- Bitcoin price’s horizontal consolidation is likely exhausted as the king of cryptocurrency leans south.

- BTC could make a 10% drop to the 61.8% Fibonacci level at $47,445 as bears gain ground.

- The bearish thesis will be invalidated if the price records a new local top above the $52,985 range high.

Bitcoin (BTC) price has extended a leg south after trading within a range for days. While the move has harmed multiple traders, particularly the ones who had taken short positions, it is the first sign that the next directional bias may be finally ready to show.

Also Read: Bitcoin price consolidation could precipitate a fall as US markets remember President Washington

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

$160 million long positions liquidated as Bitcoin slips 2%

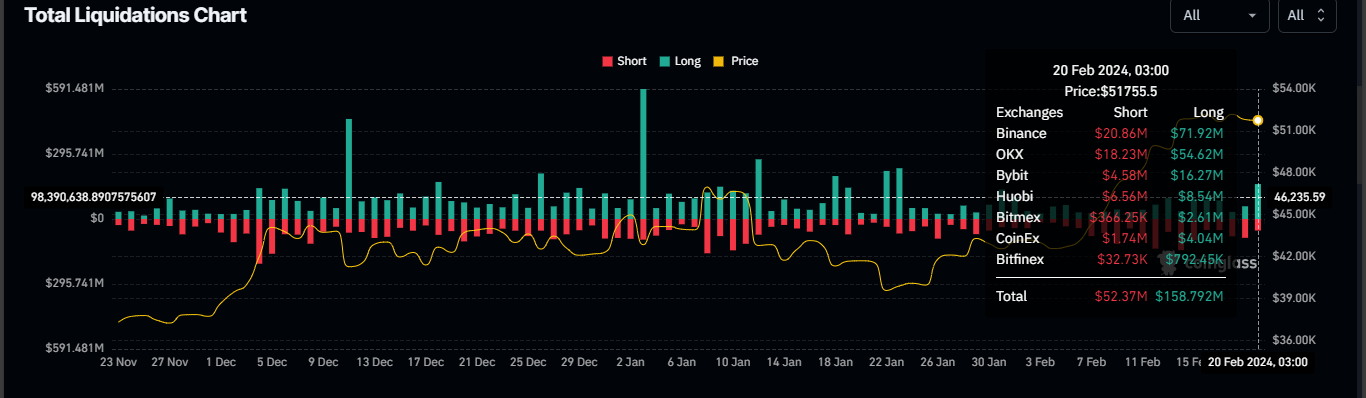

Bitcoin (BTC) price slipped almost 1.30% on Tuesday, liquidating $158.79 million in long positions against $52.37 million in short positions.

BTC liquidations chart

Liquidations in the cryptocurrency space occur when traders’ positions are forcibly closed as a consequence of their margin accounts no longer being able to support their open positions. It follows a drop in the asset’s price or shortage in sufficient margin to meet the maintenance requirements.

With a combined liquidation of over $210 million, relative to Monday’s $142 million, the surge in liquidations points to enhanced trading activity as well as volatility within the crypto arena.

Nevertheless, Bitcoin price has been in a lull for the past few days, consolidating on the back of unstable inflows into spot Bitcoin exchange-traded funds (ETFs).

JUST IN: Last week had the largest weekly inflows into #Bitcoin ETFs on record at $2.45 BILLION pic.twitter.com/BSPfRs6Utq

— Bitcoin Magazine (@BitcoinMagazine) February 19, 2024

Bitcoin price outlook as BTC longs go underwater

Bitcoin price has leaned south, with the Relative Strength Index (RSI) suggesting the fall could only be beginning as BTC is overbought. If this momentum indicator slips below the 70 level, it would signify that BTC is ripe for selling, instigating a sell-off.

The Awesome Oscillator (AO) is also showing a large red histogram bar, suggesting that the bears are establishing a presence in the BTC market.

The ensuing seller momentum could send Bitcoin price south, with a forecasted 10% fall to test the supply zone turned bullish breaker between $45,556 and $46,691. A break and close below the midline of this order block at $46,166 would confirm the continuation of the downtrend.

Nevertheless, if this order block holds as support, Bitcoin price could pivot for a bounce that would see BTC market value provide a buying opportunity before the next leg north.

BTC/USDT 1-day chart

On the other hand, if BTC bulls increase their buying pressure at current levels, Bitcoin price could push north, shattering past the upper boundary of the ascending parallel channel.

Such a directional bias would bring the $55,000 milestone into focus, or in a highly bullish case, set the pace for BTC market value to hit $60,000, levels last tested on November 21, 2021. This would constitute a 16% climb above current levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin holds $84,000 despite Fed’s hawkish remarks and spot ETFs outflows

Bitcoin is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Fed on Wednesday, BTC remains relatively stable.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Top meme coin gainers FARTCOIN, AIDOGE, and MEW as Trump coins litmus test US SEC ethics

Cryptocurrencies have been moving in lockstep since Monday, largely reflecting sentiment across global markets as United States (US) President Donald Trump's tariffs and trade wars take on new shapes and forms each passing day.

XRP buoyant above $2 as court grants Ripple breathing space in SEC lawsuit

A US appellate court temporarily paused the SEC-Ripple case for 60 days, holding the appeal in abeyance. The SEC is expected to file a status report by June 15, signaling a potential end to the four-year legal battle.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.