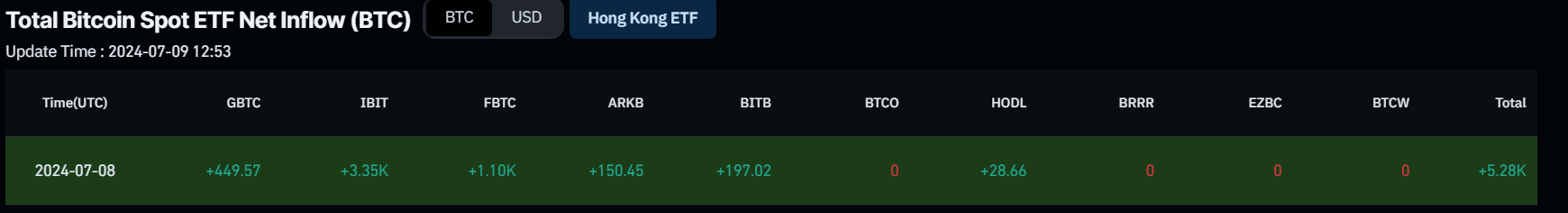

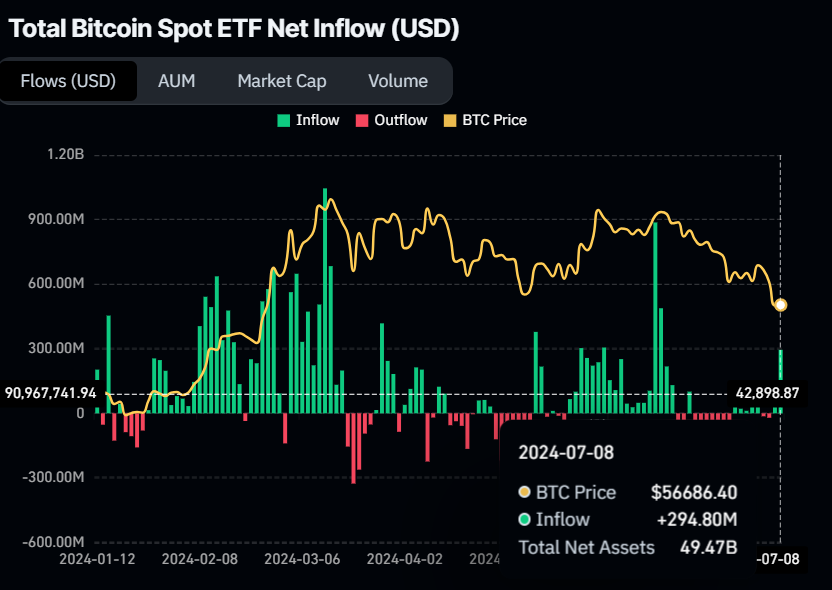

- Bitcoin spot ETFs received $294.8 million in inflows on Tuesday, the highest since June 6.

- The German Government's transfer of 6,306.9 BTC, valued at $362.12 million, to exchanges on Tuesday may negatively impact Bitcoin's price.

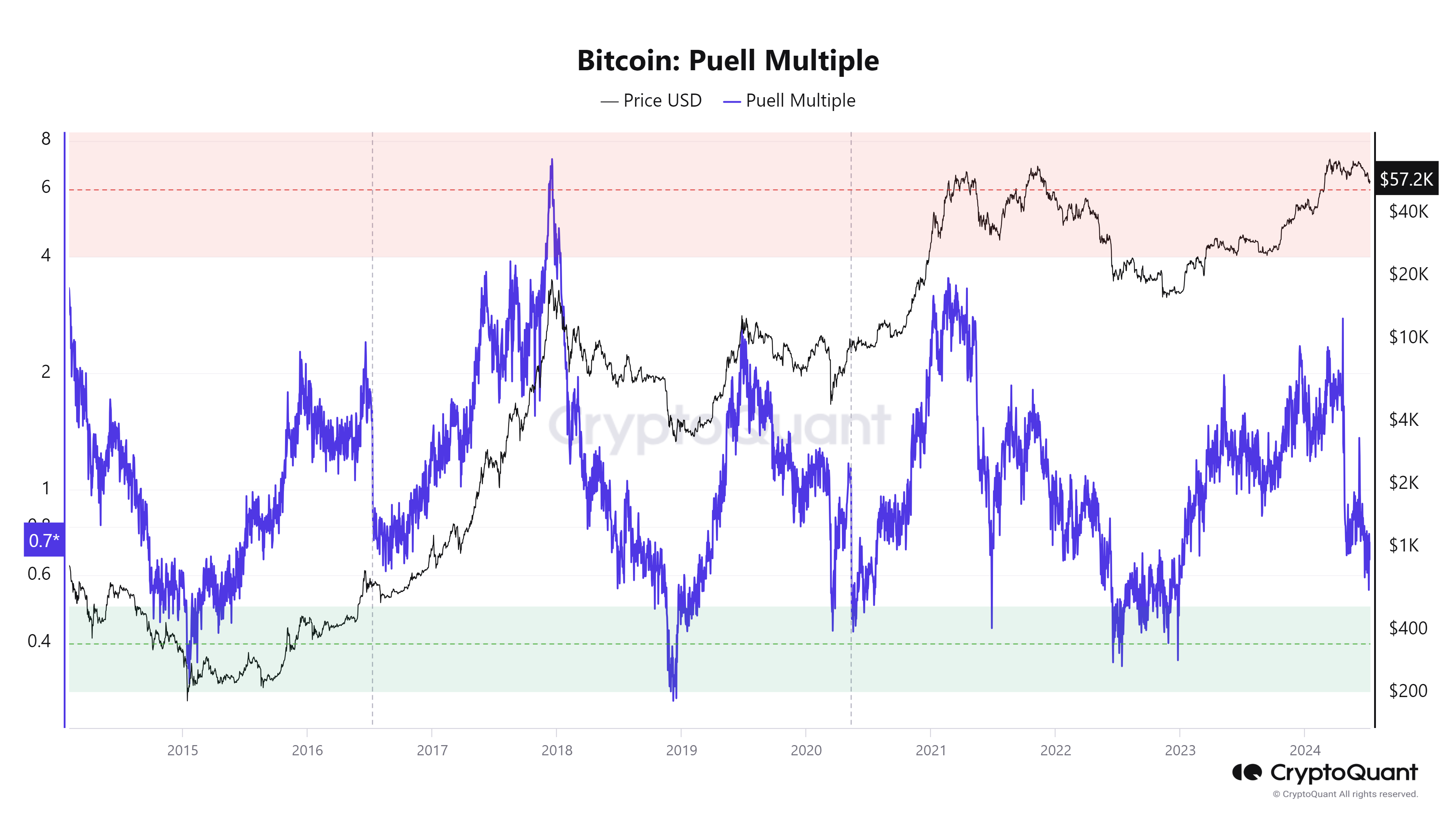

- On-chain data shows miners earn less than the historical average, indicating reduced profitability or less selling pressure.

Bitcoin (BTC) price has encountered resistance near the weekly level of $58,375 over the past three days, currently trading just below at around $57,339, marking a 1.12% increase on Tuesday. On-chain data indicates miners earn less than the historical average, suggesting reduced profitability or decreased selling pressure. Bitcoin spot ETFs saw inflows of $294.8 million on Tuesday, the highest since June 6. Technical analysis shows bullish divergence signals from the Relative Strength Index (RSI) and the Awesome Oscillator (AO) indicators, suggesting potential momentum for an upward rally.

Daily digest market movers: Bitcoin spot ETF received $294.8 million in inflows on Tuesday

- On Tuesday, US spot Bitcoin ETFs saw inflows of $294.8 million, the highest since June 6.

- This uptick suggests growing investor confidence, hinting at a possible short-term increase in Bitcoin's price. The net inflow data from ETFs is crucial for gauging investor sentiment and understanding market dynamics. Combined, the 11 US spot Bitcoin ETFs currently hold reserves totaling $49.47 billion in Bitcoin.

Bitcoin Spot ETF Net Inflow chart

- According to data from Arkham Intelligence, the German Government transferred 6,306.9 BTC, valued at $362.12 million, from its wallet to Kraken, Cumberland, 139Po (likely an institutional deposit/OTC service), and address bc1qu on Tuesday. This significant transfer activity may have triggered FUD (Fear, Uncertainty, Doubt) among traders, potentially contributing to a decline in Bitcoin's price. As of recent movements, the German Government has received 5,366 BTC back from exchanges, including Kraken, Bitstamp, and Coinbase. Currently, the German Government holds 22,847 BTC, valued at $1.32 billion.

TODAY: German Government selling up to 6306.9 BTC ($362.12M)

— Arkham (@ArkhamIntel) July 9, 2024

In the past 3 hours, the German Government has sent 6306.9 BTC ($362.12M) to Kraken, Cumberland, 139Po (likely institutional deposit/OTC service) and address bc1qu.

Of this, 3206.9 BTC ($184.58M) has been sent within… pic.twitter.com/6SmhMDElNZ

- According to data from Lookonchain, a whale has deposited 809 BTC worth $45.18 million to Binance. Depositing BTC on an exchange increases the supply, thereby leading to a price decline. Since June 27, this whale has deposited 7,790 BTC, worth $468 million, to Binance and currently holds 6,559 BTC, worth $379 million.

The whale deposited 809 $BTC($45.18M) to #Binance again 1 hour ago.

— Lookonchain (@lookonchain) July 8, 2024

He has deposited 7,790 $BTC($468M) to #Binance since June 27 and currently holds 6,559 $BTC($379M).

Address: 3G98jSULfhrES1J9HKfZdDjXx1sTNvHkhNhttps://t.co/kqDPbHy4ue pic.twitter.com/RtqpUiXwGc

- According to CryptoQuant, Bitcoin's Puell Multiple indicators offer valuable insights into the cryptocurrency's mining profitability cycles by measuring the ratio between Bitcoin's daily issuance value in USD and its 365-day moving average.

- When the Puell Multiple is high, it indicates that Bitcoin miners are earning higher USD-denominated rewards than historical averages, potentially leading to increased coin sales to cover expenses or capitalize on profits. Conversely, a low Puell Multiple suggests that miners earn less than the historical average, which could indicate reduced profitability or less selling pressure from miners.

- Currently, Bitcoin's Puell Multiple stands at 0.7, signaling lower USD-denominated rewards for miners than historical averages and potentially indicating a period of reduced profitability or decreased selling pressure.

- Additionally, the metric saw significant declines during the bull cycles of 2016 and 2020, coinciding with Bitcoin's substantial upward trends. Similar patterns are currently observed, suggesting a potential adjustment period nearing its conclusion. While pinpointing the exact end of this adjustment phase is challenging, indications point to a potential start of a bullish rally by the third quarter of 2024.

Bitcoin Puell Multiple chart

Technical analysis: BTC faces resistance around the $58,500 level

Bitcoin's price encountered resistance at the weekly resistance level of $58,375 in the past three days and trades below it around $57,339, 1.12% up on Tuesday.

Additionally, the formation of a lower low in the daily chart on July 5 contrasts with the Relative Strength Index's (RSI) higher high during the same period. This development is termed a bullish divergence and often leads to the reversal of the trend or a short-term rally.

If BTC closes above the $58,375 weekly resistance level, it could rise 9% to revisit the daily resistance at $63,956.

BTC/USDT daily chart

However, if BTC closes below the $52,266 daily support level and forms a lower low in the daily time frame, it could indicate that bearish sentiment persists. Such a development may trigger a 4% decline in Bitcoin's price to revisit its daily low of $50,521 from February 23.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ripple update: XRP shows resilience in recent crypto market sell-off

Ripple's XRP is up 6% on Tuesday following a series of on-chain metrics, which reveals investors in the remittance-based token held onto their assets despite the wider crypto market sell-off last week.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

Six Bitcoin mutual funds to debut in Israel next week: Report

Six mutual funds tracking the price of bitcoin (BTC) will debut in Israel next week after the Israel Securities Authority (ISA) granted permission for the products, Calcalist reported on Wednesday.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.