Bitcoin price falls under $27,000 as FOMC minutes show rates could remain restrictive for some time

- FOMC minutes noted that all members of the Committee were in agreement that the Federal Reserve should proceed carefully.

- The minutes also noted that the officials saw risks to achieving goals had become more two-sided.

- Bitcoin price at the time of writing slipped below $27,000, with the rest of the crypto market exhibiting mixed signals.

The Federal Open Market Committee (FOMC) decided to maintain the target interest rate at 5.25% to 5.50% during the September meeting; however, the minutes from the meeting suggest that a rate hike is possible before the year ends.

Read more - FOMC minutes: Members agreed rates should stay restrictive for some time

FOMC minutes hint at another rate hike

The next meeting of the Committee is scheduled for November 1, and according to the FOMC minutes, there is potential for the meeting to result in a rate hike. However, the minutes also noted that all members agreed that interest rates should stay restrictive for some time.

According to the minutes, there was agreement among the members of the Committee to proceed carefully, and officials saw risks to achieving goals had become more two-sided. These mixed signals were also reflected in the market, which had a bearish initial reaction that quickly subsided.

The minutes also noted,

“In addition, modal expectations for the policy rate from the surveys were that the current target range would be maintained until the May 2024 FOMC meeting, compared with March in the previous survey, with a roughly one-in-three chance of a 25 basis point increase by the November FOMC meeting.”=

Additionally, participants stressed that current inflation remained unacceptably high while acknowledging that it had moderated somewhat over the past year.

Bitcoin price dips slightly

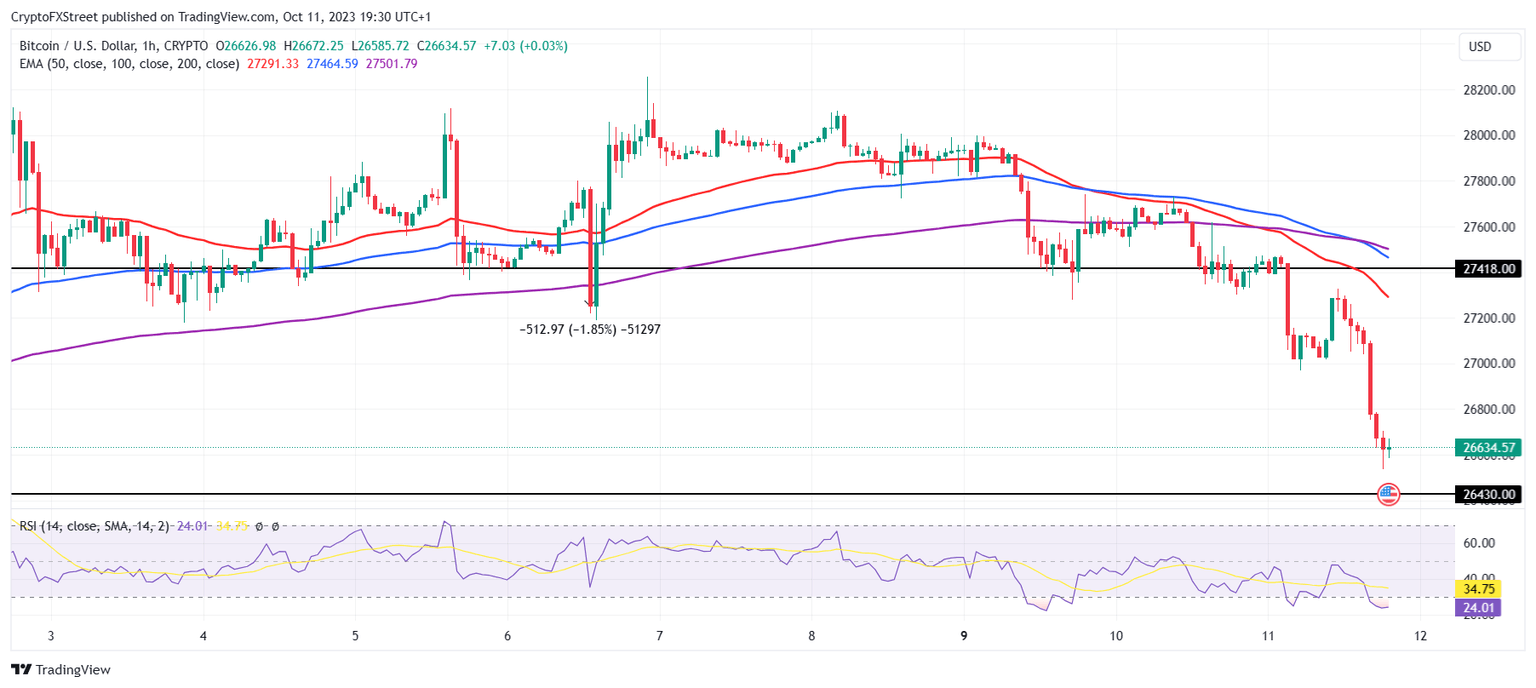

Bitcoin price had a bearish initial reaction to the FOMC minutes, which added to the decline that was initiated at the beginning of the day. The cryptocurrency, which was trading below $27,000, slipped to $26,650 at the time of writing.

BTC/USD 1-hour chart

BTC, however, quickly recovered, with the 1-hour chart suggesting a 0.17% decline in the price. The rest of the crypto market did not note any significant decline either, with the total market cap only slipping by 1.92%.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.