28.2 million, bringing the firm’s total holdings to 4,855 BTC, which were purchased for $414.5 million at an average price of $85,386 per BTC.

Investment firms’ buying activity is generally bullish for Bitcoin’s price, driven by increased demand, reduced circulation, and positive market sentiment. If this trend continues, Bitcoin could experience more stable price growth over the long term; however, short-term fluctuations are expected to persist as the market adjusts to this new wave of institutional involvement.

$MSTR has acquired 6,556 BTC for ~$555.8 million at ~$84,785 per bitcoin and has achieved BTC Yield of 12.1% YTD 2025. As of 4/20/2025, @Strategy holds 538,200 $BTC acquired for ~$36.47 billion at ~$67,766 per bitcoin. https://t.co/YxUq6mHzca

— Michael Saylor (@saylor) April 21, 2025

Paul Atkins swears in as new SEC Chairman

Paul Atkins was sworn in as the 34th Chairman of the US Securities and Exchange Commission (SEC) on Monday after Gary Gensler’s departure on January 20. Atkins previously served as an SEC Commissioner under President George W. Bush.

Atkins has proactively supported the digital asset industry, serving as co-chair of the Token Alliance at the Digital Chamber of Commerce since 2017. He has also been a strong advocate for innovation and clarity in regulation. Additionally, Atkins is considered pro-crypto due to his track record of advocating for innovation-friendly policies, his direct involvement in the industry, his personal financial stake in digital assets, and his commitment to creating a clearer and less punitive regulatory framework for cryptocurrencies.

The crypto community has broadly welcomed his appointment as he could help clarify the regulation of digital assets, which former Chair Gary Gensler failed to do during his term and followed a regulation-by-enforcement approach.

NEW: The Committee congratulates @PaulSAtkins as he was sworn in as the next Chair of @SECGov. He will bring a common-sense approach to regulation and usher in an era of prosperity and innovation to make U.S. capital markets the envy of the world.https://t.co/7qJ1w78bkz

— Financial Services GOP (@FinancialCmte) April 22, 2025

Bitcoin Price Forecast: BTC bulls aim for $90,000

Bitcoin price has faced multiple rejections around its 200-day Exponential Moving Average (EMA) at $85,000 since April 13. On Monday, BTC finally broke above this resistance level, rising 2.74%. At the time of writing on Tuesday, it continues to trade higher above $88,300.

If BTC continues its upward momentum, it could extend the rally to the key psychological level of $90,000. A successful close above this level could extend gains to test its March 2 high of $95,000.

The daily chart's Relative Strength Index (RSI) stands at 59 and is pointing upward, indicating increasing bullish momentum. The Moving Average Convergence Divergence (MACD) also exhibited a bullish crossover last week, signaling a buying opportunity and supporting the continuation of the upward trend.

BTC/USDT daily chart

On the contrary, if BTC declines, it could find support around its key level of $85,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.