Stock markets and Bitcoin price took a slight hit after the Federal Reserve announced plans to increase interest rates twice in 2023, a tad bit earlier than markets expected.

Bitcoin dropped closer to a key support level and the Dow and the S&P 500 pulled back after the Federal Reserve moved forward its plan for 2 interest rate hikes in 2023.

Bitcoin (BTC) price extended its losses shortly after Federal Reserve Chair Jerome Powell announced that the Fed would move forward its timeline and schedule two interest rate hikes in 2023.

Bitcoin price was already seeing weakness in the early trading hours after losing the $40,000 level to mark an intra-day low at $38,300. The Dow and S&P 500 also pulled back 0.77% and 0.54% respectively.

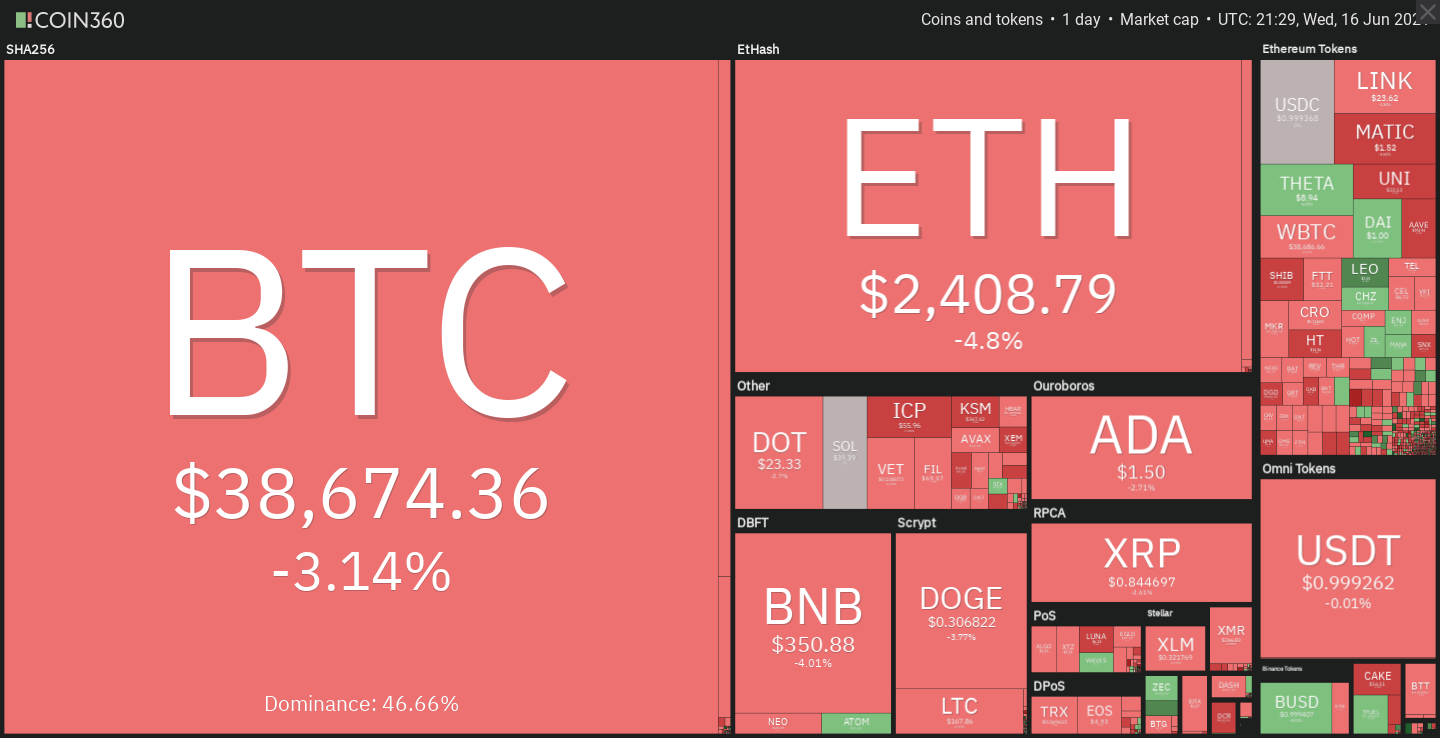

Daily cryptocurrency market performance. Source: Coin360

The decision comes as economists worry about rising inflation in the United States and Powell said that the Fed had raised its inflation expectation from 2.4% to 3.4%. While Powell described the current inflation spike as “transitory”, consumer prices are at a 13 year high and analysts worry that rising inflation will impact the post-covid economic recovery.

Powell did not directly address whether, or when the Fed would begin tapering its $120 billion monthly bond purchases but the decision to begin raising rates in 2023 suggests that the program will see cuts way in advance of 2023 in order to be carried out in a moderate fashion.

BTC/USDT daily chart. Source: TradingView

On June 15 Bitcoin price successfully completed its bullish inverse head and shoulders pattern (4-hour chart), but fell short of the $45,500 target after hitting resistance at $41,350.

While the price has slipped below $40,000 and failed to flip the level to support, analysts are viewing the current price action as nothing more than range-bound trading and at the time of writing, $38,300 looks like a lower support retest.

With less than 3 hours before the daily close, traders will likely look for BTC to hold above the 20-day moving average near the $37,000 level which is expected to function as support.

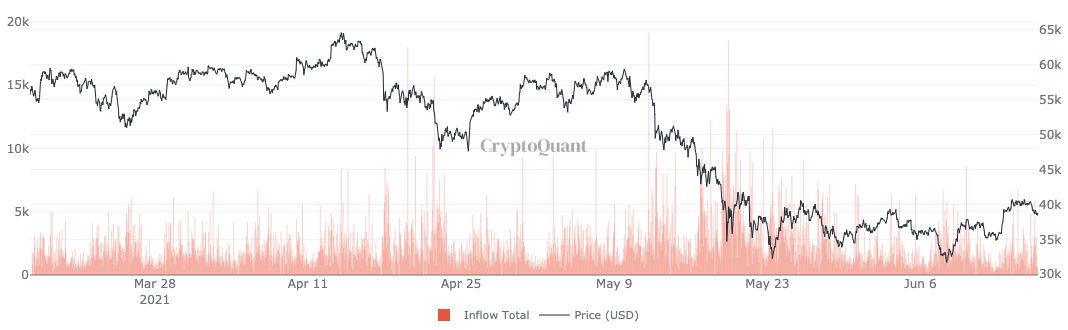

Bitcoin all exchanges inflow. Source: CryptoQuant

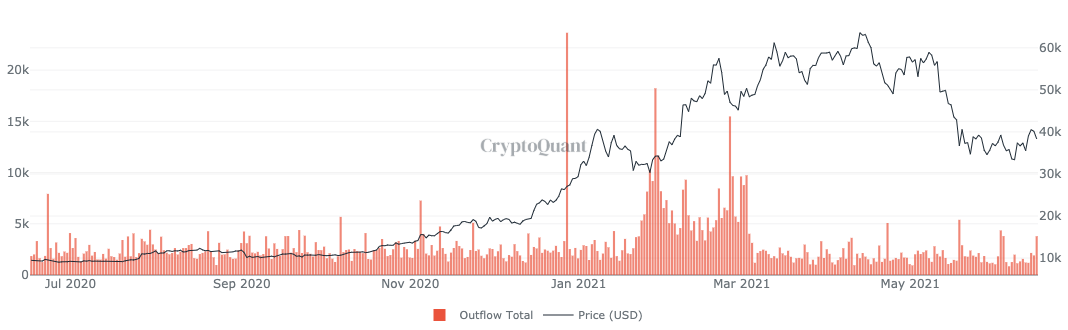

One thing to note is the steady inflow of BTC to major exchanges and an increase in miner outflows over the past few days as data from CryptoQuant suggests that Bitcoin inflows lead to bearish outcomes.

Bitcoin all miners outflow. Source: CryptoQuant

The 50- and 200-day moving averages are also en route to converge, possibly forming a bearish ‘death cross’, but both are lagging indicators, meaning they are not entirely reflective of spot price action. Nevertheless, both moving averages could present considerable resistance for bulls.

A dip below the $37,000 to $36,000 range where many traders on crypto-Twitter have announced they have bids would likely take BTC price to the lower end of its current range in the $35,000 to $31,000 zone.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Top gainers Virtuals Protocol, Floki, Hyperliquid: Altcoins extend gains alongside Bitcoin

The cryptocurrency market sustains a market-wide bullish outlook at the time of writing on Tuesday, led by Bitcoin (BTC) and select altcoins, including Virtuals Protocol (VIRTUAL), Floki, and Hyperliquid (HYPE).

Token unlocks over $625 million this week across major projects SUI, OP, SOL, AVAX and DOGE

According to Wu Blockchain, 11 altcoins with one-time tokens unlock more than $5 million each in the next seven days. The total value of cliff and linear unlocked tokens exceeds $625 million.

TRUMP meme coin on-chain activity surged following dinner announcement: Kaiko

Kaiko Research published a report on Monday highlighting the significant impact of TRUMP's team dinner announcement on the meme coin sector. The announcement triggered a surge in on-chain activity and trading volumes, with TRUMP accounting for nearly 50% of all meme coin trading volume.

Coinbase launches new Bitcoin Yield Fund, offering investors 4–8% annual returns

Coinbase has launched a Bitcoin Yield Fund, aiming to offer non-U.S. investors sustainable 4–8% returns paid directly in Bitcoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.