- The German Government transferred another 1,000 BTC, valued at $55.8 million, on Monday.

- On-chain data shows that liquidations on Defi platforms exceed $17.94 million.

- Bitcoin Exchange netflow records the highest outflow of 68,498 BTC since November 23, 2023.

Bitcoin (BTC) struggles against resistance near the $58,500 level but still trades up 2.93% at $57,515 on Monday. On-chain data shows that liquidations on Defi platforms exceed $17.94 million, and Exchange netflow records the highest outflow of 68,498 BTC since November 23, 2023. Meanwhile, the German Government transferred an additional 1,000 BTC, valued at $55.8 million, on the same day.

Daily digest market movers: Bitcoin marked the highest Exchange outflow in 2024

- According to data from Lookonchain, the German Government transferred 1,000 BTC, valued at $55.8 million, from its wallet on Monday. Of this, 500 BTC, worth $27.9 million, were transferred to Coinbase and Bitstamp.

- Since June 19, the German Government has transferred 13,466 BTC, equivalent to $819.3 million, while still holding 39,826 $BTC valued at $2.29 billion. This notable transfer activity has potentially contributed to FUD (Fear, Uncertainty, Doubt) among traders, likely influencing Bitcoin's recent decline in price over the past few weeks.

The #German government transferred 1,000 $BTC($55.8M) out again 15 minutes ago, of which 500 $BTC($27.9M) was deposited to #Coinbase and #Bitstamp.

— Lookonchain (@lookonchain) July 8, 2024

The #German government currently holds 38,826 $BTC($2.17B).https://t.co/h2JlBVFPsL pic.twitter.com/NS5pkMixrj

- According to CryptoQuant data, Bitcoin Exchange netflow is the difference between BTC flowing into and out of the exchange (Inflow -outflow = netflow).

- On Friday, Bitcoin recorded a negative netflow of 68,498 BTC, the highest since November 23, 2023. This surge in outflows, prominently visible on the chart below, indicates a significant movement of Bitcoin away from exchanges, a trend often perceived as bullish by investors. The prevailing sentiment is that major holders are transferring their Bitcoin to wallets, possibly signaling expectations of price increases or a preference for long-term holding rather than immediate selling.

%20-%20All%20Exchanges%20(1)-638560366321467169.png)

Bitcoin Exchange Netflow chart

- According to data from Santiment's Defi liquidations on Aave and Compound Finance, the recent BTC price drop from a July 4 peak of $60,498 to a July 5 low of $53,485 resulted in over $17.94 million in liquidations on Defi platforms. Historically, such liquidation spikes are typically followed by market recoveries driven by forced selling and strategic purchasing by key stakeholders.

%20[15.01.15,%2008%20Jul,%202024]-638560366785461522.png)

Santiment Defi Liquidation chart

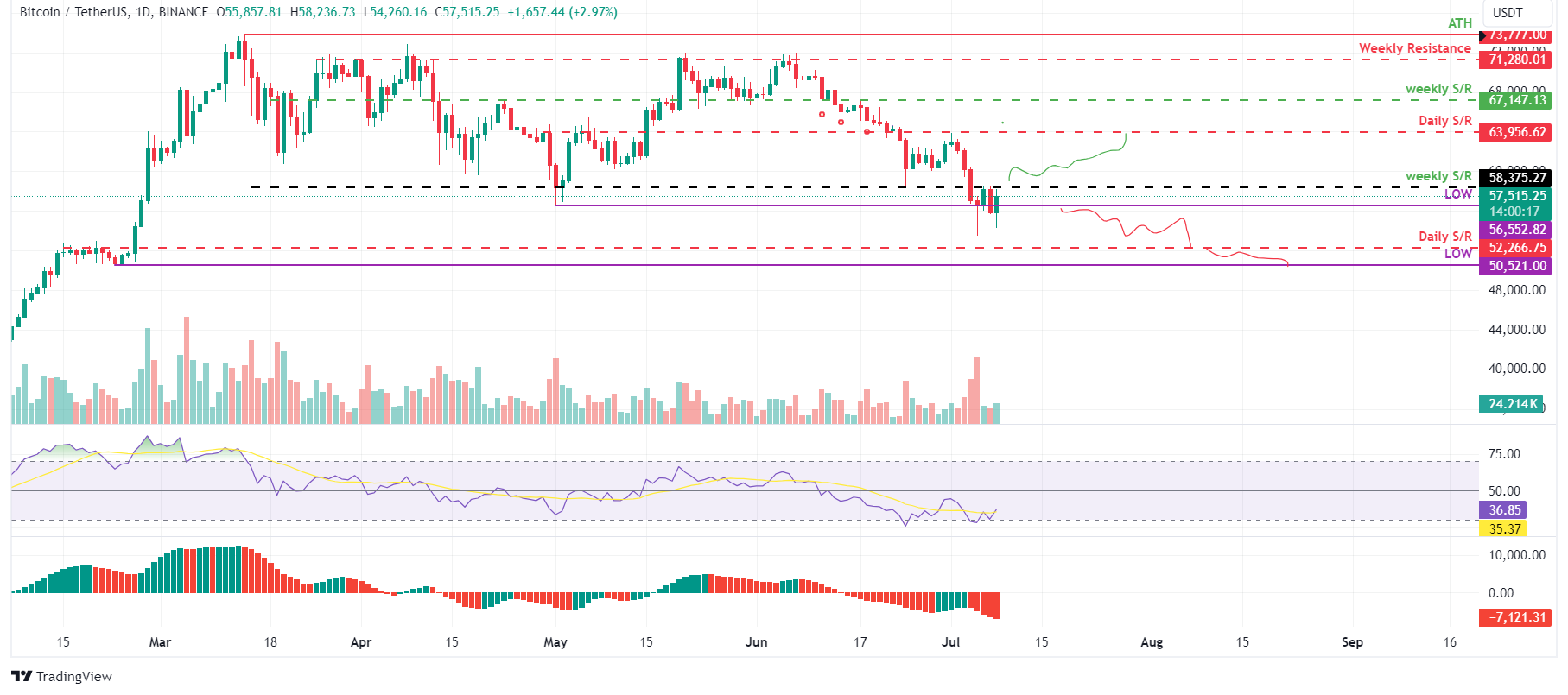

Technical analysis: BTC faces resistance around $58,500 level

Bitcoin's price encountered resistance at the weekly resistance level of $58,375 on Saturday, resulting in a 4% decline the next day. By Sunday's close, it had fallen below the May 1 low of $56,552 and trades around $57,515, 2.93% up on Monday.

If BTC's weekly level at $58,375 acts as resistance, it could decline 5% to revisit the daily support at $52,266.

The Relative Strength Index (RSI) and the Awesome Oscillator (AO) on the daily chart support this bearish thesis, as both indicators are below their respective neutral levels of 50 and zero.

This suggests continued momentum favoring bears, potentially leading to a further decline in the Bitcoin price.

Additionally, if the bears are aggressive and the overall crypto market outlook is negative, BTC could extend an additional decline of 3.3% to retest its February 23 low of $50,521.

BTC/USDT daily chart

However, if BTC closes above the $58,375 weekly resistance level and forms a higher high in the daily time frame, it could indicate that bullish sentiment persists. Such a development may trigger a 9.7% rise in Bitcoin's price to revisit its next daily resistance at $63,956.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.