Bitcoin price falls under $33K, but on-chain data hints at BTC accumulation

Signs of BTC accumulation begin to emerge as the network’s hashrate rises and exchange outflows increase in July.

As the pressures placed on the market by China’s cryptocurrency crackdown begin to subside and the Bitcoin (BTC) hashrate starts to show signs of recovery, traders are now focused on how the price will be affected by this week's unlocking of more than $550 million worth of Grayscale's GBTC shares.

Data from Cointelegraph Markets Pro and TradingView shows that the early morning downtrend in BTC on July 12 continued into the afternoon as the price of BTC dropped below the $33,000 support level after bears took control of the market.

BTC/USDT 4-hour chart. Source: TradingView

Grayscale attracted further attention on Monday after various media reported that the firm has publicly filed three Form 10 registration statements with the United States Securities and Exchange Commission (SEC).

This brings the number of publicly reported trusts managed by Grayscale to five, with the trusts for Bitcoin Cash (BCH), Ethereum Classic (ETC) and Litecoin (LTC) joining the previously filed trusts for Bitcoin and Ether (ETH).

Bitcoin hashrate shows signs of recovery

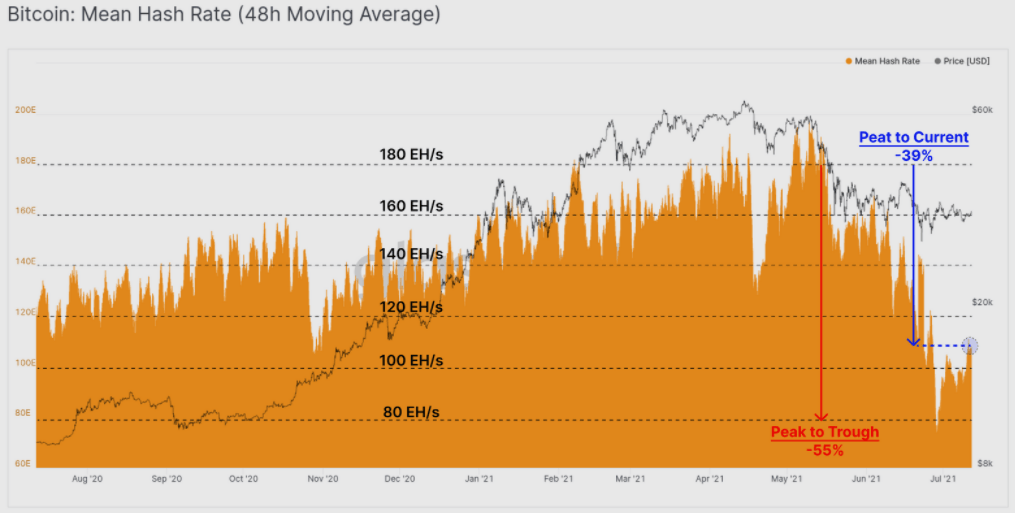

China’s crackdown on Bitcoin mining resulted in a 55% decline in the network hashrate as BTC mines were shut down across the country and operations moved overseas.

According to a recent report from Glassnode, roughly 29% of the lost hashpower has now come back online as a result of Chinese miners successfully relocating hardware while “previously obsolete hardware has been dusted off and found a new lease on life.”

Bitcoin mean hash rate. Source: Glassnode

After nearly a month of selling from miners, the Miner Net Position Change metric now shows that they are back in accumulation mode indicating that “the sell-side pressure coming from offline miners is more than offset by accumulation by the operational miners.”

Further evidence for a decrease in selling can be found in the exchange flow data for BTC, which has seen a larger amount of BTC withdrawn from exchanges than deposited over the past two weeks.

Bitcoin all exchanges netflow. Source: CryptoQuant

As a result of the increased outflows, the amount of Bitcoin reserves held across all exchanges fell by more than 16,100 BTC between June 28 and July 11.

Bitcoin all exchange reserves. Source: CryptoQuant

From a macro perspective, many interpret this as a bullish development for Bitcoin as token holders appear to be withdrawing BTC to put into long-term storage as the market awaits the next significant move higher.

Altcoins fall under pressure

Altcoins as a whole fell under pressure on Monday as the pullback in BTC led to weakness across the market.

Daily cryptocurrency market performance. Source: Coin360

As the sell-off intensified into the afternoon the price of Ether (ETH) fell to the $2,000 support level after traders rushed for the exits.

While the majority of the market was in the red for the day, there were several projects that managed to rise above the noise and post gains on July 12, with Metal (MTL) putting up a gain of 18% while Revain (REV), Stratis (STRAX) and Injective Protocol (INJ) gained 12%

The overall cryptocurrency market cap now stands at $1.354 trillion and Bitcoin’s dominance rate is 45.5%.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.