- Bitcoin price is targeting a 15% surge according to a technical pattern that appears to be forming.

- There are a few key hurdles for BTC to overcome before it can achieve the bullish target.

- The lack of demand for leveraged long positions raises concern for the bellwether cryptocurrency.

Bitcoin price is forming a technical pattern that suggests that it could surge by 15% toward $56,219 if BTC manages to slice above a critical level of resistance. However, the potential for the bellwether cryptocurrency to surge may fall short as the spread between futures and spot prices has shriveled compared to the rally earlier this year.

Bitcoin price aims for 15% bounce

Bitcoin price has been forming an inverse head-and-shoulders pattern on the 12-hour chart, suggesting a bullish outlook for the leading cryptocurrency.

The governing technical pattern suggests that Bitcoin price may be headed for a 15% climb from the neckline. However, a few obstacles remain before BTC could achieve the target given by the chart pattern at $56,219.

BTC/USDT 12-hour chart

The first obstacle is at the breakout line given by the Momentum Reversal Indicator at $48,000, then the neckline of the inverse head-and-shoulders pattern at $49,450.

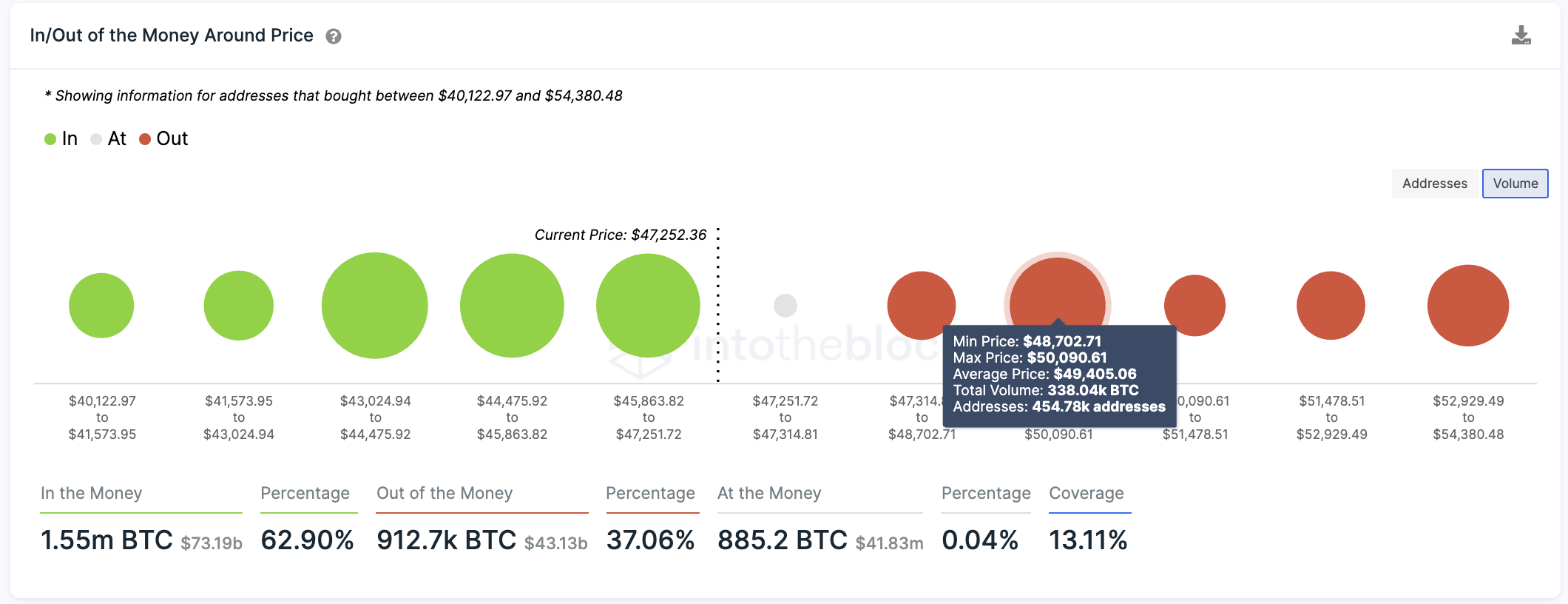

The IntoTheBlock’s In/Out of the Money Around Price (IOMAP) metric indicates that the largest cluster of resistance ahead for Bitcoin price is at $49,405, where 454,780 addresses purchased 338,040 BTC.

BTC IOMAP

Investors should note that only if Bitcoin price slices above the neckline of the prevailing chart pattern would confirm the bullish thesis, and only then can it be used to anticipate price moves.

Should Bitcoin price surge above the neckline, BTC still faces the 61.8% Fibonacci extension level at $51,167 before reaching the target given by the technical pattern.

Currently, Bitcoin price finds meaningful support at the 50% Fibonacci extension level at $46,901. The IOMAP shows that there appears to be ample support for the leading cryptocurrency, with the next large cluster of 801,870 addresses that purchased 422,280 BTC at an average price of $46,298.

However, should Bitcoin price fall below $46,901, the bullish outlook could be at risk. A spike in selling pressure could see BTC crash toward $44,173, voiding the governing technical pattern, and the rally could be short-lived.

In addition, the recent recovery from July lows has been missing a key aspect, as cryptocurrency traders have not increased their leverage. Demand for leveraged long positions has been muted, as the spread between the Bitcoin futures and spot price has diminished compared to the February rally this year.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC remains calm before a storm

Bitcoin price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday. A K33 Research report explains how the markets are relatively calm and shaping up for volatility as investors absorb the tariff announcements.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

Ethereum Price Forecast: Whales increase buying pressure as developers set April 30 for Pectra mainnet upgrade

Ethereum developers tentatively scheduled the Pectra mainnet upgrade for April 30 in the latest ACDC call. Whales have stepped up their buying pressure in hopes of a price uptick upon Pectra going live on mainnet.

BTC stabilizes while ETH and XRP show weakness

Bitcoin price stabilizes at around $87,000 on Friday, as its RSI indicates indecisiveness among traders. However, Ethereum and Ripple show signs of weakness as they face resistance around their key levels and face a pullback this week.

Bitcoin: BTC remains calm before a storm

Bitcoin (BTC) price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.