Bitcoin price struggles at $64,000 amid Mt. Gox funds movement, steady US interest rates and ETF outflows

- Mt. Gox moved $3.1 billion worth of BTC on Wednesday.

- Grayscale Mini BTC ETF receives a $1.8 billion inflow on Wednesday.

- The FOMC decided to hold US interest rates steady, resulting in a BTC price decline.

- Bitcoin Spot ETF registered slight outflows of $17.70 million on Wednesday.

Bitcoin’s (BTC) price stabilizes at around $64,000 on Thursday after falling short of closing above $70,000 at the beginning of the week. On Wednesday, Mt. Gox moved $3.1 billion worth of BTC, Grayscale's Mini BTC ETF received a $1.8 billion inflow, and the Bitcoin Spot ETF experienced slight outflows of $17.70 million. The FOMC's decision to hold US interest rates steady also contributed to the decline in Bitcoin’s price.

Daily digest market movers: Bitcoin drops as US interest rates steady

- According to Arkham Intelligence, Mt. Gox wallet moved $3.1 billion worth of BTC on Wednesday. Mt. Gox addresses recently transferred 33,960 BTC, valued at $2.25 billion, to new addresses, which are highly likely to be associated with BitGo:

bc1q26tsxc0ge7phvcr2kyczexqf5pcj8rk79cqk90h34c30dn9dskeq3gmw3f

bc1q48a5tjhdjtkfv8zv6tj68767h8lgep9dpx0emrkx0yhhmum7wscs95ft36

BitGo is the 5th and final custodian working with the Mt. Gox Trustee to return funds to creditors.

After these transfers, Mt. Gox now holds 46,160 BTC worth $3.06 billion, including the new Mt. Gox address:

1MUQEiiQEckiBkrQswqq225nQTRWJ5SXZZ

These ongoing transfers are likely fueling FUD (Fear, Uncertainty, Doubt) among traders, contributing to Bitcoin's recent price decline.

UPDATE: MT. GOX MOVES $3.1B BTC

— Arkham (@ArkhamIntel) July 31, 2024

Last night Mt. Gox addresses moved 33.96K BTC ($2.25B) to addresses we believe are most likely BitGo:

bc1q26tsxc0ge7phvcr2kyczexqf5pcj8rk79cqk90h34c30dn9dskeq3gmw3f

bc1q48a5tjhdjtkfv8zv6tj68767h8lgep9dpx0emrkx0yhhmum7wscs95ft36

BitGo is the 5th… pic.twitter.com/XWNiZ2boAN

- Arkham Intelligence shows that Grayscale moved $1.8 billion in BTC through Coinbase Prime to their Mini Bitcoin Trust ETF sourced from the GBTC Bitcoin Trust on Wednesday.

- The Mini Trust began trading on Wednesday – the ticker is Bitcoin $BTC.

- All GBTC investors are entitled to one share of BTC for every share of GBTC that they own.

GRAYSCALE MINI BTC ETF RECEIVES $1.8B BTC INFLOW

— Arkham (@ArkhamIntel) July 31, 2024

Grayscale moved $1.8B in BTC through Coinbase Prime to their Mini Bitcoin Trust ETF last night - sourced from the GBTC Bitcoin Trust.

The Mini Trust began trading today - the ticker is Bitcoin $BTC.

All GBTC investors are… pic.twitter.com/bLln8x9awG

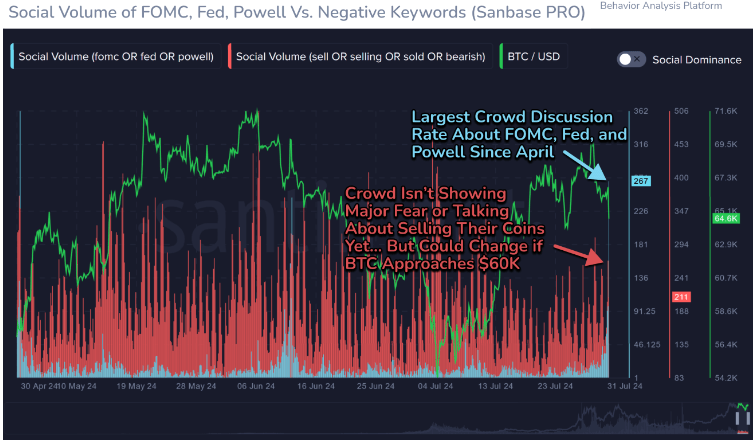

- Santiment's data shows that the FOMC's decision to keep US interest rates steady on Wednesday led to an initial decline in crypto prices, as traders had hoped for a rate cut for the first time since March 15, 2020. Once the initial emotional sell-offs subside, markets are expected to stabilize, though a significant market-wide rebound could occur if aggressive whale accumulation and heightened crowd negativity both occur.

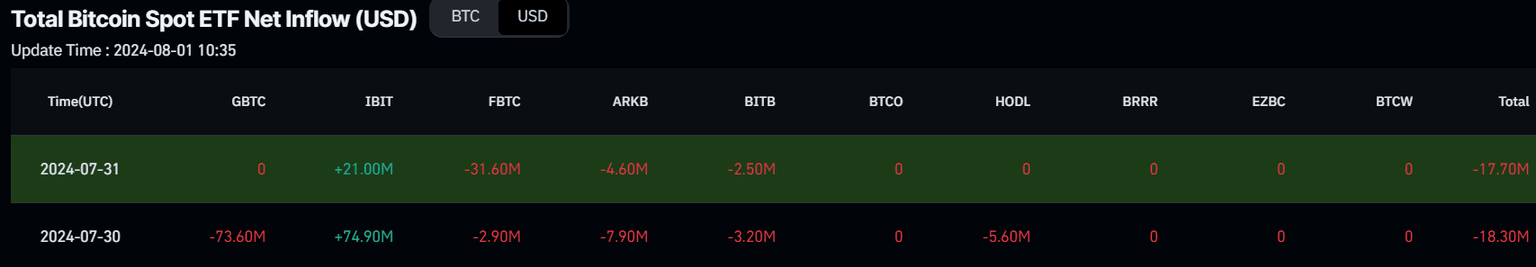

- According to Coinglass, Bitcoin Spot ETF registered slight outflows of $17.70 million on Wednesday. Monitoring these ETFs' net flow data is crucial for understanding market dynamics and investor sentiment. The combined Bitcoin reserves held by the 11 US spot Bitcoin ETFs stand at $50.38 billion.

Bitcoin Spot ETF chart

Technical analysis: BTC price breaks below the daily support level

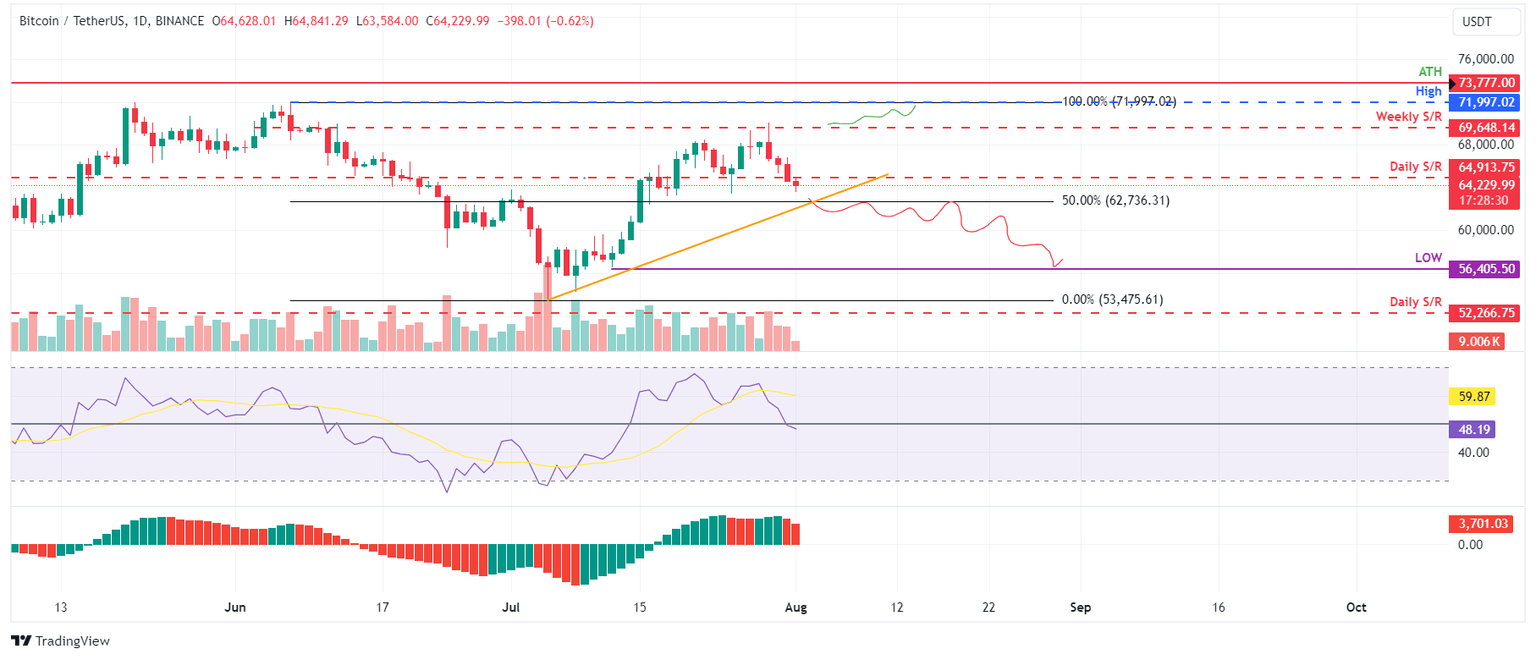

Bitcoin price was rejected at the weekly resistance level of $69,648 on Monday and declined 2.7% the following two days to close below the daily support at $64,913 on Wednesday.

At the time of writing, BTC trades slightly lower by 0.64% at $64,229 on Thursday.

If BTC continues to decline and closes below the ascending trendline and the 50% Fibonacci retracement level at $62,736 (drawn from a swing high of $71,997 on June 7 to a swing low of $53,475 on July 5), BTC could crash 10% to retest its daily low of $56,405 from July 12.

The Relative Strength Index (RSI) on the daily chart has briefly dropped below the 50 neutral level, and the Awesome Oscillator (AO) is nearing a similar decline; if these momentum indicators continue to weaken, it could signal strong bearish pressure and lead to further declines in Bitcoin's price.

BTC/USDT daily chart

However, a close above the $69,648 weekly resistance level would change the market structure by forming a higher high on the daily timeframe. Such a scenario might drive a 3% rise in Bitcoin's price to retest its June 7 high of $71,997.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.