Bitcoin price drops, $90 million in open interest wiped out amid jitter over spot BTC ETF window closing

- Bitcoin price has dropped almost 5% on Tuesday to lose the $35,500 level as crypto markets grow anxious ahead of November 17.

- The move has seen $119.246 million long positions liquidated with a $90 million drop in open interest for BTC.

- Altcoins have also been wiped out, recording $194.57 in total altcoin liquidations amid immense selling pressure.

Bitcoin (BTC) holders and the entire cryptocurrency market have been awaiting developments from the US Securities & Exchange Commission (SEC) after recent declarations that the financial regulator had a narrow window of only eight days to approve a spot BTC exchange-traded fund (ETF). With the window closing fast, the markets are growing anxious.

Also Read: Week Ahead: Bitcoin ETF approval this week, yay or nay?

Bitcoin drops 5%, liquidates $120 million long positions

Bitcoin (BTC) price slid almost 5% south during the early hours of the New York session on Tuesday amid brewing anxiety for news from the SEC. With only three days left before the deadline, the SEC still has not provided any clarity or hint at whether they will be approving or rejecting the ETF applications, and the market is reacting negatively.

Okay, we're nearing in on deadline dates for 3 spot #Bitcoin ETF applications. I want to get ahead of it because there's a pretty good chance we'll see delay orders from the SEC. Delays WOULD NOT change anything about our views & 90% odds for 19b-4 approval by Jan 10, 2024 pic.twitter.com/LE7sOlHAHM

— James Seyffart (@JSeyff) November 14, 2023

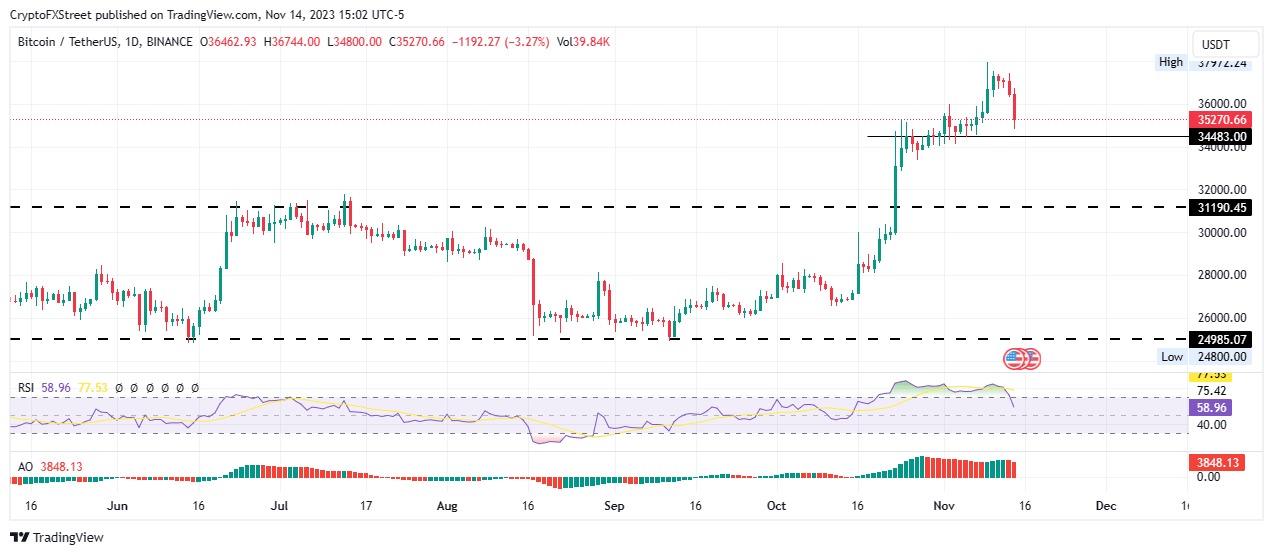

The king of crypto has been showing weakness since the Saturday sell-off

BTC/USDT 1-day chart

The move has seen almost $120 million in long BTC positions liquidated as longs who were trying to front-run the SEC’s decision were caught off-guard.

BTC Liquidations

Along with the longs, up to $6.14 million short positions have also been liquidated after their stop losses were hit. With this move, around $90 million in aggregated open interest has been wiped out in 24 hours, moving from $16.50 billion to $16.41 billion.

BTC Open Interest

Altcoins also suffer

As had been reported, altcoins have also suffered, with up to $194.57 million in total altcoin liquidations. Many altcoins have crashed, losing between 4% to 10% in market value across the board amid immense selling pressure. It comes after the spot ETF hype inflated the market, causing investors to bet on altcoins. Altcoins rallied egregiously over the past few days, but the impact of the delay, first felt by Bitcoin, has extended to altcoins.

Despite the catastrophe, however, the SEC still has just about three days before the window closes or traders may have to wait until January 10, 2024, marking the hard deadline when the SEC will have to announce the verdict on the 12 applications by all means.

Crypto ETF FAQs

What is an ETF?

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Is Bitcoin futures ETF approved?

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Is Bitcoin spot ETF approved?

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.