Bitcoin price explodes past $30,500, gains strength with US CPI release

- US CPI year-over-year measure declined to 5.2% in March, coming in at market expectations.

- Bitcoin price climbed in response to the CPI release, resuming its uptrend above the $30,500 level.

- Upcoming FOMC Minutes could offer further insight on the Fed’s rate outlook and likely impact on Bitcoin’s recent gains.

The US Bureau for Labor Statistics (BLS) released Consumer Price Index (CPI) data for March. Both CPI YoY, at 5% and CPI MoM at 0.1% came in below market expectations, supporting Bitcoin’s bullish thesis.

The asset climbed past the $30,500 level ahead of the release and experts believe BTC is likely to continue yielding gains for holders with CPI coming in at market expectations.

Also read: Breaking: US annual CPI data declines to 5% in March vs. 5.2% expected

Bitcoin price rally gains strength with US CPI release

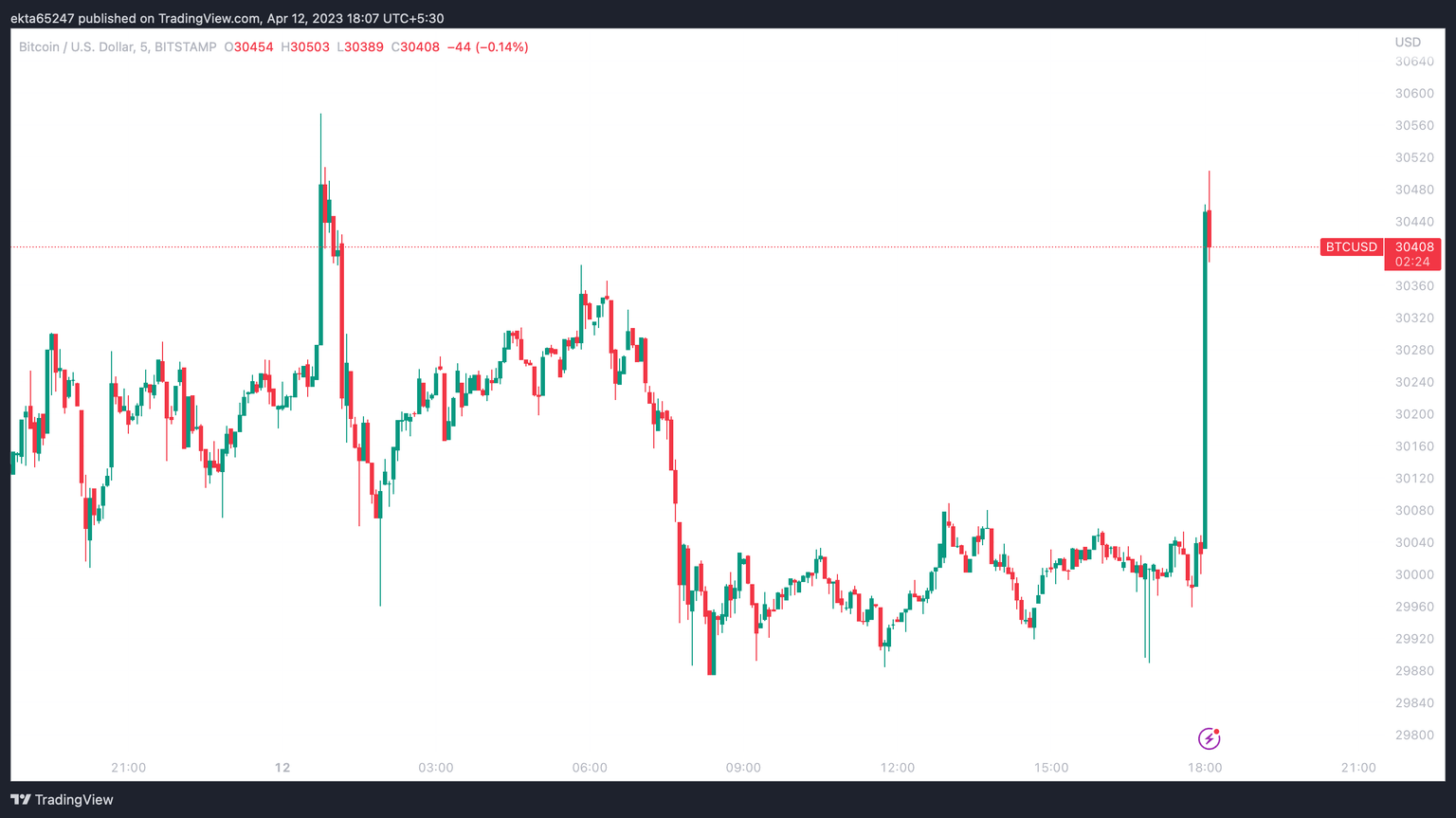

Bitcoin price witnessed a massive gain in its price (see the five-minute chart from TradingView) as BTC holders rejoiced. The headline Consumer Price Index data figures came in below market expectations, fueling a bullish sentiment and a positive reaction among market participants.

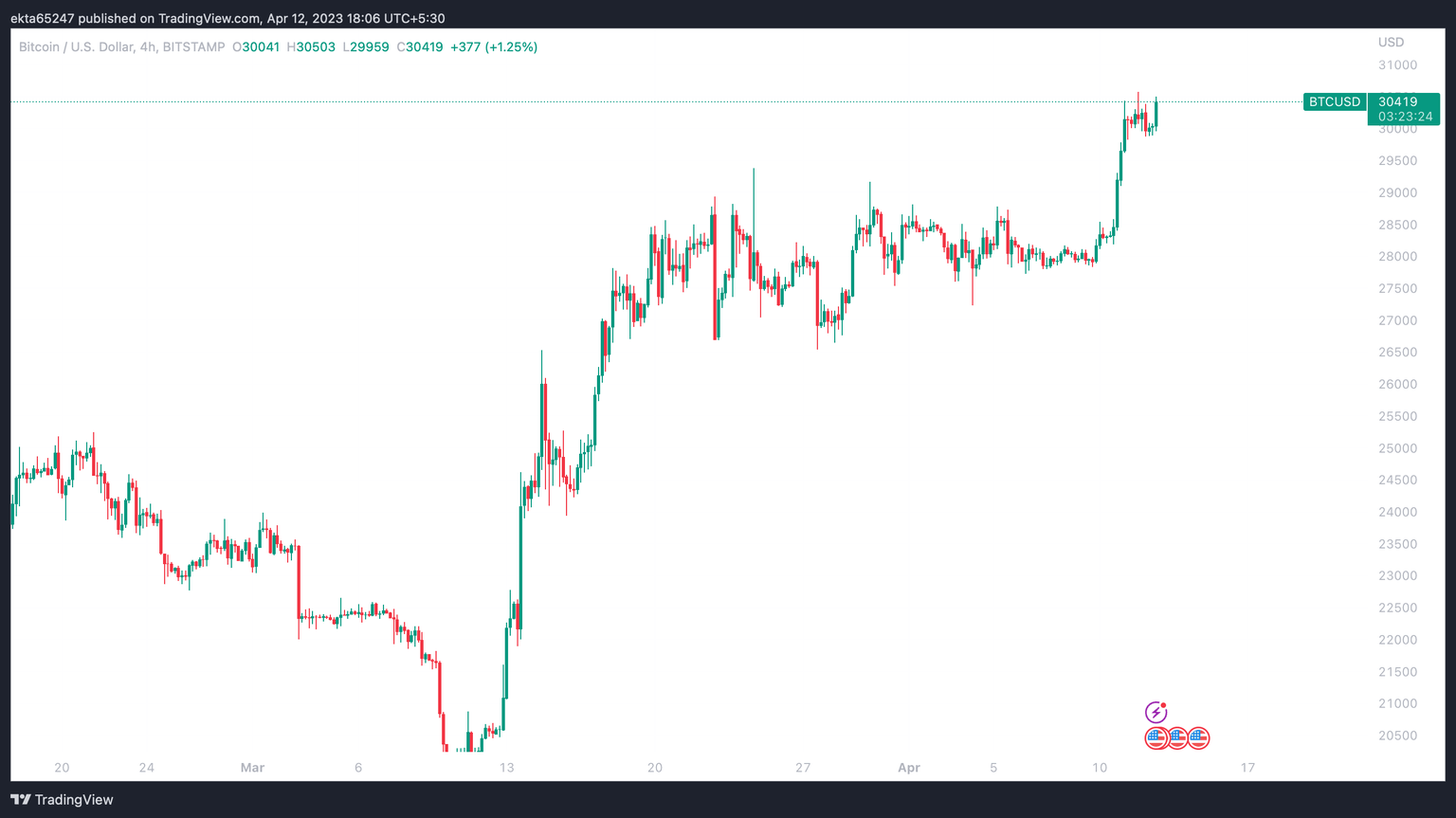

BTC/USD 4-hour price chart

Bitcoin price has recently outperformed stocks and witnessed a higher correlation with Gold, rather than Nasdaq 100, setting the stage for its gains. On Bitcoin shorter time frame charts, the US CPI release has triggered a large bullish engulfing candle.

BTC/USD 5-minute price chart

Bitcoin is therefore likely to sustain its recent gains and the largest asset by market capitalization is positioned for a run up to $32,000. The 28,000 - $32,000 level is a key range where Bitcoin price faces resistance, since June 2022. A rally past $32,000 could clear the path for BTC to hit the $35,000 bullish target.

Macroeconomic outlook shifts: Bullish for BTC

A soft inflation report has increased the selling pressure on the US Dollar. This is positive for risk assets like Bitcoin, Ethereum and cryptocurrencies. Market participants are now awaiting a confirmation of a shift in the Federal Reserve’s outlook to “dovish” and investors will watch the FOMC Minutes (to be published on Wednesday at 18 GMT) closely to gather more clues on the Fed's next steps and decisions on rate hikes in 2023.

At the time of writing, nearly all cryptocurrencies in the top 30 assets by market capitalization have yielded gains in response to the US CPI data release.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.