Bitcoin Price Forecast: BTC edges below $90,000, ending its long streak of consolidation

- Bitcoin price falls below $90,000 on Tuesday after dropping 4.89% the previous day.

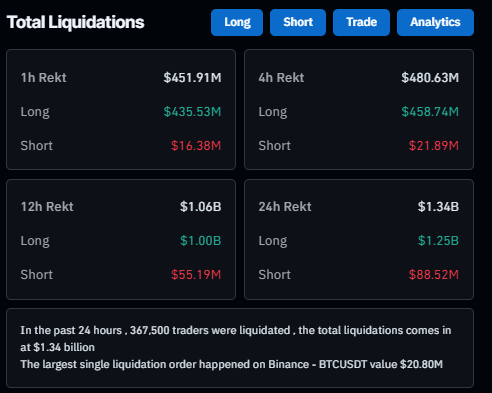

- The total liquidations are $1.34 billion, with 367,500 traders wiped out in the past 24 hours.

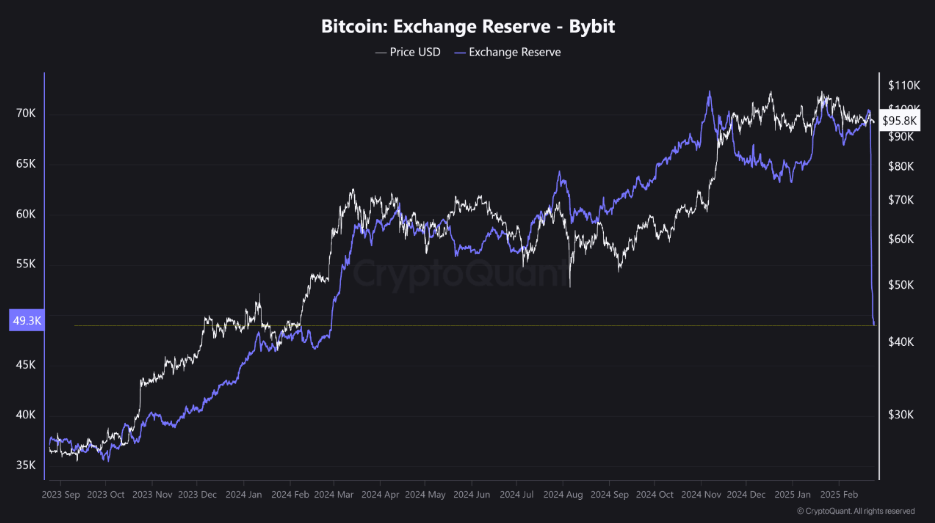

- After its recent exchange compromise, Bybit loses around $2 billion in BTC from reserves.

Bitcoin (BTC) continues to trade in red, reaching a low of $88,200 during Tuesday’s early Europen trading session and hitting the lowest level since mid-November after falling 4.89% the previous day. This price pullback triggered a wave of liquidation in the crypto market, totaling $1.34 billion, with 367,500 traders wiped out in the past 24 hours. Moreover, after its recent compromise, Bybit loses around $2 billion in BTC from reserves.

Bitcoin dips below $90,000, wiping $1.02 billion from the crypto market

Bitcoin continues to edge down, reaching a low of $88,200 during Tuesday’s early Europen trading session after falling 4.89% the previous day. This pullback has triggered a series of liquidations in the crypto market totaling $1.34 billion and wiping 367,500 traders in the past 24 hours, according to Coinglass data. The largest single liquidation order happened on Binance - BTC/USDT, worth $20.80 million.

Strong liquidations like this could spark Fear, Uncertainty, and Doubt (FUD) among Bitcoin investors, raising selling pressure and leading to a further decline in BTC price.

Total Liquidations chart. Source: Coinglass

This correction was fueled by last week’s news that the Bybit cryptocurrency exchange was compromised, and funds worth $1.4 billion were stolen. This compromise caused Bybit to lose around $2 billion in BTC from its reserve, according to CryptoQuant data.

A total amount of 20,190 BTC has been drained from Bybit’s reserve from Friday to Tuesday, reaching reverse levels seen in early March 2024. This was mostly because the exchange did not stop withdrawals after the ETH hack, and investors tend to withdraw funds given the uncertainty in the market.

Bitcoin exchange reserve Bybit chart. Source: CryptoQuant

In an exclusive interview, James Toledano, Chief Operating Officer at Unity Wallet, told FXStreet, “A major security breach at Bybit hasn’t helped on the sentiment front, shaken investor sentiment, leading to broader sell-offs across crypto assets.”

Toledano continued, “Although Bybit did raise enough to cover the losses and restore confidence and funds to their customers. But this again just highlights the importance of truly decentralized self-custodial services and wallets to store digital assets.”

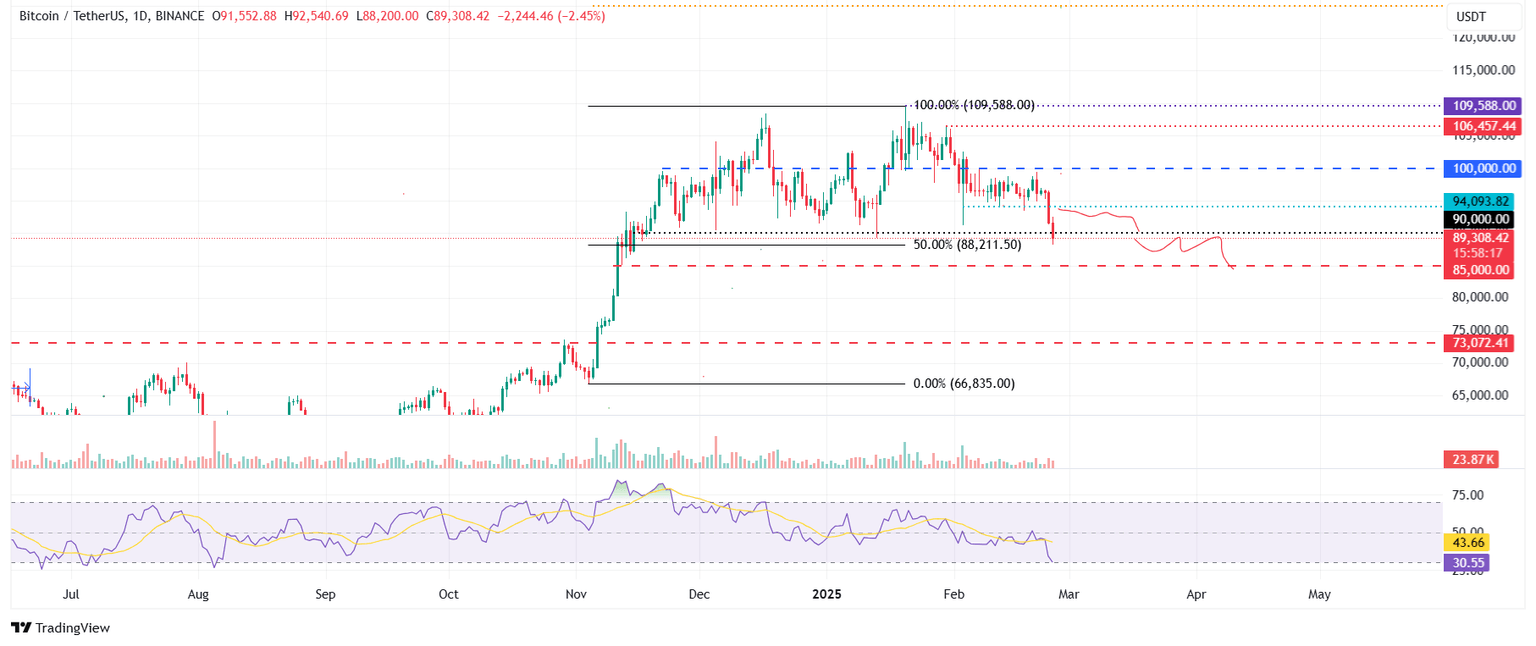

Bitcoin Price Forecast: BTC heading toward $85,000 mark

Bitcoin price broke out of its prolonged consolidation phase on Monday, slipping below the $94,000 support level and closing at $91,552 after a 4.89% decline. At the time of writing on Tuesday, it continues to trade down by 2.45% at $89,300.

If BTC continues its correction, it could extend the decline to test its next support level at $85,000.

The daily chart’s Relative Strength Index (RSI) reads 30, pointing downwards and approaching its oversold levels, indicating strong bearish momentum.

BTC/USDT daily chart

However, if BTC recovers, it could extend the recovery to retest its $100,000 psychological level.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.