Bitcoin price rally to $48,000 likely with BTC uptrend gaining strength in bull market

- Bitcoin wallet addresses holding over $1,000 in BTC have hit a new all-time high, signaling demand among retail traders.

- BTC enters overbought territory for the first time since February 2021, reflecting strength in Bitcoin’s uptrend.

- Analysts at Castillo trading predict Bitcoin price rally to $48,000, if BTC price sustains above $30,000.

Bitcoin wallet addresses holding over $1,000 worth of Bitcoin climbed to a new high, pointing at rising demand for BTC among retail traders. Analysts identified technical indicators that point at a stronger uptrend in Bitcoin price.

Bitcoin price rally is strengthened by macroeconomic factors like the US Federal Reserve’s decision to keep interest rates unchanged and cooling Nonfarm Payroll data for October.

Daily Digest Market Movers: BTC price gains likely to extend, retail traders accumulate Bitcoin

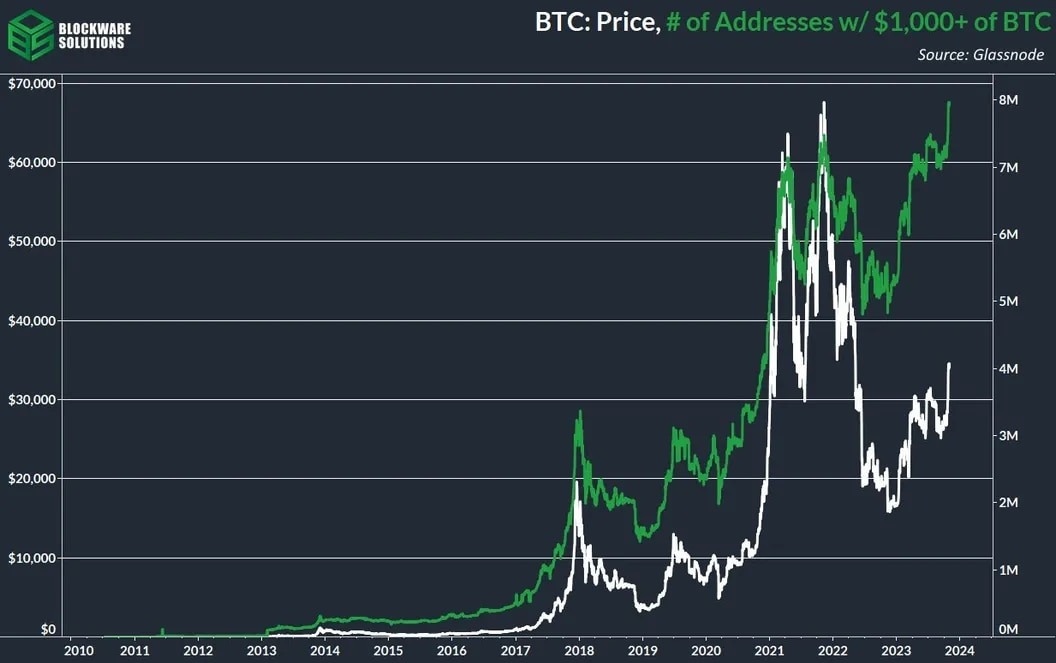

- Bitcoin wallet addresses holding 0.028 BTC, or $1,000 in BTC have hit a new all-time high, according to data from Blockware solutions.

- A total of 8 million addresses now hold Bitcoin, supporting the thesis of rising demand for the asset among retail market participants, as seen in the chart below.

Bitcoin wallet addresses holding $1,000 in BTC

- Bitcoin mining stocks rallied on Thursday last week, as BTC price hit a 17-month high. The rally in mining company stocks supports a bullish thesis for Bitcoin price in the ongoing cycle.

- Other catalysts supporting BTC price uptrend are cooling jobs data for October, as seen in the NFP release last week. Find out more here.

- Analyst William Clemente analyzed the Bitcoin price trend and identified that BTC has entered the overbought territory, as seen in its one-week Relative Strength Index (RSI) chart. This occurred for the first time since February 2021.

- Clemente argues that while the short term may not be the best timeframe to evaluate Bitcoin’s price trend, on a cycle to cycle basis, it is a positive indicator of BTC’s uptrend.

Bitcoin/USDollar one-week price chart

Technical Analysis: Bitcoin price could extend its gains above $30,000

Bitcoin price uptrend gained strength with recent macroeconomic data releases and the anticipation of a spot Bitcoin ETF approval. Technical analysts at Castillo Trading evaluated the Bitcoin price trend and set a $48,000 to $50,000 price target for BTC.

Analysts believe that Bitcoin price could hit its $48,000 target if BTC price sustains above $30,000 without any significant rejection. Technical experts have left room for a bearish turn in Bitcoin price trend if BTC price is rejected in its uptrend.

BTC/USD three-day price chart on Coinbase

If Bitcoin price drops to the lower limit below $30,000, the bullish thesis for BTC price is invalidated. Below $30,000, if BTC price continues bleeding, it could nosedive to the $19,902 level, as seen in the price chart.

Cryptocurrency metrics FAQs

What is circulating supply?

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. Since its inception, a total of 19,445,656 BTCs have been mined, which is the circulating supply of Bitcoin. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

What is market capitalization?

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value. For Bitcoin, the market capitalization at the beginning of August 2023 is above $570 billion, which is the result of the more than 19 million BTC in circulation multiplied by the Bitcoin price around $29,600.

What is trading volume?

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

What is funding rate?

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.